The importance of this week in guiding financial market trends for the rest of the year and possibly beyond cannot be overstated. The raft of US data should go some ways in determining the character of the US ‘landing’, whether hard or soft, especially in the hyper-sensitive housing market, which sees new and existing home sales figures for October. This should, by extension, provide us with significant information as to whether the dollar’s sell-off will continue, and to a lesser degree whether the bond market can rally any further.

With Bernanke speaking on the economic outlook tomorrow and the Beige Book released on Wednesday, the volatility surrounding Fed expectations should be extremely high, particularly given recent hints from Poole and Warsh that they think the strip might be mispriced. Forget judgment day: this is judgment week!

Price action in the dollar has been relatively muted in Europe after Asia gapped it lower. The gap in EUR/USD was closed thanks to more moaning from the French, but Macro Man suspects that the marginal impact of this bleating will swindle until and unless the Germans join the chorus. Comments from the German exporters’ association on Friday suggested that currency complaints will not be forthcoming; indeed, they sounded almost smug in suggesting that EUR/USD could rally to 1.40 and not affect them. It sounds very much like the German carmakers and Siemens may have locked in tasty hedges while their French counterparts have not! As noted this morning, Macro Man stepped up to the plate and bought 10 million EUR/USD at 1.3110 on a spot basis. Further dollar sales may well be made on an opportunistic basis. EM, meanwhile, has shaken off the election of 'bad guy' Rafael Correa in Ecuador, providing furthe evidence that the prevailing theme is not one of 'carry unwinding.'

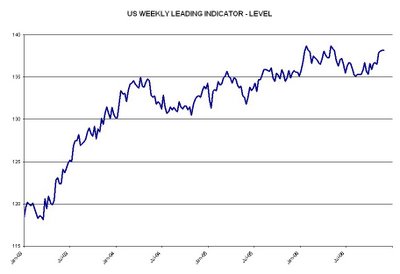

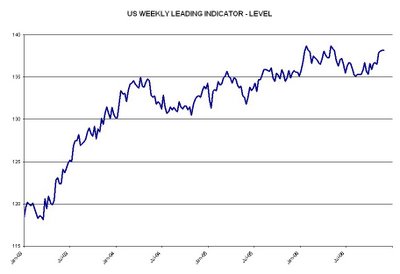

Elsewhere, bonds have retreated from their highs, with the yield backing up this morning to nearly 4.58%. Continued heavy intervention from Asian central banks suggests that a bond bid will likely persist, and in the absence of absolutely cracking US data, 4.70-4.75% may now be the top of the yield range; indeed, it might take cracking US data to get us there! Macro Man will consider taking off some of the bond short below 108 on the Dec future, as the trade has frankly become a bit boring. Will Macro Man have a chance? Depending on whom you ask, Black Friday either went very well or horribly, so the jury remains out. One potential source of encouragement has been the recent uptick in the weekly leading indicator, which has surged in the last two months. Could this be a sign that the data in the US is about to improve, thereby squeezing dollar shorts and bond longs? We’ll see.

With Bernanke speaking on the economic outlook tomorrow and the Beige Book released on Wednesday, the volatility surrounding Fed expectations should be extremely high, particularly given recent hints from Poole and Warsh that they think the strip might be mispriced. Forget judgment day: this is judgment week!

Price action in the dollar has been relatively muted in Europe after Asia gapped it lower. The gap in EUR/USD was closed thanks to more moaning from the French, but Macro Man suspects that the marginal impact of this bleating will swindle until and unless the Germans join the chorus. Comments from the German exporters’ association on Friday suggested that currency complaints will not be forthcoming; indeed, they sounded almost smug in suggesting that EUR/USD could rally to 1.40 and not affect them. It sounds very much like the German carmakers and Siemens may have locked in tasty hedges while their French counterparts have not! As noted this morning, Macro Man stepped up to the plate and bought 10 million EUR/USD at 1.3110 on a spot basis. Further dollar sales may well be made on an opportunistic basis. EM, meanwhile, has shaken off the election of 'bad guy' Rafael Correa in Ecuador, providing furthe evidence that the prevailing theme is not one of 'carry unwinding.'

Elsewhere, bonds have retreated from their highs, with the yield backing up this morning to nearly 4.58%. Continued heavy intervention from Asian central banks suggests that a bond bid will likely persist, and in the absence of absolutely cracking US data, 4.70-4.75% may now be the top of the yield range; indeed, it might take cracking US data to get us there! Macro Man will consider taking off some of the bond short below 108 on the Dec future, as the trade has frankly become a bit boring. Will Macro Man have a chance? Depending on whom you ask, Black Friday either went very well or horribly, so the jury remains out. One potential source of encouragement has been the recent uptick in the weekly leading indicator, which has surged in the last two months. Could this be a sign that the data in the US is about to improve, thereby squeezing dollar shorts and bond longs? We’ll see.

Finally, and despite the comments above re: German exporters, Macro Man cannot help but think that a surge in EUR/USD will really benefit US corporates at the expense of their European competitors. Anecdotal evidence suggests that US exporters are coming out of the woodwork to lock in attractive hedge ratios, which should, all being equal, spur US equity outperformance moving forwards. As the chart below indicates, the last time EUR/USD was around these levels, the ratio of the DAX to the SPX was around 3.5, well below its current level of 4.54. Given that the recent high was around 4.60, the risk/reward looks compelling. Macro Man therefore looks to buy 100 SPH7 and sell 170 GXH7 at a ratio of 4.56: 1. The stop will be set just above 4.60 if and when the trade is executed.

2 comments

Click here for commentswith this large Euro/$ move recently , do you think Trichet still wants to raise rates at the next ECB meeting ?

ReplyAbsolutely. While this move has been large by the standards of 2006, it is extremely modest when viewd from an historical perspective. Moreover, he is generally fairly muted in press conferences on the day of raising rates, so it should be important to look through any 'dovishness' that he may express.

ReplyRealistically, for the euro to impact the ECB's calculus, you need to see one of three things occur: a) the euro moves to an egregiously overvaled level on a trade-weighted basis. While some may argue it is already there, it is still weaker than it was a couple of years ago, thanks to a stronger sterling; b) arate of change that suggests a market dislocation. As noted above, we are hardly there yet, though 1.40 by Christmas may qualify; c) a marked deterioration in Europe's economic outlook. Given that the private sector keeps raising its forecasts for European growth and the refi rate, we are clearly not there yet.