Yesterday saw a little bit of good (bonds cratering despite an incredibly dovish CPI figure), a fair amount of bad (the broad equity melt-up continued), and a whole lot of ugly (catastrophic declines in crude, the OIH, and a curiously delayed collapse in Goldcorp.) The net result was a roughly 0.50% drop in P/L, taking November back towards flat and the since inception bottom line back into the red.

Macro Man is not afraid to admit that he understood very little of the price action observed yesterday. Why, after floating on air since payrolls, did the bond market abruptly reverse course in the face of such dovish price data? Sure, Moskow was hawkish, capacity utilization was higher than expected, and the NAHB registered another monthly rise. But was that really sufficient to produce a 10 bp peak-to-trough sell-off in bonds? Similarly, why did crude prices collapse starting at 10 a.m. New York time? Macro Man has heard explanations ranging from a consultant report on OPEC shipments to distortions caused by the futures roll, but none seem terrible compelling. Why, also, did USD/MXN rally in a straight line from 9 a.m. NY time onwards? ‘Profit-taking’ seems to be the default explanation, though it is a fairly uncompelling one.

What all of these moves have in common is that they appear to be flow driven, where motivated buyers and/or sellers push prices, regardless of any fundamental rationale. Such markets are inherently difficult to trade, particularly if one cannot see, let alone anticipate, the flow. Caution is therefore warranted, and perhaps a more tactical approach is required. Macro Man is kicking himself for not lightening up on the OIH at 142, when the DIA/OIH ratio was comfortably on a 0.86 handle.

A few random thoughts as we head into the weekend:

*The usually useless TIC data provided one interesting insight, which supported Macro Man’s thesis that the predictive value of the yield curve has declined. Although foreign official authorities were (surprisingly) tiny net sellers of Treasuries in September, there was an interesting yield curve dynamic in their flows. Foreign official sources sold $9.1 billion worth of Treasury bills and bought $7.7 billion worth of Treasury bonds. So despite an-already inverted yield curve, central banks are putting on flatteners. This, on top of the pension perma-bid, is one of the big reasons that Macro Man is willing to bet against the signals sent by curve inversion.

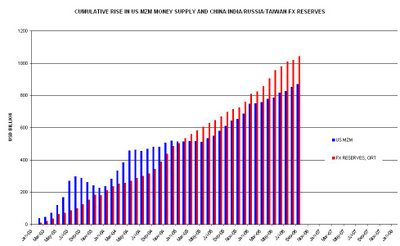

*Macro Man alluded to the growth in CB reserves equaling that of US money supply growth over the last few years. The chart below illustrates that fact, illustrating the cumulative rise in MZM and the FX reserves of China, India, Russia, and Taiwan since the start of 2003. Is it any wonder that central banks are losing control of monetary policy?

*A poster to the site alluded to the poor performance of currency traders in recent years as a result of central bank meddling in currency markets. Macro Man decided to investigate to see if the theory, which Macro Man shares, is borne out by facts. His view is that the dollar should have strengthened dramatically and consistently since US short rates went above those of Europe in December of 2004, and would have done so had it not been for central bank euro purchases. If he were correct, then we should see a notable drop-off in currency trading performance once Voldemort became a head-wind, rather than tail-wind, to private sector trading strategies. In fact, this is exactly what happened, using three different return indices (Stark currency trader, Barclays currency trader, Deutsche Bank currency trader) as a measure of currency fund performance. Hmmm.....

*The danger of an equity melt-up remains a key one for the portfolio. Macro Man will look to overlay this risk by slapping on a risk reversal. He will buy 50 Dec 1425 calls/ sell 50 Dec 1375 puts at the option opening later today.

*It is perhaps fitting that as the economics world mourns the passing of Milton Friedman, national money supply data are becoming increasingly irrelevant with the distortions caused by FX reserve allocators.

Macro Man is not afraid to admit that he understood very little of the price action observed yesterday. Why, after floating on air since payrolls, did the bond market abruptly reverse course in the face of such dovish price data? Sure, Moskow was hawkish, capacity utilization was higher than expected, and the NAHB registered another monthly rise. But was that really sufficient to produce a 10 bp peak-to-trough sell-off in bonds? Similarly, why did crude prices collapse starting at 10 a.m. New York time? Macro Man has heard explanations ranging from a consultant report on OPEC shipments to distortions caused by the futures roll, but none seem terrible compelling. Why, also, did USD/MXN rally in a straight line from 9 a.m. NY time onwards? ‘Profit-taking’ seems to be the default explanation, though it is a fairly uncompelling one.

What all of these moves have in common is that they appear to be flow driven, where motivated buyers and/or sellers push prices, regardless of any fundamental rationale. Such markets are inherently difficult to trade, particularly if one cannot see, let alone anticipate, the flow. Caution is therefore warranted, and perhaps a more tactical approach is required. Macro Man is kicking himself for not lightening up on the OIH at 142, when the DIA/OIH ratio was comfortably on a 0.86 handle.

A few random thoughts as we head into the weekend:

*The usually useless TIC data provided one interesting insight, which supported Macro Man’s thesis that the predictive value of the yield curve has declined. Although foreign official authorities were (surprisingly) tiny net sellers of Treasuries in September, there was an interesting yield curve dynamic in their flows. Foreign official sources sold $9.1 billion worth of Treasury bills and bought $7.7 billion worth of Treasury bonds. So despite an-already inverted yield curve, central banks are putting on flatteners. This, on top of the pension perma-bid, is one of the big reasons that Macro Man is willing to bet against the signals sent by curve inversion.

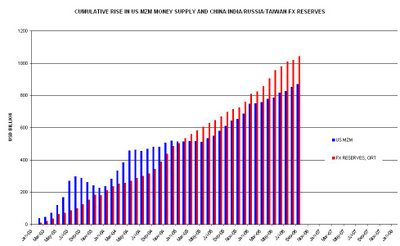

*Macro Man alluded to the growth in CB reserves equaling that of US money supply growth over the last few years. The chart below illustrates that fact, illustrating the cumulative rise in MZM and the FX reserves of China, India, Russia, and Taiwan since the start of 2003. Is it any wonder that central banks are losing control of monetary policy?

*CBs have reportedly been all over the foreign exchange market this morning, both intervening in USD/Asia and selling dollars against a panoply of G10 currencies. Meanwhile, President Chirac moaned about the strength of the euro again yesterday. Although Macro Man doesn’t expect too much from the G20 meeting this weekend, he will be very keen to observe over the coming weeks whether the Germans join the French in muttering about euro strength, or whether the original thesis of electoral posturing is proven to be the correct one.

*A poster to the site alluded to the poor performance of currency traders in recent years as a result of central bank meddling in currency markets. Macro Man decided to investigate to see if the theory, which Macro Man shares, is borne out by facts. His view is that the dollar should have strengthened dramatically and consistently since US short rates went above those of Europe in December of 2004, and would have done so had it not been for central bank euro purchases. If he were correct, then we should see a notable drop-off in currency trading performance once Voldemort became a head-wind, rather than tail-wind, to private sector trading strategies. In fact, this is exactly what happened, using three different return indices (Stark currency trader, Barclays currency trader, Deutsche Bank currency trader) as a measure of currency fund performance. Hmmm.....

*The danger of an equity melt-up remains a key one for the portfolio. Macro Man will look to overlay this risk by slapping on a risk reversal. He will buy 50 Dec 1425 calls/ sell 50 Dec 1375 puts at the option opening later today.

*It is perhaps fitting that as the economics world mourns the passing of Milton Friedman, national money supply data are becoming increasingly irrelevant with the distortions caused by FX reserve allocators.