Macro Man is back in the saddle and pleased tHat the resource bets have compensated for the execrable performance of the bond short. The post-payroll bond short was stopped at the highs of 108-14 on Monday, which looked like a bit of a mug’s trade until yesterday’s data. The remaining 200 lot short is maintained, with a stop at 109. While Macro Man remains a believer that the market is underestimating the trajectory of US nominal GDP growth, he has to concede that the timing to allocate risk to the view may not be right. 10 year yields below 4.50 are not something that he wishes to see for any duration of time. The Fed minutes, CPI, and housing data this week will determine whether being short bonds makes Macro Man a hero or a villain.

Elsewhere, equity markets continue to price a soft landing. Macro Man is impressed with the strength of the SPX and considers himself fortunate that his short equity bias has not been particularly painful. Certainly picking the right market is key, and the continued weakness in copper suggests that the Aussie equity short remains the appropriate trade. Less appropriate is the position in DAX puts, and Macro Man sells out the position at 6.5 before they expire worthless. He remains 145 offer for another $2.5 million worth of OIH.

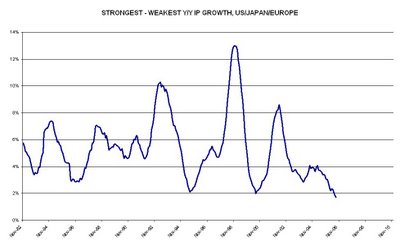

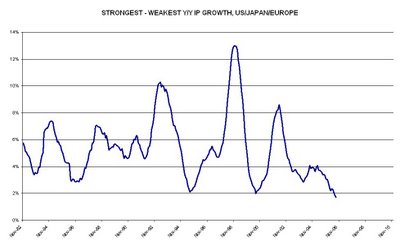

Long option positions have not worked for most of the year as actual and implied volatilities have remained extraordinarily low by historical standards, across asset classes? Why is this? Macro Man has done some investigating. One of the first requirements for asset market volatility is macroeconomic volatility, or a divergence in the macroeconomic fortunes of major economies. Not only is this not happening, one could argue that because of globalization major economies have never been so synchronous. Consider that most major economies seem to be growing at roughly 2%, give or take, with core inflation at the upper end of comfort levels and every G10 central bank bar New Zealand’s raising rates this year. Using industrial production as a proxy for growth, we can see below that the difference in y/y industrial production between the highest and lowest in the G3 has never been lower in the last 25 years.

Elsewhere, equity markets continue to price a soft landing. Macro Man is impressed with the strength of the SPX and considers himself fortunate that his short equity bias has not been particularly painful. Certainly picking the right market is key, and the continued weakness in copper suggests that the Aussie equity short remains the appropriate trade. Less appropriate is the position in DAX puts, and Macro Man sells out the position at 6.5 before they expire worthless. He remains 145 offer for another $2.5 million worth of OIH.

Long option positions have not worked for most of the year as actual and implied volatilities have remained extraordinarily low by historical standards, across asset classes? Why is this? Macro Man has done some investigating. One of the first requirements for asset market volatility is macroeconomic volatility, or a divergence in the macroeconomic fortunes of major economies. Not only is this not happening, one could argue that because of globalization major economies have never been so synchronous. Consider that most major economies seem to be growing at roughly 2%, give or take, with core inflation at the upper end of comfort levels and every G10 central bank bar New Zealand’s raising rates this year. Using industrial production as a proxy for growth, we can see below that the difference in y/y industrial production between the highest and lowest in the G3 has never been lower in the last 25 years.

Synchronicity of the cycle is all well and good, but if there is a large disparity in asset market returns and/or volatility across countries/currency blocs, investors will be rewarded for making country bets and currency volatility should ensue. One of the more remarkable financial market phenomena over the last six years has been the remarkable convergence of risk-adjusted returns across the US, Eurozone, and Japan on an apples-for-apples basis. If we look at a basic asset allocation strategy- 60% equities (MSCI total return), 35% bonds (7-10 year total return), and 5% cash, we see that the rolling three year return to risk ratios amongst the G3- which had showed a large degree of variation in the 1980’s and 90’s- have been virtually identical across the G3 for the entire decade.

The implication is that investors are in fact NOT rewarded for taking country and currency bets, because they generate a virtually identical return for each unit of risk that they place in each country/bloc. Because the capital account is by far the most dominant driver of currency moves, the fact that there has been a convergence of capital market returns has been absolutely vital in explaining why there’s been so little volatility in currency markets.

The obvious conclusion is that when we observe a decoupling of the economic cycle and/or asset market returns, currency volatility should return with a bang. At the current juncture, however, there is little indication that this will happen any time soon.

Later this week: Part 2: the rise of Lord Voldemort

The obvious conclusion is that when we observe a decoupling of the economic cycle and/or asset market returns, currency volatility should return with a bang. At the current juncture, however, there is little indication that this will happen any time soon.

Later this week: Part 2: the rise of Lord Voldemort

1 comments:

Click here for commentsas weak as this job recovery has been , the US has produced 5.9 Million jobs , more than Europe and Japan combined ..... and all we hear is complaining from the Perma-Bear , Perma-Dope crowd ... or from blowhards who call for Dow 6800