December 1 is always a significant day chez Macro Man, as it marks the first day that holiday music is played on the stereo. Macro Man fully expects to return home tomorrow evening to the smooth sounds of Bing Crosby or the Rat Pack crooning about what a great month December is. At the office, however, he is already deluged with the electronic equivalent of Crosby or Sinatra.

The Macro Man email inbox is crammed full of research telling him how to benefit from December seasonality in financial markets. According to the conclusions of these various studies, December is a great time to be:

Long stocks

Long bonds

Long EUR

Long GBP

Short USD

Short CAD

Short AUD

Long EUR/JPY

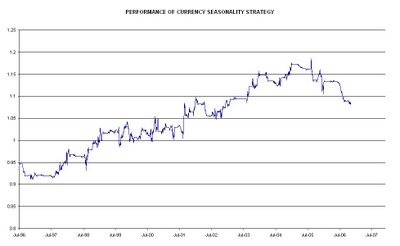

The historical persistence and Sharpe ratio of these strategies is impressive. However, Macro Man wonders if the seasonality issue has gone a bit ‘tabloid.’ If everyone knows about seasonality, surely they load up on the seasonal trades beforehand and telescope the opportunity? The equity market is perhaps the best example of this, where the ‘January effect’ now takes place in November-December (kind of like Oktoberfest takes place in September.....)

The Macro Man email inbox is crammed full of research telling him how to benefit from December seasonality in financial markets. According to the conclusions of these various studies, December is a great time to be:

Long stocks

Long bonds

Long EUR

Long GBP

Short USD

Short CAD

Short AUD

Long EUR/JPY

The historical persistence and Sharpe ratio of these strategies is impressive. However, Macro Man wonders if the seasonality issue has gone a bit ‘tabloid.’ If everyone knows about seasonality, surely they load up on the seasonal trades beforehand and telescope the opportunity? The equity market is perhaps the best example of this, where the ‘January effect’ now takes place in November-December (kind of like Oktoberfest takes place in September.....)

Elsewhere, all three tidy-up orders were filled yesterday. The TYH7 straddle was sold at 2 22/64, while GG and the DIA/OIH spread were offloaded at the limit levels of 29.00 and 0.86, respectively. The last of those was clearly premature, as a surprising drawdown in crude inventories sent oil rocking higher. The OIH decisively broke through resistance and now targets 150 as the next stop. Fortunately, the Jan 145 calls are now in the money and should ensure at least some degree of further participation to the upside. Overall, the portfolio looks set for a reasonable month’s profit which should take the since-inception numbers into the black. The main thrust of the portfolio is short equities, short bonds, short the dollar, and long energy. It will be vital to keep a watchful eye on these themes, as it is unlikely that all will come off at once.

2 comments

Click here for commentsWhat are your thoughts on Non-inversion notes , "inverting " ?

Replyvery strange and rare behavior , thanks in advance

Well....I think it is symptomatic of what we have seen all over the world....a structural flattening/inversion of yield curves. The term premium seems to have utterly vanished from govvy markets, so I suppose it was only a matter of time that it started disappearing from swap markets as well.

ReplyI gather that some holders of the notes are starting to get out, which of course exacerbates the inversion of the swap curve for anyone left holding the bag, or in this case, the n-i notes.

So in a sense, these guys are just the latest domino to fall as excess liquidity chases returns and drives risk premia to zero. People structurally short duration, short credit, short EM, and long volatility have all been carted out over the last year, and indeed the last three. It's now the turn of the structural steepener to get taken behind the woodshed for a good caning.

It's all a sypmtom of too much investment capital chasing not enough return. The proceeds from US imports no longer goes towards the purchase of real goods and services, but rather towards the purchase of financial assets. Is it any wonder, then, that DVD players seem dirt cheap and bonds of virtually every description bum-clenchingly expensive?