Well, October didn’t finish too badly. A late rally in oil (and the OIH), plus an excellent performance from the new Goldcorp position kept the portfolio in the black to the tune of 0.16% on the month. Not stellar, but not awful given the (incorrect) bias to be short bonds and long the dollar. Indeed, the only Halloween horror that materialized was the Chicago PMI data, which sent bonds screaming higher and the dollar plumbing new (recent) depths against many major currencies.

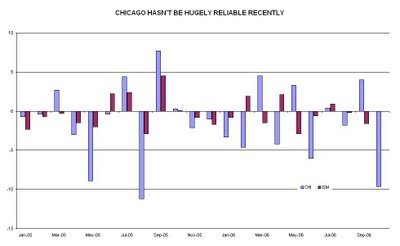

A couple of Macro Man’s professional counterparties have reduced their ISM forecasts below the magical 50 level as a result. Now, Macro Man suspects that this is a bit of an over-reaction. The correlation between monthly changes in the Chicago PMI and the monthly survey over the past couple of years has only been 0.3, and as the chart below demonstrates, the recent relationship has been even weaker.

A couple of Macro Man’s professional counterparties have reduced their ISM forecasts below the magical 50 level as a result. Now, Macro Man suspects that this is a bit of an over-reaction. The correlation between monthly changes in the Chicago PMI and the monthly survey over the past couple of years has only been 0.3, and as the chart below demonstrates, the recent relationship has been even weaker.

Nevertheless, Macro Man is cognizant that a sub 50 reading would be taking as clinching a Fed rate cut, perhaps as early as January. After all, the Fed ‘always’ cuts rates when the ISM dips below 50. As a result, some insurance is probably a good idea. Therefore, Macro Man buys 10,000 EDH7 95 calls for 5.5 ticks ($137,500.)

Elsewhere, the second leg of the bond short was implemented at 108, closing October marginally offside. Bonds are approaching the top edge of the range, so it’s put up or shut up time. Macro Man will stop out of yesterday’s sale at 109; the stop on the existing short will be reviewed after today. Meanwhile, Macro Man places his stop on the Goldcorp long at $22. This will be trailed up aggressively if/as the stock continues to perform. Elsewhere, Macro Man is hoping for an SPX rally so that he can buy some strangles as cheaply as possible.