Well, the good news is that the bond short avoided being stopped out by one tick, as the TYZ6 high yesterday was 108-31. The bad news is that the recovery in global stock markets looks to have scuppered Macro Man’s chances of notching a monthly profit in excess of 1%, as the recovery in the ASX and DAX have put an unsightly dent in the P/L this morning. As the end of the month approaches, it is time to review the portfolio and tidy up a few trades that have outlived their usefulness or reached relative extremes:

* Close the long TYHY107 straddle/short Bund 117.50 straddle position. The Bund straddle is bought back at 2.04. While the US market isn’t open yet, the Treasury straddle should fetch something like 2 28/64 by hitting bids. The position has been a positive, if low vol, performer, thanks to the long bond beta that it has at current levels. However, with the TYZ6 position so close to getting stopped, it makes sense to take off what has become a hedge, rather than go long US bonds at a yield level below 4.50.

* Sell the Goldcorp position at $29 or the opening price, whichever is higher. Gold has reached its near term target of $640, where it seems to be stalling. A near term reversal would provide a welcome flush of weak longs, and provide an opportunity to re-establish a long gold (actual or proxy) position. A 14% return in less than two months is not to be sniffed at, and at these levels Macro Man is happy to take it.

* Take profit on $2.5 million of the DIA/OIH spread at 0.8600 or the US opening, whichever is lower. The January WTI future is approaching levels that have served as formidable resistance over the last couple of months, and Macro Man would be remiss in not lightening up ahead of these levels. If this order is filled, the 145 offer in OIH will be cancelled.

The overall tone of yesterday’s US data was undeniably weak. The failure of the bond market to maintain its rally below 4.50 in 10yr yield is perhaps instructive, however. Maybe there was an offer ahead of 109 in the futures, or maybe there were simply no fresh buyers of bonds at levels more consistent with recession than soft landing. Regardless, we have perhaps reached an inflection point and should now expect stocks and bonds to trade with a negative correlation, rather than the positive correlation of the past several months.

While there was a good deal of spilled ink over the existing home sales data, including more attention paid to the decline in the median sale price, relatively little attention was paid to the Case/Schiller house price index, which provides a more complete picture of trends in the price of US housing. This data showed a 3.7% y/y rise in house prices. While this still represents a significant slowdown from the prior pace of house price growth, that fact should come as no surprise to anyone possessing a functioning set of eyes or ears, given the hype attached to the housing bust.

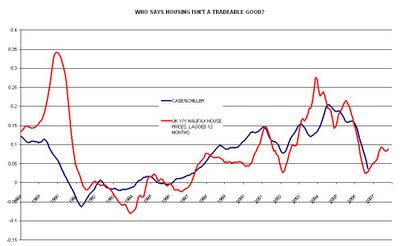

In digging around, Macro Man came across a rather curious set of data. Housing is the classic non-tradable good, whose price is dictated by local supply and demand dynamics. As such, one would expect a relatively low correlation between house prices in different countries. Macro Man was astonished, therefore, to see a relatively strong correlation (both in terms of direction and magnitude) between the Case/Schiller index in the US and the Halifax house price data in the UK. The correlation comes with a caveat, however; the Halifax data is lagged by twelve months (i.e., it is a leading indicator.)

2 comments

Click here for commentsMM,

ReplyDont you think with the USD weakening and global investors running to gold as safe haven, GOLD stocks would only rise ?

What is your prognosis on Gold. Has it reached a stiff resistance at $640 ?

There is clearly some resistance in gold at $640, which coincides with perceived resistance in EUR/USD at 1.32-1.3250. I suspect that either both of these resistances give way, or neither do. Ultimately, the balance of risk favours that the resistance breaks, but perhaps we need a bit of a pullback first.

ReplyGiven the strength of the run-up in gold, EUR, and GG, I just feel like prudence dictates taking something off the table, preferably in the least liquid asset that has run up the most.

The best way to play the dollar downtrend is to be short dollars...and given that the portfolio now has a reasonable position there, I am happy to take profits on the proxy trade.

Moreover, as I have learned to my chagrin this week, one sharp dip does not a global equity rout make!