On Sunday, in a speech to the IIF, Janet Yellen again expressed her “surprise” at low inflation figures: “Inflation readings over the past several months have been surprisingly soft….”

Indeed...the Chairwoman goes on to detail just what was so surprising:

“...The recent softness seems to have been exaggerated by what look like one-off reductions in some categories of prices, especially a large decline in quality-adjusted prices for wireless telephone services.”

And the September minutes didn’t mention wireless prices by name, but it is tough to believe that wasn’t under the hood here: “In addition, many judged that at least part of the softening in inflation this year was the result of idiosyncratic or one-time factors, and, thus, their effects were likely to fade over time.”

Same script back in July: "idiosyncratic factors, including sharp declines in prices of wireless telephone services and prescription drugs, and expected these developments to have little bearing on inflation over the medium run."

As most of you know I am outside the orbit of most sell side research. I find US economic research particularly vexing. Have you read any economists take apart these talking points and evaluate if their veracity?

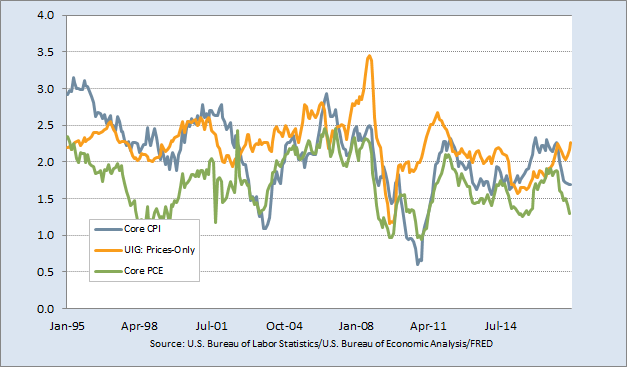

This is a chart of the NY Fed’s underlying inflation gauge “prices-only” index, which I dug into a while back in this post. It doesn’t take into account financial conditions and other non-price measures. It continues to rise, despite the fall in core CPI, Core PCE (through August)

Adding in financial conditions, the UIG index is getting into some frothy territory similar to what the US experienced in the late 90s and mid 00s. The break with PCE measures is stunning.

So yes, perhaps some one-off idiosyncratic factors at work in the low headline readings. If you look at the Fed speak, Yellen isn’t the only one that has cited wireless prices….The FOMC leadership clearly has established this as their explanatory variable workhorse. And indeed, prices gapped lower earlier this year:

But this begs the question, is Janet Yellen a millennial? Is she one of those people that is constantly texting and snapchatting but cut the cord on cable long ago?

Cable and satellite companies are picking up the slack and definitely doing their part to help the FMOC meet their beloved 2% inflation mandate....prices in this category are up 6.8% YoY. On behalf of the Fed, thank you Comcast. You are true patriotic Americans. Please continue to hike prices so we can fight those deflationista bolsheviks over at Verizon.

It is worth noting that wireless service and cable/satellite components started breaking in opposite directions around the same time….The right axis in this chart shows the contribution of Cable/Sat and Telephone to the overall CPI index (Inflation nerds: I cheated a little when I calculated this because I didn’t want it to consume my whole day...ping me if you want to get deep in the weeds). Don’t look now, but Cable/Sat prices’ contribution to the headline index is at all time highs!

Here’s what we get if we sum up the two incidence components. Net -6bps contribution in the September CPI and +/-12bps for the past twenty years...Thanks for flagging this, Janet.

This leads you to one of two conclusions: 1 ) the FOMC is clueless, and is blaming irrelevant factors for low inflation when something else is really at work, or 2) the FOMC--as an institution...not just Yellen--will continue to “look through” recent low inflation readings, and they are citing certain components as examples for what is giving them the confidence to do so. The data in the underlying inflation gauge and the drumbeat from Dudley backs that theory.

Yet this chart might argue in favor of the former--is the Fed willfully clueless about the drivers of low inflation readings? The Trimmed Mean PCE and Median CPI figures, which are constructed specifically to exclude noisy data, are in a persuasive downturn. Yet that is not what FOMC leadership is choosing to focus on. Instead we get “Idiosyncratic. wireless prices.”

Bottom line: Yellen and Dudley are looking at the underlying inflation gauge, where prices are rising and already above 2%. They are looking at financial conditions, they are looking at wages--and while they are too smart to take the punch bowl away, they are going to continue to drain it slowly until economic data tells them they should be doing otherwise, or until the underlying gauges start to converge with headline price data.

Perhaps it is what Polemic said, which has a certain Occum’s Razor appeal to it. Maybe they just don’t know why the UIG and financial conditions are diverging so dramatically from trimmed mean PCE and median CPI...and that’s why the curve relentlessly flattens.

13 comments

Click here for commentsPolemic + Shawn =

ReplySuprise at low inflation = Suprise at a Trump victory.

Job security is a thing of the past due to machines/robots/algo's in the work place.

Close but no cigar.

“Active central bank Narrative construction in the service of their policy goals is a permanent change in our market dynamics”

Reply"In his last Jackson Hole address, Ben Bernanke extols the virtues of their “communication tools”, carefully constructed media messages designed to alter investor behavior, messages that he says have been their most effective policy tools to date. Interest rates may hit a lower bound of zero, and asset purchases may lose their punch, but investors can ALWAYS be “guided”. The architect of this new and powerful toolkit? Vice Chair Janet Yellen, natch. Forward guidance and what the Fed calls communication policy are the very definition of Missionary statements, and our utter absorption in what everyone believes that everyone believes about the Fed’s impact on markets IS sheep logic."

“We think we are wolves, living by the logic of the pack.

In truth we are sheep, living by the logic of the flock.”

http://www.epsilontheory.com/sheep-logic/

Precisely. Per the sheep logic thesis, it will work until it doesn't (although I must say I learned more about actual sheep than market behavior in that piece).

ReplyTrichet tried to use action instead of words, and look how that turned out.

I'm saying...It's not just the CB'S of the world. Once the FED excuse me the "Oracle" makes a pronouncement the message is then disseminated to the gatekeepers in the 4th estate. So nearly every media outlet, be it TV, newspaper, radio, or internet will be repeating this to us all day every day. We might know the facts. Evidence could be right in front of our face, but with a constant f noise (messages) bombardment, it has an effect on people.

ReplyThen it's time for the heavies like the PhDs, famous economists, news anchors, industry professionals, FED officials. They are the "experts" we should believe unconditionally. It's a fucking racket man. This last round went on for nearly 3 months and by the last couple of week I was straight up sick of it...and remember these false signals will cause real people (business owner or grandma down the street) to make poorly timed or ill-advised purchases or decisions regarding their finances. Not FED's mandate they'll say....fuck it.

Fuck them

PS Anyone got any thoughts on going long BRA maybe against the Argentina Peso? Brazil has improved drastically and the Peso is perpetually falling, although its eems to have bottomed out. Maybe BRA/JPY I think the JPY will weaken a bit continuing the QE when the US isn't and teh BOE is thinking of tappering.

ReplyShane, the only chatter going on in the central bankers boardroom at the moment is what the betting fluctuations are from when I commented that after the last at Ascot I'll be sneaking in Polemic and alpha into the after party. Who cares what they say.

ReplyAnd then there were six. :)

ReplySo this new 9-mo crude supply cut extension deal talk, but most importantly, the decision announcement delay until early 2018 is quite an interesting development. I mean at the time when Iraq is supposedly once again unified in its oil wealth with Kurds not opposing that much (yet) and it looked like $52 res was going to hold on WTI, we get this candy thrown to the longs in terms of no real reason to sell the news until early 2018 or whenever the extension announcement finally comes. If shorties can't defend $52.90 area then short covering en masse in a total vacuum should ensue for about $2 straight up. Hence I remain long with a $55 target. The only thing that could possibly derail this would be a strong rally in DXY through $94, but somehow I don't think it happens. Weekly looks mightily embedded in a sell mode on some momentum indicators with the right shoulder of inverted h+s looking more like a retracement than a beginning of a new leg up. Also, it seems like there is a firing squad at 2.4% on a 10-yr.

IPA...i'm going to jot out a quick post backing you on that one--the supply story is grabbing the headlines but demand is picking up too.

Reply@shane, long brl/short jpy...the widowmaker...there are enough traders that have made their year on this one but for me this type of trade drives me nuts because you are picking up a nominal amount of carry in the jpy leg but you will get totally slaughtered in a risk off event. So it is two trades to me--short usd/brl and long usd/jpy--not much has changed for me on my Brazil view relative to my post on the subject a while back.

Same in Argy--IMO trading long BRL vs. short ARS is squirrelly risk because you are trading a "floating" currency (BRL) vs. a semi-managed one, where the BCRA is on the bid replenishing USD reserves. If you don't like the Argy story, that's fine--and maybe there's a correlation effect that allows for larger sizing/lower neg carry against long BRL, but I struggle with painting a negative view of Argy while having a positive view of BRL unless there's a convincing local case to take each side of the trade.

I don't think there is, but one can easily argue Macri loses this weekend or wins a close one and the picture for his re-election/mandate get murkier, while Brazilian politics move the other direction.

Lastly, i disagree ARS has done poorly lately--true it has gone sideways since mid-July but you've banked roughly 5% running in carry since then. How about the ultimate widowmaker, long ARS short CHF?

Looks like I hurt someone's feelings and had my post deleted lol.

ReplyLook "macro people", we all know that macro has been one of the worst performing strategies in the last 7 years. Witness how MM and his friends tried to short US indexes and lost their shirts - they have now all have left trading to find alternate careers.

Meanwhile we remain long US equities. Will be amusing if they continue to rise like this for the next 6-7 years!

Dude Puerto Rico GO bonds trading near 30c. Now as bad as that place is, and it is bad guys the NAFTA talks could utterly change Puerto Rico's future overnight. NAFTA destroyed PR. 40% GDP rip in 12-14 years. Poor and struggling since then...that changes combined with a bailout and tax reform...I don't know boys it seems like its enticing. What do you think? I hear brokerages are letting some advanced retail clients get their hands on the action. I guess that's a 3-5yr play though, maybe longer.

Reply@shawn I'm really thinking the BRA/JPY trade to ride the lightning. I agree with the concern with ARS semi-managed and intervention. It would be difficult to manage the two legs...I think Argentina is doing much better, I just struggle to trust SA and LA because of the political volatility. 1 year ago inflation was nearing 40% haha, I mean that's scccceeeerrryyyy yo. I think Macri will win decidedly actually so that's a plus. The fact that China is involved with some of these countries concerns me as well. Communism hasn't been kind to our brothers to the south. Long ARS short CHF...Not sure I have the sand (or experience) to trade that, never have have you? If so your a fucking wild man

Off the grid for a few days there. Back and catching up. Thank you for those last two posts, Shawn.

ReplyThere are these two charts stuck in my head. One is the Citi graph of change in central bank balance sheets versus change in MSCI world, suggesting market performance is very central bank-driven. The other is the three-factor behavioral model of stock valuations from Grantham's last quarterly letter which suggests stock valuations are just fine, given current profit margins, inflation volatility, and economic volatility. I used to think the former was the correct explanation, but the second has me doubting that and thinking we're on a "high plateau" until one/some of those three factors change. I don't have a view that any of those will change much in the next twelve months, though presume (without actually doing a study) that they're all at/close to sweet spots versus historical ranges.

Re those term premium effect graphs from Shawn's last post, I would note that while large (maybe ~100bps), the effect rolls off slowly enough that, by itself, it doesn't look tradable from the short-side after carry. Please correct me if I'm looking at that the wrong way.

@Buy Stocks, listen here you idiot. Just get on with it and tell whoever they are that an "era" has been decimated!

ReplyLong live social media and the hashtag. I'll be still at the track though.

@johno, yeah you may be right on the slow roll there, but then shouldn't something like 5y5y or 10y10y be steepener? Indeed, you can carry that one into your grave. But I think it illustrates a disconnect between the wonks and the market (and sure, they are wonks and not traders for a reason).

Reply