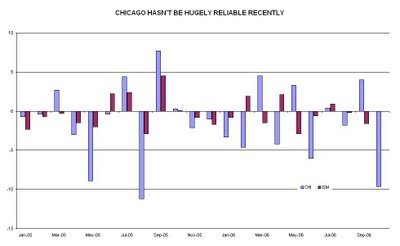

The sub 50 Chicago PMI has prompted the 109 stop loss on the short Treasury position to get filled at 109-01. Fortunately, short equities an...

Read More

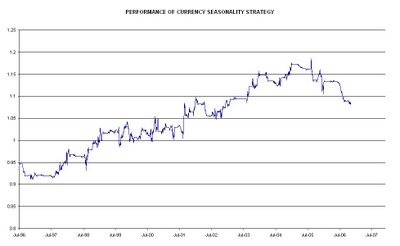

'Tis the season

December 1 is always a significant day chez Macro Man, as it marks the first day that holiday music is played on the stereo. Macro Man full...

Read More

Tidy up time

Well, the good news is that the bond short avoided being stopped out by one tick, as the TYZ6 high yesterday was 108-31. The bad news is th...

Read More

Adding to $ short

Macro Man buys another 10 million EUR at 1.3144. Voldemort is reportedly bidding below that level, and barriers at 1.32 beckon....

Read More

Awaiting confirmation

Yesterday saw the S&P halt an impressive winning streak, as the index registered a decline of more than 1% for the first time in 95 trad...

Read More

DAX/SPX ratio spread filled

Macro Man bought 100 SPH7 at 1400 and sold 170 GXH7 at 6384.

Read More

Judgment Week

The importance of this week in guiding financial market trends for the rest of the year and possibly beyond cannot be overstated. The raft o...

Read More

Mind the gap

The USD gapped sharply lower in the Asian opening, a relative rarity in foreign exchange. Although the buck has retraced much of its loss ag...

Read More

Whither the dollar? Reply to a poster

Is this the big dollar downmove? Well, that is what I am wrestling with. While the dollar's price has changed, that is a necessary but n...

Read More

FX explosion!

Ranges have finally broken in FX, with EUR/USD surging above 1.30. Macro Man was filled at 1.3005 on his 10 million stop loss. He will now...

Read More

Turkey Day

As Americans prepare to settle into their annual orgy of food and televised sport, financial markets are surprisingly (and irritatingly) vol...

Read More

Dollar downtrend?

Currencyland has risen from its long slumber today as the dollar has gotten creamed against most of its G10 counterparts. While most curren...

Read More

Limp out of EUR/JPY

Macro Man will attempt to leg, rather than limp, out of the EUR/JPY 'hedge' by buying $12.5 million USD/JPY at 116.80 and then biddi...

Read More

Chinese whispers

As the holiday season moves swiftly towards us, the noise-to-signal ratio in financial markets approaches infinity. The level of frustration...

Read More

Random shots

What would you rather be: a financial market trader or an American turkey? The lack of action in these markets is so dire, Macro Man is swi...

Read More

Macro Man wants your view

At the risk of embarrassing himself by displaying the dearth of readership of this (admittedly young) project, Macro Man would like to solic...

Read More

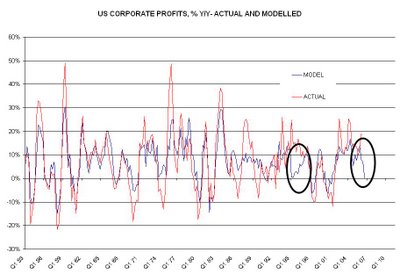

An honest man’s assessment of US equities

It’s hard to believe that we are almost at Thanksgiving already. For such an irritating year (in terms of the collapse of volatility, May ex...

Read More

S&P riskie

Bought 50 Dec SPZ6 1425 calls at 4.45 Sold 50 Dec SPZ6 1375 puts at 6.3 Strange things are afoot when housing starts collapse and bonds bare...

Read More

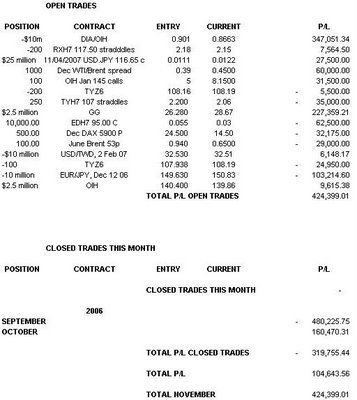

The good, the bad, and the ugly

Yesterday saw a little bit of good (bonds cratering despite an incredibly dovish CPI figure), a fair amount of bad (the broad equity melt-up...

Read More

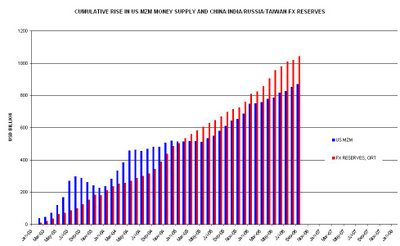

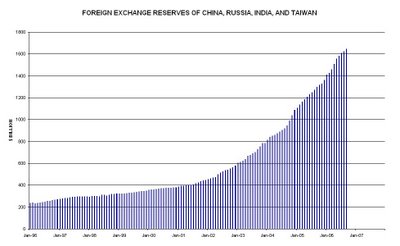

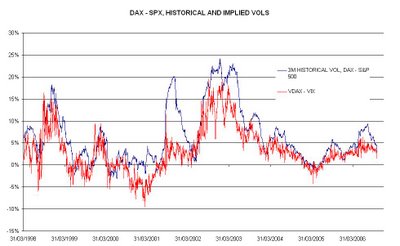

Harry Potter and the FX reserve managers (Why is there no volatility? Part II)

The portfolio had a good day yesterday, almost in spite of itself. Goldcorp had a glaring earnings miss and metals traded on the back foot, ...

Read More

Why is there no volatility? Part I

Macro Man is back in the saddle and pleased tHat the resource bets have compensated for the execrable performance of the bond short. The po...

Read More

It's elementary!

Consider the following: 1) Global bonds are once again strongly bid. Is it central bank liquidity, growth fears, or a short-killing coc...

Read More

Friday morning joke

Q. What do you get when you invite a bunch of central bankers together in Frankfurt? A. [EXPLETIVE DELETED] Macro Man's buddies are at...

Read More

Sell $2.5 million OIH at 140.40

The 142 offer looks out of bounds, so might as well take the windfall gain while it still exisits.

Read More

Thursday bullet points

* The OIH looks set to open through the 140 offer for $2.5 million. Macro Man moves the offer to 142, but will go to market an hour after t...

Read More

Whip it real good

The soundtrack of the day in financial markets is being supplied by Devo, singing 'Whip it.' The bond market continued yesterday...

Read More

A faint whiff of sulphur

So bond markets across the world go super bid (-5 bps in US and Europe, -6 in UK) on no news as the dollar mysteriously sells off. This com...

Read More

A confederacy of dunces

Well, today is the day that the US electorate will (delete as appropriate) throw the bastards out/let the bastards in and bring sense to Was...

Read More

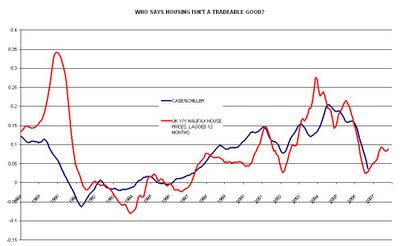

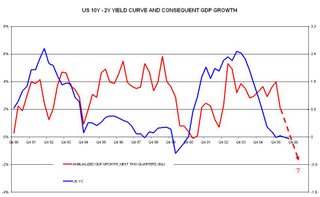

Is the yield curve forecasting a recession?

Macro Man was unsurprised to see a substantial discounting of Friday’s employment data on the basis of a) the loss of employment in the manu...

Read More

Four is a magic number

Four was a magic number in today's employment situation report. The household survey reported employment growth of roughly four hundre...

Read More

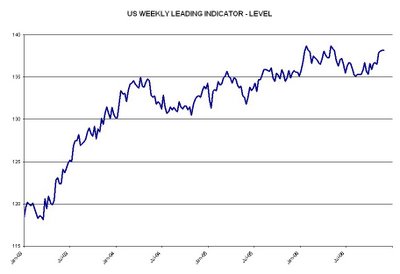

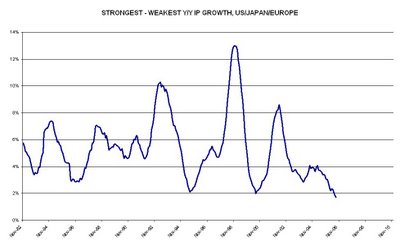

Balancing Act

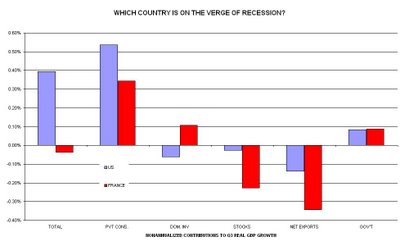

Markets are now finely balanced between pricing a soft versus hard landing in the US and, by extension, the world. As yet, no decisive conc...

Read More

Pin the tail risk on the donkey

Markets appear to be approaching put up or shut up time. Bonds are trading close to top of the recent range, with a deep inversion to cash ...

Read More

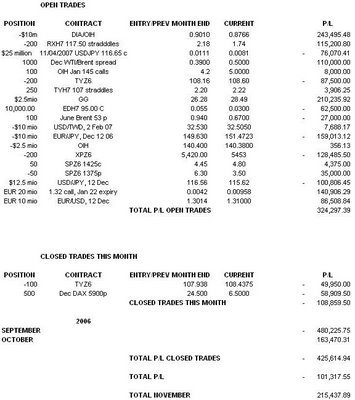

Chicago (Economy) Bears?

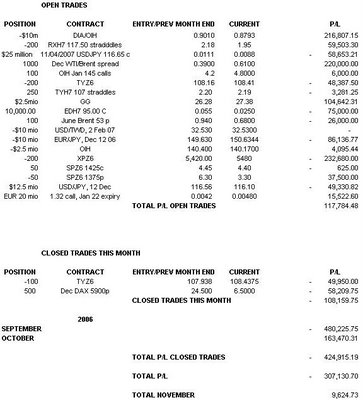

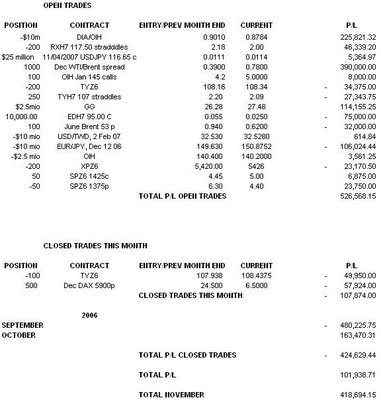

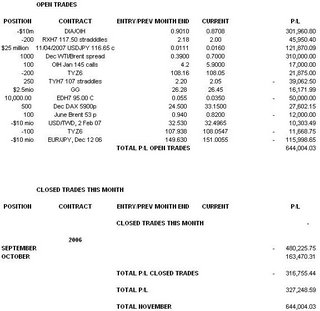

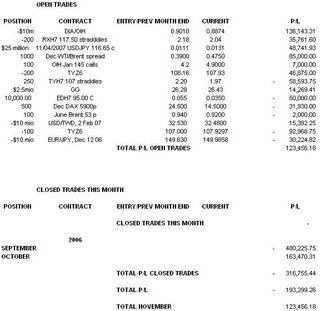

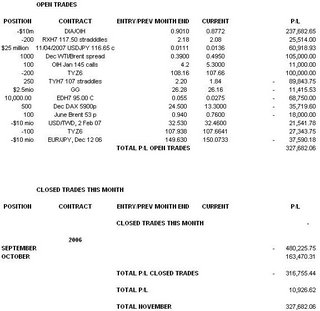

Well, October didn’t finish too badly. A late rally in oil (and the OIH), plus an excellent performance from the new Goldcorp position kept ...

Read More

Subscribe to:

Comments (Atom)