Macro Man feels like doing his Christmas shopping, these markets are so slow. Foreign exchange is a total write off, as the G3 appear to be trading in the same 0.3% daily band as the CNY, while minors like NZD and NOK exhibit the erratic behavior characteristic of Brownian motion. Fixed income is equally sluggish, with bonds waiting to take their cue from the monthly sacrifice at the altar of standard error, the US non-farm payroll report. Yesterday the ECB took rates up to 3.25% as everyone including Macro Man’s milkman’s dog expected; on the margin Mr. Euro was slightly less hawkish than he could have been (the ‘vigilant’ count was fairly modest), though that is the norm on rate hike day.

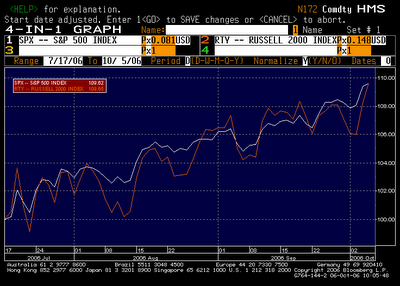

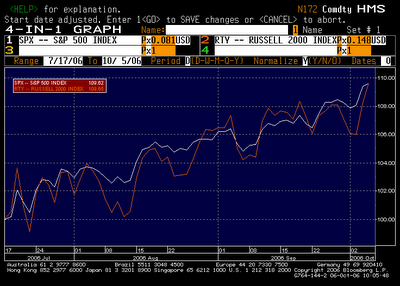

Commodities and equities are more interesting, but that is really the same trade. Energy prices remain limp, thus providing an excuse to take stocks higher. The rally appears to be becoming more broad-based; small caps, which had lagged the rebound off of the June lows, have now kept pace with the S&P 500 since mid-July. This suggests that participation in the equity bull is broadening. The OIH took a sickening lurch below 120 earlier in the week before snapping back. The danger is still not over, however, and the DIA/OIH spread remains (un)comfortably offside. Perhaps we need to see evidence that specs are actively short the energy complex before a more meaningful rally can occur; in that vein, tonight’s CFTC data will be especially interesting. Certainly oil is trading limply despite the efforts of OPEC to talk it up.

Commodities and equities are more interesting, but that is really the same trade. Energy prices remain limp, thus providing an excuse to take stocks higher. The rally appears to be becoming more broad-based; small caps, which had lagged the rebound off of the June lows, have now kept pace with the S&P 500 since mid-July. This suggests that participation in the equity bull is broadening. The OIH took a sickening lurch below 120 earlier in the week before snapping back. The danger is still not over, however, and the DIA/OIH spread remains (un)comfortably offside. Perhaps we need to see evidence that specs are actively short the energy complex before a more meaningful rally can occur; in that vein, tonight’s CFTC data will be especially interesting. Certainly oil is trading limply despite the efforts of OPEC to talk it up.

That’s about all the writing that Macro man can muster this morning....hopefully payrolls or the Hungarian political vote can inject a spot of volatility into markets that have become well and truly dire for anyone not short vol or long equity indices.