Well, for once the US employment figures delivered a spot of volatility to financial markets, courtesy of a tasty 810k upward revision to part payroll data through March 2006. It is really getting to the point where macroeconomic data is becoming utterly useless, given the frequency and magnitude of historical revisions. Are unit labour costs 0.3% y/y or 5% y/y? Is nominal GDP 6% y/y or 4.8% y/y? Is the unemployment rate turning dangerously higher or reaching a new low for the cycle? If you don’t like today’s data, wait til next month, when it will be revised away!

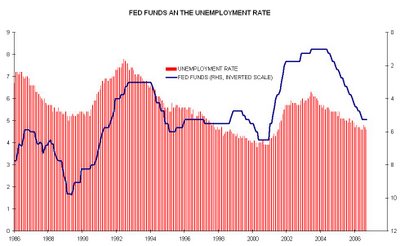

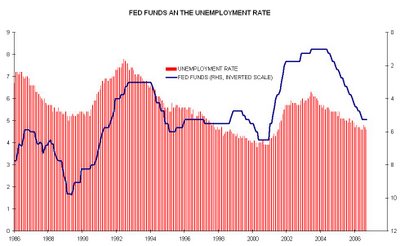

It begs the question of why volatility remains so low when the very building blocks of a macro view can be undermined with the swish of a bureaucrat’s pen. Nevertheless, Friday’s edition of ‘Revise-U-Like’ was friendly to Macro Man’s view, seemingly confirming that the underlying strength of the economy is greater than a myopic focus on monthly payroll numbers would indicate. Indeed, the revisions at least eased the discrepancy between apparently tepid payroll growth and the strength of personal income and expenditure. The strip and bonds both responded by moving lower, though the latter remains way too high in Macro Man’s view. The Fed doesn’t ease rates until the unemployment rate begins to rise, and we currently reside at the cycle low for the unemployment rate (at least until Friday’s data is revised away in March.) Therefore, a 60 bp inversion between 3m cash and 10y yields continues to look excessive.

Also remaining too high is the NZD. Although the USD enjoyed a solid day on Friday, breaking key resistance levels against the EUR and JPY, it is actually down on the month against the kiwi. This makes relatively little sense, given New Zealand’s clear policy preference for a lower NZD. It is difficult to see many differences between the NZD and the ZAR, other than that the latter goes down in a straight line and the former, well, doesn’t. Macro Man is beginning to wonder if it isn’t time to seek pastures new in expressing a long dollar bias. At this juncture it is worth waiting to see if technical breaks are confirmed, or if this is just another in a seemingly endless series of false breaks and loss-making opportunities. Stay tuned.

Far and away the most significant (alas, negative) contributor to P/L this month is the DIA/OIH spread. We are entering ‘put up or shut up’ territory now. Earnings season kicks off this week, which should provide a bit of volatility to equity prices. Hopefully, the generally upbeat news on US activity will spur oil higher, providing a fillip to the OIH position.

It begs the question of why volatility remains so low when the very building blocks of a macro view can be undermined with the swish of a bureaucrat’s pen. Nevertheless, Friday’s edition of ‘Revise-U-Like’ was friendly to Macro Man’s view, seemingly confirming that the underlying strength of the economy is greater than a myopic focus on monthly payroll numbers would indicate. Indeed, the revisions at least eased the discrepancy between apparently tepid payroll growth and the strength of personal income and expenditure. The strip and bonds both responded by moving lower, though the latter remains way too high in Macro Man’s view. The Fed doesn’t ease rates until the unemployment rate begins to rise, and we currently reside at the cycle low for the unemployment rate (at least until Friday’s data is revised away in March.) Therefore, a 60 bp inversion between 3m cash and 10y yields continues to look excessive.

Also remaining too high is the NZD. Although the USD enjoyed a solid day on Friday, breaking key resistance levels against the EUR and JPY, it is actually down on the month against the kiwi. This makes relatively little sense, given New Zealand’s clear policy preference for a lower NZD. It is difficult to see many differences between the NZD and the ZAR, other than that the latter goes down in a straight line and the former, well, doesn’t. Macro Man is beginning to wonder if it isn’t time to seek pastures new in expressing a long dollar bias. At this juncture it is worth waiting to see if technical breaks are confirmed, or if this is just another in a seemingly endless series of false breaks and loss-making opportunities. Stay tuned.

Far and away the most significant (alas, negative) contributor to P/L this month is the DIA/OIH spread. We are entering ‘put up or shut up’ territory now. Earnings season kicks off this week, which should provide a bit of volatility to equity prices. Hopefully, the generally upbeat news on US activity will spur oil higher, providing a fillip to the OIH position.