* Maybe the mysterious buyer was there, maybe he wasn’t, but Treasuries once again stopped around the 107 level. The weak Philly Fed headline certainly helped bonds bounce after the bearish jobless claims data, but in the big picture the rally has been fairly modest. Macro Man expects bonds to range trade until the middle of next week given the absence of any market moving data. He therefore sells out his long TYH7 107 straddles at the current price of 1-28/32 and will look to rebuy on Tuesday evening or Wednesday morning.

* The SPZ6 1355 calls expire today and will of course be exercised. The trade, including delta hedges, has generated a small loss given the one-way train that is the US equity market. The long of 11 contracts provides a small hedge against the short DIA position. Macro Man leaves a stop at 1363 on the futures and will trail it higher.

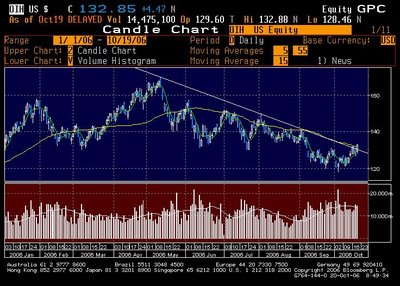

* Back in Black: The DIA/OIH trade, a source of consternation since inception, is finally (and modestly) in the money. Courtesy of bang up earnings from Noble and a somewhat more hawkish than expected commentary from the Saudis, the OIH broke through trend resistance at 130.90, surging to close at the highs at 132.85. Given the embedded bearishness on the energy complex as well as the cheapness of the stocks, it is worth pressing bets here. Macro Man spends $50k of option premium, buying 100 Jan 145 calls @ $5.00. If oil spikes to $65, let alone anywhere close to the highs, this should provide a nice leveraged exposure.

* The SPZ6 1355 calls expire today and will of course be exercised. The trade, including delta hedges, has generated a small loss given the one-way train that is the US equity market. The long of 11 contracts provides a small hedge against the short DIA position. Macro Man leaves a stop at 1363 on the futures and will trail it higher.

* Back in Black: The DIA/OIH trade, a source of consternation since inception, is finally (and modestly) in the money. Courtesy of bang up earnings from Noble and a somewhat more hawkish than expected commentary from the Saudis, the OIH broke through trend resistance at 130.90, surging to close at the highs at 132.85. Given the embedded bearishness on the energy complex as well as the cheapness of the stocks, it is worth pressing bets here. Macro Man spends $50k of option premium, buying 100 Jan 145 calls @ $5.00. If oil spikes to $65, let alone anywhere close to the highs, this should provide a nice leveraged exposure.

* FX becomes more wretched by the day. Central bank flow and the concomitant range trading environment has killed risk appetite and telescoped trading horizons to the micro-term. An 80 point pullback in EUR/USD was sufficient to send the market scurrying for cover as traders stopped out of long $ positions across the board. Patience on the NZD trade has worn very thin indeed, though Macro Man senses that the market is now leaning long kiwi. With the CPI reweighting/RBNZ slated for next week. With bills discounting another RBNZ hike with virtual certainty, risks must remain that disappointment ensues. Nevertheless, Macro Man isn’t prepared to lose too much more on the trade. He sets a stop at 0.6755, above the previous high of the move.

1 comments:

Click here for commentstest