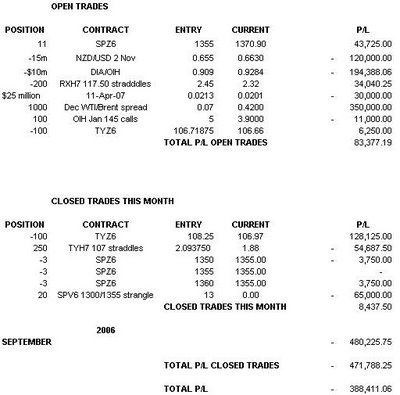

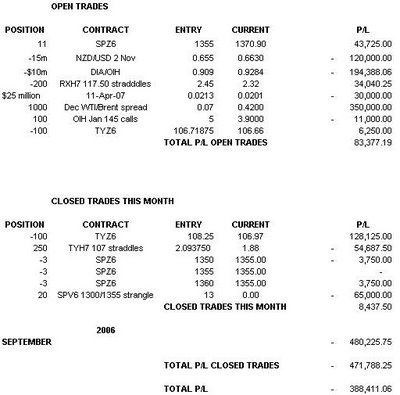

Well, the bond market has dragged Macro Man back in the saddle earlier than anticipated. Whether the ride turns out to be smooth or bumpy depends on the outcome of the second half of the week with the Fed, durables, and of course the muhc-vaunted weak Q3 GDP. Macro Man was filled at 106-23 on a sale of 100 Treasury futures, and now needs the CTA community to provide a tailwind by exiting some of their near-record longs.

Elsewhere, the dollar is refreshingly firm as models have been jerked around yet again. It is close to D-day for the kiwi, with the new model CPI plus RBNZ this week. If the kiwi retains in mysterious bid after these, it will be time to pull the plug. Oil has once again broken down, hurting the OIH exposure, but the Texas/Brent spread is hanging in there at a reasonable profit.

Elsewhere, the dollar is refreshingly firm as models have been jerked around yet again. It is close to D-day for the kiwi, with the new model CPI plus RBNZ this week. If the kiwi retains in mysterious bid after these, it will be time to pull the plug. Oil has once again broken down, hurting the OIH exposure, but the Texas/Brent spread is hanging in there at a reasonable profit.