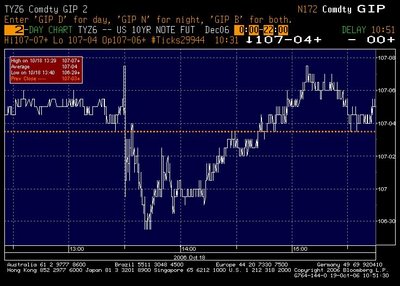

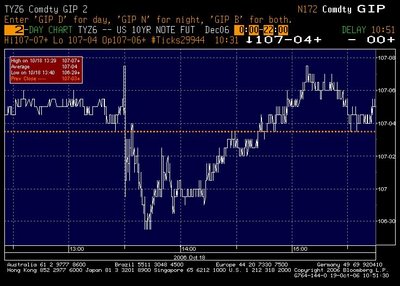

Macro Man feels like he’s been transported back to the days of his youth when he used to while away winter days playing the Atari 2600 game Breakout. Currencies and bonds remains frustratingly rangebound, and every attempt to breach established highs/lows is met with a wall of resistance. Markets may have chipped away at some initial layers of the wall, but like the ‘ball’ in Breakout, keep coming back. Yesterday’s post data price action was suspicious, to say the least. A new cycle high for core CPI and, perhaps more importantly, a strong rebound in housing starts were met with fleeting weakness in bonds before an evidently motivated (and price insensitive) buyer put the squeeze on. Was it a central bank? A pension fund doing an asset allocation switch? It’s hard to say, though central banks were once again active in constraining USD strength against the euro yesterday. Either way, it stinks.

Elsewhere, Macro Man finds that most of his portfolio risk is coming from energy plays. While the lurch lower in crude has set the DIA/OIH spread higher, comfort can nevertheless be taken that the OIH is putting in an impressive positive divergence vis-à-vis crude prices. However, the WTI/Brent spread has widened marginally, providing a handy offset. Yesterday’s inventory data was curious- a sharp decline in distillate/product inventories, but a sharp rise in crude stocks. Clearly utilization rates are heading lower. Hopefully the recent cold snap is a sign of things to come and demand will pick up. In any event, today’s OPEC 1m bpd production cut has been well-flagged, so the surprise content should be zero.

Elsewhere, Macro Man finds that most of his portfolio risk is coming from energy plays. While the lurch lower in crude has set the DIA/OIH spread higher, comfort can nevertheless be taken that the OIH is putting in an impressive positive divergence vis-à-vis crude prices. However, the WTI/Brent spread has widened marginally, providing a handy offset. Yesterday’s inventory data was curious- a sharp decline in distillate/product inventories, but a sharp rise in crude stocks. Clearly utilization rates are heading lower. Hopefully the recent cold snap is a sign of things to come and demand will pick up. In any event, today’s OPEC 1m bpd production cut has been well-flagged, so the surprise content should be zero.

Elsewhere, Macro Man finds that most of his portfolio risk is coming from energy plays. While the lurch lower in crude has set the DIA/OIH spread higher, comfort can nevertheless be taken that the OIH is putting in an impressive positive divergence vis-à-vis crude prices. However, the WTI/Brent spread has widened marginally, providing a handy offset. Yesterday’s inventory data was curious- a sharp decline in distillate/product inventories, but a sharp rise in crude stocks. Clearly utilization rates are heading lower. Hopefully the recent cold snap is a sign of things to come and demand will pick up. In any event, today’s OPEC 1m bpd production cut has been well-flagged, so the surprise content should be zero.

Elsewhere, Macro Man finds that most of his portfolio risk is coming from energy plays. While the lurch lower in crude has set the DIA/OIH spread higher, comfort can nevertheless be taken that the OIH is putting in an impressive positive divergence vis-à-vis crude prices. However, the WTI/Brent spread has widened marginally, providing a handy offset. Yesterday’s inventory data was curious- a sharp decline in distillate/product inventories, but a sharp rise in crude stocks. Clearly utilization rates are heading lower. Hopefully the recent cold snap is a sign of things to come and demand will pick up. In any event, today’s OPEC 1m bpd production cut has been well-flagged, so the surprise content should be zero.