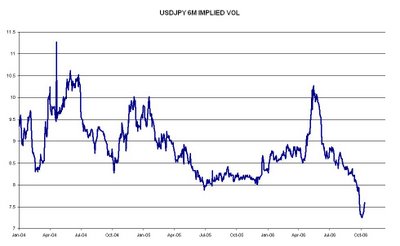

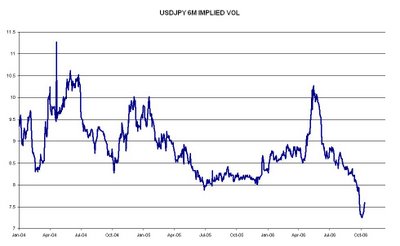

Have we turned the corner? Are markets finally turning from aimless to trending, with a concomitant pop in volatility and interest/participation? Anecdotal evidence is encouraging. Trading rooms are reporting more noise than they’ve seen in a while, and implied vols in currency land have finally turned up. Macro Man expects that we are in for a period of dollar vollar, where implied vols will trade with a 100% correlation to spot (higher dollar = higher implieds, lower dollar = lower implieds.)

The performance of USD/JPY since breaking the pivotal 118.50 resistance after payrolls has been impressive. At the time of writing it is only 20 pips off its highs, despite Japanese exporters having had two full sessions two take advantage of the ‘gift’ of USD/JPY spot close to 120. Quite what Japan’s importers make of it is another question altogether, having had relatively little experience over the years managing the need to buy USD in a bid market. Risks must surely lie in the direction of these guys, along with their investment management counterparts, chasing the $ higher. Given that the price of a 6m ATMF $ call is less than the forward points, this seems an excellent way of expressing a bullish spot and vol view. Macro Man buys $20 million 6m 116.65 USD calls for 2.13% of face (i.e., 254 yen pips.)

Meanwhile, fixed income has traded refreshingly poorly. Recent Fed speakers (with the sad exception of Bernanke) have highlighted that markets have gotten ahead of themselves in pricing 3 cuts next year. Risks must surely lie in the direction of the strip and the back end both selling of further. Bulls may try to hang their hats on cherry picking dovish comments from tonight’s Fed minutes, but obviously subsequent data has brought less dovish factors to light. The 25 bps of easing that’s already been taken out has been worth a point and a half on the 10yr future. Presumably, a total eradication of 2007 easing expectations would generate another 3 points or so of downside. Given the uncertainties surrounding the US and the fact that the Treasury market is generally high-beta, it is remarkable to observe that implied vol in the Bund market is above that of Treasuries. Macro Man smells a trade here. He buys 250 TYH7 107 straddles at 2 3/32 points (4.1 implied vol) and sells 200 RXH7 117.50 straddles at 2.45 (4.33 vol.) The trade should win unless the ECB drastically overreacts to the VAT-inspired surge in German Q4 consumption.

The performance of USD/JPY since breaking the pivotal 118.50 resistance after payrolls has been impressive. At the time of writing it is only 20 pips off its highs, despite Japanese exporters having had two full sessions two take advantage of the ‘gift’ of USD/JPY spot close to 120. Quite what Japan’s importers make of it is another question altogether, having had relatively little experience over the years managing the need to buy USD in a bid market. Risks must surely lie in the direction of these guys, along with their investment management counterparts, chasing the $ higher. Given that the price of a 6m ATMF $ call is less than the forward points, this seems an excellent way of expressing a bullish spot and vol view. Macro Man buys $20 million 6m 116.65 USD calls for 2.13% of face (i.e., 254 yen pips.)

Meanwhile, fixed income has traded refreshingly poorly. Recent Fed speakers (with the sad exception of Bernanke) have highlighted that markets have gotten ahead of themselves in pricing 3 cuts next year. Risks must surely lie in the direction of the strip and the back end both selling of further. Bulls may try to hang their hats on cherry picking dovish comments from tonight’s Fed minutes, but obviously subsequent data has brought less dovish factors to light. The 25 bps of easing that’s already been taken out has been worth a point and a half on the 10yr future. Presumably, a total eradication of 2007 easing expectations would generate another 3 points or so of downside. Given the uncertainties surrounding the US and the fact that the Treasury market is generally high-beta, it is remarkable to observe that implied vol in the Bund market is above that of Treasuries. Macro Man smells a trade here. He buys 250 TYH7 107 straddles at 2 3/32 points (4.1 implied vol) and sells 200 RXH7 117.50 straddles at 2.45 (4.33 vol.) The trade should win unless the ECB drastically overreacts to the VAT-inspired surge in German Q4 consumption.