What would you rather be: a financial market trader or an American turkey? The lack of action in these markets is so dire, Macro Man is swiftly moving to favour the latter; at least turkeys will be put out of their misery in the near future. Portfolio performance has remained solid over the last 24 hours; what the recovery in Aussie stocks took away, the out-performance of energy stocks and NYMEX crude gave back. Given how quiet everything has been, it would be relatively surprising to see much change in the P/L.

Jeff Currie, the energy analyst at Goldman Sachs, put out an excellent piece last week discussing the underperformance of WTI. Essentially, WTI has faced a headwind caused by the fact that the delivery depot in Oklahoma is landlocked and oversupplied; Macro Man was aware of the former factor but did not realize the significance of the latter. The upshot is that WTI is underperforming and not reflecting the global supply/demand dynamic, and anomalous spreads have emerged with not only Brent, but also with crudes of similar quality such as Louisiana light. It also explains the relative outperformance of the OIH versus WTI. Assuming the conditions at Cushing are mitigated (and Currie believes the fundamentals are already turning), WTI discounts should ebb, and the Dec 07 WTI/Brent spread should continue to widen out back towards its longer term average of $1.50-$2.50.

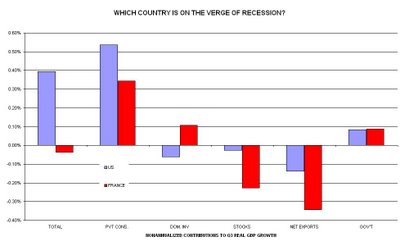

A less compelling research missive from Goldman is the introductory piece from their global economics monthly, wherein they declare partial for their ‘global decoupling’ thesis. While acknowledging that Japan seems to have hit a rocky patch, they state that Europe appears to be decoupling from the US. Perhaps, but maybe not in the way that they expected!

Jeff Currie, the energy analyst at Goldman Sachs, put out an excellent piece last week discussing the underperformance of WTI. Essentially, WTI has faced a headwind caused by the fact that the delivery depot in Oklahoma is landlocked and oversupplied; Macro Man was aware of the former factor but did not realize the significance of the latter. The upshot is that WTI is underperforming and not reflecting the global supply/demand dynamic, and anomalous spreads have emerged with not only Brent, but also with crudes of similar quality such as Louisiana light. It also explains the relative outperformance of the OIH versus WTI. Assuming the conditions at Cushing are mitigated (and Currie believes the fundamentals are already turning), WTI discounts should ebb, and the Dec 07 WTI/Brent spread should continue to widen out back towards its longer term average of $1.50-$2.50.

A less compelling research missive from Goldman is the introductory piece from their global economics monthly, wherein they declare partial for their ‘global decoupling’ thesis. While acknowledging that Japan seems to have hit a rocky patch, they state that Europe appears to be decoupling from the US. Perhaps, but maybe not in the way that they expected!

Platinum has gone bid today on news that an ETF might be launched. While the move has generated a small p.a. profit (his and Mrs. Macro’s wedding rings are platinum), there is little to suggest that this is anything other than noise. If there were a liquid platinum option market, he’d be tempted to buy puts. Sadly, there isn’t, and the recent history of copper and nickel suggest that fading squeeze-y moves in illiquid metals can be a relatively costly exercise. Macro Man might be tempted to fade any sell-off in USD/ZAR resulting from the platinum move, but he’s need to see levels closer to 7.00 before pulling the trigger.

Finally, Macro Man encourages you to vote in the equity market poll posted yesterday. The results will feed into a much larger poll (which is the source of the response options), but Macro Man might be too embarrassed to forward his results if he cannot notch a double-digit response figure!

Finally, Macro Man encourages you to vote in the equity market poll posted yesterday. The results will feed into a much larger poll (which is the source of the response options), but Macro Man might be too embarrassed to forward his results if he cannot notch a double-digit response figure!

4 comments

Click here for commentsThx Dude UFABET เกมส์บาคาร่า

ReplyThx Dude UFABET เกมส์บาคาร่า

ReplyThx Dude UFABET เกมส์บาคาร่า

ReplyThx Dude UFABET เกมส์บาคาร่า

Reply