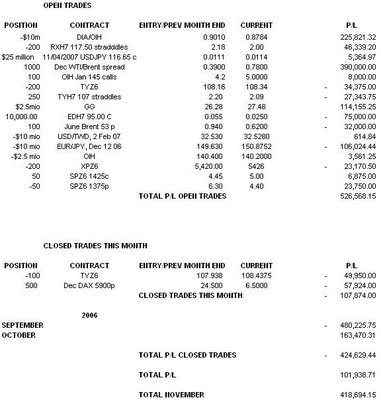

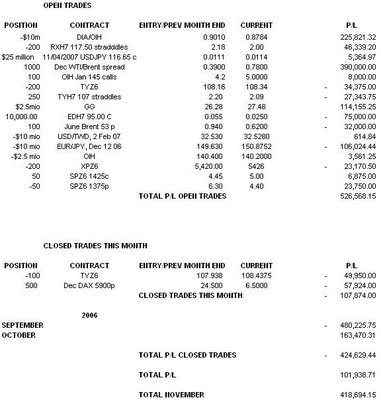

As the holiday season moves swiftly towards us, the noise-to-signal ratio in financial markets approaches infinity. The level of frustration in markets is palpable, virtually regardless of what positions one chooses to hold at any particular point in time. The resource complex has saved Macro Man’s bacon, as gains in GG and OIH have made up for losses in bonds and the short Aussie equity trade. Net-net, the portfolio has lost a smidge overnight, though again there has been quite a bit of volatility amongst the constituent positions.

The holidays also bring us to the rumor-mongering silly season, where a good imagination is more important than good analysis when it comes to getting the markets right. If you can conjure up the right kind of nonsense, you can move markets your way, if only for a few minutes. Still, sometimes that’s all it takes. Among the rumors and Chinese whispers that Macro Man has heard recently are the following:

*The BLS is going to adjust the October unemployment rate from 4.4% to 4.6%

*Iceland is going to see its sovereign debt rating downgraded

*Voldemort is buying EUR/USD

*Voldemort is selling EUR/USD

*Voldemort is buying EUR/JPY

*Voldemort is selling USD/JPY

*China will limit CNY appreciation against the dollar to 3% next year

*MOF has told Japanese exporters to sell USD/JPY

*The Fed is flooding the US economy with liquidity which would have been picked up in the now-discontinued M3 data but somehow is not captured in narrower monetary aggregates

*A platinum ETF will be launched

*Risk trades are on the brink of a massive liquidation

*The central banks of many if not most Asia ex Japan countries have been intervening to buy dollars heavily this week

*Tom Cruise wore six inch platform shoes to his wedding to disguise the fact that he is closer in stature to Mini-me than Dr. Evil

*And of course........there are ‘huge’ stop losses on either side of the market! (Pick any market- the rumor works well for everything from TYZ6 to Malaysian palm oil.)

Needless to say, most of it is rubbish. However, if you were long platinum and looking for a tasty exit level, yesterday’s ETF story served one up on a silver platter. The moral of that particular story, evidently, is caveat auditor!

And if you haven't voted.... http://vkg.pollhost.com/

The holidays also bring us to the rumor-mongering silly season, where a good imagination is more important than good analysis when it comes to getting the markets right. If you can conjure up the right kind of nonsense, you can move markets your way, if only for a few minutes. Still, sometimes that’s all it takes. Among the rumors and Chinese whispers that Macro Man has heard recently are the following:

*The BLS is going to adjust the October unemployment rate from 4.4% to 4.6%

*Iceland is going to see its sovereign debt rating downgraded

*Voldemort is buying EUR/USD

*Voldemort is selling EUR/USD

*Voldemort is buying EUR/JPY

*Voldemort is selling USD/JPY

*China will limit CNY appreciation against the dollar to 3% next year

*MOF has told Japanese exporters to sell USD/JPY

*The Fed is flooding the US economy with liquidity which would have been picked up in the now-discontinued M3 data but somehow is not captured in narrower monetary aggregates

*A platinum ETF will be launched

*Risk trades are on the brink of a massive liquidation

*The central banks of many if not most Asia ex Japan countries have been intervening to buy dollars heavily this week

*Tom Cruise wore six inch platform shoes to his wedding to disguise the fact that he is closer in stature to Mini-me than Dr. Evil

*And of course........there are ‘huge’ stop losses on either side of the market! (Pick any market- the rumor works well for everything from TYZ6 to Malaysian palm oil.)

Needless to say, most of it is rubbish. However, if you were long platinum and looking for a tasty exit level, yesterday’s ETF story served one up on a silver platter. The moral of that particular story, evidently, is caveat auditor!

And if you haven't voted.... http://vkg.pollhost.com/

3 comments

Click here for commentswho's voldemort ???

ReplyCentral banks and monetary authorities, i.e. 'He who must not be named' by the brokerage community. See the 'Harry Potter and the FX reserve managers' post from Nov 16 for a fuller explanation.

Replythanks .... love the commentary

Reply