Well, today is the day that the US electorate will (delete as appropriate) throw the bastards out/let the bastards in and bring sense to Washington/bring nonsense to Washington. In reality, the policy differences between Democrats and Republicans are not terribly large; indeed, the policy that each party seems to stand for most strongly is the desire to seem themselves elected. Although Macro Man is not a political scientist and does not pretend to have the energy or desire to sift through the minutiae of the various parties/candidates, it appears to his inexpert view that both of the US parties remain aligned to the right of, say, David Cameron’s Tory Party on the political spectrum.

Macro Man fails to see a substantial real impact from the Democrats winning control of the House or even the Senate, though he concedes that the market may conclude differently. Certainly the historical performance of equities is much higher under gridlock than under single-party rule, which may explain at least part of the recent run up in US stocks. This, at least, would appear to fit in with Macro Man’s general attitude towards politicians, namely that those most desirous of political power are generally amongst the least qualified to wield it effectively.

The one political item that Macro Man keeps on the radar is that of protectionism. The tide in the US seems to have tilted decisively towards more rather than less; insofar as there ever will be a ‘dollar crisis’ (and Macro Man has serious reservations that there will be), it will likely be spurred by the US government telling foreigners that either their dollars or their goods are no longer welcome. Macro Man remembers how acrimonious trade negotiations were among the spurs for the very sharp rally in the yen in the mid 90’s.

Elsewhere, it’s been a quiet start to the week on the data front, with central banks comments grabbing most of the headlines. Janet Yellen grabbed headlines with some fairly innocuous comments on foreigners potentially buying fewer US assets in the future. Well, when Asian and oil exporting countries quit buying so many dollars, they’ll be less need for them to purchase US assets, won’t there? That the dollar sold off on the back of Yellen’s comments is probably more reflective of short term positioning than the expectation that she will catalyze a substantial downtrend in the dollar as she did in September of 2004.

BOJ governor Fukui, meanwhile, promised to act pre-emptively in adjusting monetary policy and promised that policy normalization won’t take longer than five years. To a market for whom five days now represents the ‘medium term’, Macro Man cannot see that this promise should have a definitive impact. Not even the observation that the yen’s real effective exchange rate is the weakest since 1985 prompted much in the way of yen buying, else EUR/JPY would not remain comfortably north of 150. The problem, it seems to Macro Man, is much more to do with yen crosses than USD/JPY. Indeed, with US finished goods price inflation substantially below that of Japan at the moment, the equilibrium PPP rate for USD/JPY is actually drifting higher. No, the real problem is that there are motivated buyers of Asian, European, and Antipodean currencies who do not share the same enthusiasm for the yen. Macro Man leaves you to decide who these motivated buyers might be.

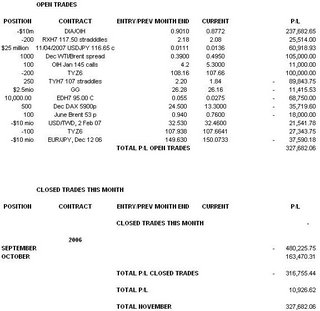

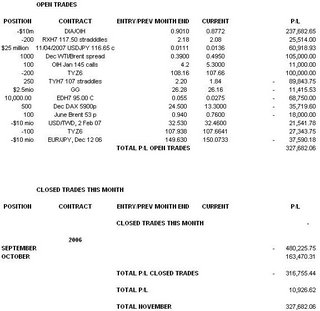

The portfolio remains solidly in the black this month, though the pullback in Treasuries and Goldcorp has taken a bit of the shine off. On the plus side, oil and energy stocks are performing well, with the OIH trades delivering a nice fillip to the P/L. Macro Man remains 140 offer in $2.5 million worth of OIH, allowing the options to take a greater delta burden. The 107 bid in Treasuries remains unfilled, and it will likely remain so until at least Thursday, when the Michigan sentiment is released. The continued softness of retail energy prices should maintain the recent recovery.

Macro Man fails to see a substantial real impact from the Democrats winning control of the House or even the Senate, though he concedes that the market may conclude differently. Certainly the historical performance of equities is much higher under gridlock than under single-party rule, which may explain at least part of the recent run up in US stocks. This, at least, would appear to fit in with Macro Man’s general attitude towards politicians, namely that those most desirous of political power are generally amongst the least qualified to wield it effectively.

The one political item that Macro Man keeps on the radar is that of protectionism. The tide in the US seems to have tilted decisively towards more rather than less; insofar as there ever will be a ‘dollar crisis’ (and Macro Man has serious reservations that there will be), it will likely be spurred by the US government telling foreigners that either their dollars or their goods are no longer welcome. Macro Man remembers how acrimonious trade negotiations were among the spurs for the very sharp rally in the yen in the mid 90’s.

Elsewhere, it’s been a quiet start to the week on the data front, with central banks comments grabbing most of the headlines. Janet Yellen grabbed headlines with some fairly innocuous comments on foreigners potentially buying fewer US assets in the future. Well, when Asian and oil exporting countries quit buying so many dollars, they’ll be less need for them to purchase US assets, won’t there? That the dollar sold off on the back of Yellen’s comments is probably more reflective of short term positioning than the expectation that she will catalyze a substantial downtrend in the dollar as she did in September of 2004.

BOJ governor Fukui, meanwhile, promised to act pre-emptively in adjusting monetary policy and promised that policy normalization won’t take longer than five years. To a market for whom five days now represents the ‘medium term’, Macro Man cannot see that this promise should have a definitive impact. Not even the observation that the yen’s real effective exchange rate is the weakest since 1985 prompted much in the way of yen buying, else EUR/JPY would not remain comfortably north of 150. The problem, it seems to Macro Man, is much more to do with yen crosses than USD/JPY. Indeed, with US finished goods price inflation substantially below that of Japan at the moment, the equilibrium PPP rate for USD/JPY is actually drifting higher. No, the real problem is that there are motivated buyers of Asian, European, and Antipodean currencies who do not share the same enthusiasm for the yen. Macro Man leaves you to decide who these motivated buyers might be.

The portfolio remains solidly in the black this month, though the pullback in Treasuries and Goldcorp has taken a bit of the shine off. On the plus side, oil and energy stocks are performing well, with the OIH trades delivering a nice fillip to the P/L. Macro Man remains 140 offer in $2.5 million worth of OIH, allowing the options to take a greater delta burden. The 107 bid in Treasuries remains unfilled, and it will likely remain so until at least Thursday, when the Michigan sentiment is released. The continued softness of retail energy prices should maintain the recent recovery.

2 comments

Click here for commentswe'll wake up tomorrow and the Dems will cry "victory " ... but nothing will change and the economy will keep growing , and the market will keep rallying and all's well that ends well... and that's good enough for me !!!

ReplyIt reminds me of the old joke: (Candidate A), (Candidate B), and (Candidate C) are all stranded on a desert island. Who wins?

ReplyA. The American people