Q. What do you get when you invite a bunch of central bankers together in Frankfurt?

A. [EXPLETIVE DELETED]

Macro Man's buddies are at it again. PBOC governor Zhou decided yesterday afternoon to yank the market's chain by stating that China has a 'clear plan to diversify reserves.' The dollar predictably tanked. This morning, meanwhile, Asian central banks (no naming names, of course) have reportedly been buyers of dollars as the private sector scrambles to sell the buck given the Chinese tailwind.

And lo and behold! Look what Mr. Zhou has to say for himself this morning. He claims that China has 'No plans to speed up diversification' and 'no plans to sell dollars.' Hmm. Nice trading, guys. Macro Man is not a conspiracy theorist by nature, and is not sure if this sort of behaviour qualifies as a conspiracy so much as naked and blatant market manipulation. Either way, the whiff of sulphur has strengthened to a stench. Where's Harry Potter when you need him? Lord Voldemort is trading foreign exchange!

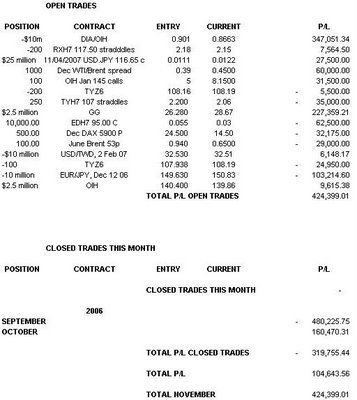

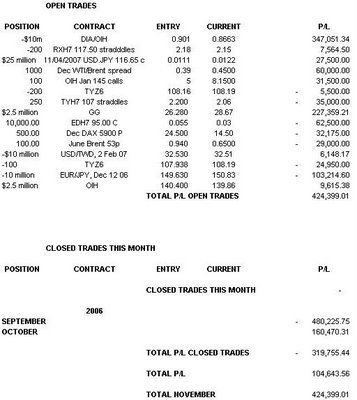

In actuality, the shenanigans of the CBs have impacted the portfolio only tangentially. Although there are a few FX trades, the net exposure is essentially short EUR/long TWD. If the market is going to ramp EUR/USD above 1.30, obviously this position will need some adjusting. However, having sold EUR/JPY at 150, Macro Man wants to give it a couple of days to see how it enjoys the rarified air of being closer to 200 than 100.

Elsewhere, the commodity plays are peforming strongly. Goldcorp benefitted from an anaylst upgrade and the underlying strength in gold to rise roughly 8% yesterday. Macro Man will be keen to see if it can keep running higher as gold approaches the tecnhical target of $650. Perhaps writing some calls will be worthwhile. The OIH, meanwhile, sank into the close despite the underlying strength of oil. The partial profit take at 140.40 is therefore slightly in the money. Although Macro Man does not believe that a Democratic Congress will be able to pass a windfall tax on energy companies, the possibility thereof will create some noise. This, in turn, could provide an opportunity to trade around the core position. Macro Man will offer out another $2.5 million of his cash OIH position at 145.

Bonds, meanwhile, continue to squeeze higher. The Michigan number was disappointing, of course, but Macro Man thought that the resultant bond rally was outsized, particularly given the correction lower in claims and the implications of the trade data for GDP growth (Q3 likely to be revised to a 2 handle.)

Macro Man cannot help but observe, meanwhile, that the 'global decoupling' pipe that the market likes to smoke is giving off a rather acrid smoke. Japan saw the release of yet another disappointing figure last night, as machinery orders revealed a further retrenchment in capex spending. There is a decent chance we see a negative print for Q3 next week.

In France, meanwhile, GDP stagnated in Q3, showing zero growth from Q2. This contrasts sharply with expectations for 0.5% nonannualized quarterly growth. Seperately, IP registered a surpising decline and is now down on a year-on-year basis. It may be difficult for the ECB to sound too hawkish with data like this in the background. By the same token, however, the European bond market isn't exactly priced for a substantial extension of the tightening cycle, either. Nevertheless, it is curious to see how happy the FX markt is to ignore poor data in Europe and Japan in their lust to follow Lord Voldemort, the Pied Piper of foreign exchange.

A. [EXPLETIVE DELETED]

Macro Man's buddies are at it again. PBOC governor Zhou decided yesterday afternoon to yank the market's chain by stating that China has a 'clear plan to diversify reserves.' The dollar predictably tanked. This morning, meanwhile, Asian central banks (no naming names, of course) have reportedly been buyers of dollars as the private sector scrambles to sell the buck given the Chinese tailwind.

And lo and behold! Look what Mr. Zhou has to say for himself this morning. He claims that China has 'No plans to speed up diversification' and 'no plans to sell dollars.' Hmm. Nice trading, guys. Macro Man is not a conspiracy theorist by nature, and is not sure if this sort of behaviour qualifies as a conspiracy so much as naked and blatant market manipulation. Either way, the whiff of sulphur has strengthened to a stench. Where's Harry Potter when you need him? Lord Voldemort is trading foreign exchange!

In actuality, the shenanigans of the CBs have impacted the portfolio only tangentially. Although there are a few FX trades, the net exposure is essentially short EUR/long TWD. If the market is going to ramp EUR/USD above 1.30, obviously this position will need some adjusting. However, having sold EUR/JPY at 150, Macro Man wants to give it a couple of days to see how it enjoys the rarified air of being closer to 200 than 100.

Elsewhere, the commodity plays are peforming strongly. Goldcorp benefitted from an anaylst upgrade and the underlying strength in gold to rise roughly 8% yesterday. Macro Man will be keen to see if it can keep running higher as gold approaches the tecnhical target of $650. Perhaps writing some calls will be worthwhile. The OIH, meanwhile, sank into the close despite the underlying strength of oil. The partial profit take at 140.40 is therefore slightly in the money. Although Macro Man does not believe that a Democratic Congress will be able to pass a windfall tax on energy companies, the possibility thereof will create some noise. This, in turn, could provide an opportunity to trade around the core position. Macro Man will offer out another $2.5 million of his cash OIH position at 145.

Bonds, meanwhile, continue to squeeze higher. The Michigan number was disappointing, of course, but Macro Man thought that the resultant bond rally was outsized, particularly given the correction lower in claims and the implications of the trade data for GDP growth (Q3 likely to be revised to a 2 handle.)

Macro Man cannot help but observe, meanwhile, that the 'global decoupling' pipe that the market likes to smoke is giving off a rather acrid smoke. Japan saw the release of yet another disappointing figure last night, as machinery orders revealed a further retrenchment in capex spending. There is a decent chance we see a negative print for Q3 next week.

In France, meanwhile, GDP stagnated in Q3, showing zero growth from Q2. This contrasts sharply with expectations for 0.5% nonannualized quarterly growth. Seperately, IP registered a surpising decline and is now down on a year-on-year basis. It may be difficult for the ECB to sound too hawkish with data like this in the background. By the same token, however, the European bond market isn't exactly priced for a substantial extension of the tightening cycle, either. Nevertheless, it is curious to see how happy the FX markt is to ignore poor data in Europe and Japan in their lust to follow Lord Voldemort, the Pied Piper of foreign exchange.

2 comments

Click here for commentsTrichet's nuts to raise rates next month

ReplyI don't think he's nuts, given the (apparent) prior momentum of the European economy and an ECB forecast of above trend growth in 2007. However, it will be interesting to observe the degree to which he tones down the rhetoric at the Dec press conference. Should the French deceleration be corroborated by other activity data (as opposed to the incerdibly strong string of ifo readings), then the ECB would be wise to pause a la the Fed.

Reply