Usually I get a warm feeling when Latin America makes the cover of the Economist, like when the national news talks about your hometown. I know I won’t learn much but it is always fascinating to see how the media portrays your backyard. Mexico had a feature there back in 2012, which marked a nice top in MXN, right before growth ground to a halt and oil production took another leg lower. Argentina was there way back in the day during their financial crisis early in the century--although one had to wait for the restructuring in 2004 before there was light at the end of the tunnel.

And of course there is Brazil, which graced the cover three times> Few covers can match this one as the famous “Economist Contrary Indicator”: January 2, 2016: “Brazil and the Disastrous Year Ahead”

Go ahead and look at a chart of EWZ. I’ll wait.

Ok, I can’t help myself. Here it is.

Epic.

So it is not without trepidation that I read this week’s cover story highlighting the humanitarian disaster in Venezuela, and yesterday’s vote for a constituent assembly that aims to rewrite the constitution and officially bury one of Latin America’s oldest democracies.

After spending many years covering the region, this is the first story that genuinely makes me sad. Economies rise, economies fall--people get good jobs and advance, people get fired and suffer--this is basic material of capitalism.

What is going on in Venezuela is so far from capitalism, it boggles the imagination. In addition to violent tactics to repress opposition protests, the government has implemented a policy to continue to service the country’s external debt at all costs. This means dollars that could be used to import food and medical supplies are being diverted to pay back loans and service bonds. Exports have fallen 70% from “non-peak” levels.

An often quoted statistic is from a survey carried out by a group of universities earlier this year--they found 90% of people are living in conditions of poverty and can’t buy enough food, and 75% of people have lost significant weight in the last year.

Give that a minute to sink in.

This isn’t a backwater--it is a country of 31 million people that only ten years ago counted itself among the top of the heap in emerging markets. But reliance on oil revenues, socialist spending policies and corruption frittered this fortune away.

What does a policy to prioritize debt service over food and medicine imports mean for investors? I wrote an article on that subject a few months ago, right before Goldman Sachs took down $3 billion worth of bonds from the central bank for roughly 31 cents on the dollar.

As an owner of front-end debt you cash in on Maduro’s most damaging decisions. One of those decisions is whether or not the state-owned oil company will pay back their next bond, which matures in November.

The performance of this bond historically correlated nicely with WTI, but this year that correlation broke down when it became clear that Maduro would do practically anything to stay in power--and keeping current on the debt is the cornerstone of that castle. Earlier this year, at a time when oil prices were modestly falling back into the 40s, the Nov17s moved from 75 to 90.

The “Pay at All Costs” Trade has unravelled over the past month--violence has gotten worse, the Trump Administration announced more sanctions, and yesterday’s Constituyente election was a bloody disaster for the government.

Similarly, in the chart below, despite the destitute nature of the bonds, you can see there was a premium for the Venny 20s over the 34s, which indicates some probability that the government would find a way to muddle through and pay back this bond too. That premium has vaporized.

Yet you can see in both charts that there is plenty of air between current prices and recovery value--most of these bonds traded in the 30s back in early 2016 when oil prices appeared to be going to zero.

Amazingly, the current price of the Nov17s implies roughly a 58% probability the bond will be paid back at par. While that is down from 80% in early June, it is a testament to the power of the gun--the guy that wants to pay back the bonds at par is the one that controls the military.

Where does that leave us as investors? As I mentioned in my article, and today’s update on Caracas Chronicles by Daniel Urdaneta discusses, there are serious moral reasons why investors should hesitate to lend more money to the government, and many reasons to doubt how much longer Maduro can keep up this deadly charade.

My take is that as an investor this market is a complete, opaque, mess. The people that will know what’s going to happen politically are the same ones trading the bonds--and well...today they are whacking any bid they can find. I wouldn’t be caught dead owning the Pdvsa17s at a 43% default probability. And I’m not sure I could look at myself in the mirror if I made a buck off it anyway.

As much as I would like to say this Economist cover is yet another Latin Contrary Indicator, I think bond prices are bound to fall further. There will be many more investors looking to hit the exits and there are still further risks that, incredibly, the situation gets worse before it gets better. With long end bonds still skulking around 40, and recovery values still too high given the complete clustercuss this restructuring will be, I see nothing but pain here.

Not sure where the macro set’s philosophy stands on trafficking in this kind of stuff--do moral implications have any role in investing, or does fiduciary responsibility trump all? Feel free to chip in your two cents in the comment section.

Moving on...the implications for oil prices are more interesting. One could be forgiven for thinking oil has been trading in a boring range for the last year, even if OPEC might be making progress on slowing the taps down.

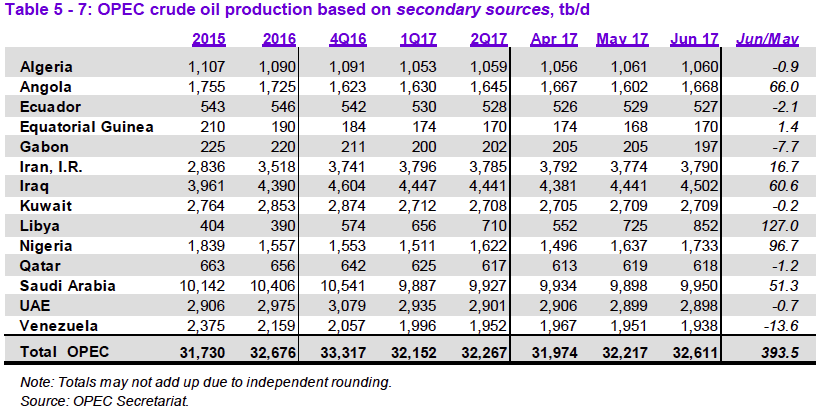

Despite all of the problems in Venezuela, production has been relatively stable around 2mm barrels per day, ranking them right up there with the big boys in OPEC.

Perhaps the market is finally coming around to this idea, but those barrels are in serious jeopardy, especially after Trump opened Pandora’s box on implementing sanctions against PdVSA by restricting or banning US dollar transactions. That would likely cause a total destruction of a significant part of the oil supply chain.

There is also the possibility that Venezuela descends into complete anarchy with widespread fighting. Beyond the humanitarian toll, oil installations would be a ripe target.

You can see in the chart above what an additional 400,000 barrels per day did to oil prices in June--either of these factors could cause an even bigger swing the other way in the weeks ahead.

I don’t think the supply response from US producers will be as quick this time as WTI peaks above 50---I’m looking for continued strength in oil prices in the weeks ahead, with Venezuela adding a combustible mix of upside optionality.

Shawn

TeamMacroMan2@gmail.com

@EMInflationista

Shawn

TeamMacroMan2@gmail.com

@EMInflationista

30 comments

Click here for commentsThanks for the article. Venezuela's population is larger than that.

Replynoted and corrected...I believe I read there are 21 million registered voters, 31 million people, according to google.

ReplyI was surprised to note that Peru and Venezuela have identical population sizes, yet such different economies.

ReplyResearch note just in:

ReplyA secret gathering over the weekend of News Limited shareholders is being accounted for the stock of "AI Trumpy" reaching an all time new high on Wall Street this week. Sources close to the company said that news limited chiefs became concern after the recent appointment of "The Mooch" as White House communications director due to his ensuing metamorphosis in what one source said resembled a doubling season of "The Apprentice" with in the West Wing. During this meeting the issue of "advertising" revenue was a focal point with concerns that Donald Trump's media exposure was at risk of being downsized due to "The Mooch" style of politics. Thus, last week's twitter ratings had come in in favor of "The Mooch" over the incumbent year to date ratings leader Donald Trump. These circumstances what was supposedly behind the share price's fall seen last week, thus news limited shareholders held a extraordinary meeting that what was said to be held at access friendly location in the early hours of Sunday morning.

Going forward with the share price our market analyst's have rated " AI Trumpy" outperform.

Yep, crude is probably going to surprise with a breakout this time. My WTI $60 year-end target is looking a bit more doable. Interestingly enough, the equity leading correlation has broken down and XLE, XOP, OIH have a bit of catching up to do (especially the latter two) with XLE above 50 dsma smartly and on to assault 100 dsma. But a new leader has emerged. Even as we are passed the peak of the US driving season, RBOB has broken out above the May 25th high and is looking like a straight up rocket to the top off the aforementioned by Shawn boring trading range. Of course, until the range is broken and back-tested (for some of us with grey hair :) it ain't a winner just yet. Ride the oil wave, guys, as toxic as it could be.

ReplyAgree. Even LB isn't bearish crude at the moment.

ReplyA few more surprises. We are bearish bonds. Today we took down the very last of our US f/I exposure and closed the trade that we began back at the end of November 2016. Despite today's move lower in yields, the charts don't look especially good especially for TLT, and a raft of weak data points have failed to push yields into a new lower range. Slightly better data probably lies ahead.

We are still looking for a bounce in DX as it probes long-term support levels around 93. That will probably also translate to higher US yields, although we expect fixed income selling to begin in Europe as in other recent bouts of weakness.

A few commentators have suggested that the critical area of low volatility is in the bond market, suggesting that volatility and market weakness will return first in Treasuries, rather than in corporate bonds and equities, and we concur. However, a sizable yield spike of 50 bps in US10y would result in a rapidly propagating volatility wave that would quickly invade other markets and trigger a sizable dislocation as risk is repriced.

Going a little further with the dollar bounce, we would suggest that CAD and especially AUD are good shorts now, both having benefited from sharp short squeezes after traders built excessively large positions heading into the May-June period.

ReplyAnother fantastic post, Shawn. And thank you for the feedback on CLP in the comment section of your previous post.

ReplyVery interesting piece. Hard working population, enormous natural resources (not just oil) and politicians promising money for nothing manage to screw up a good economic story. The interesting thing is the comfortable left in the developed world refuses to believe the evil twins, -socialist economic policies and crony corruption (they always travel together) could be at fault.

ReplyGreat Post Shawn thank you

Reply@ citizen plain, you're certainly right on all points--but what worries me is when the developed market conservatives preach liberal economics to EM and figure income inequality will take care of itself eventually--if you add in the combustible mix of oil loot and weak institutions, at some point you end up with something like this.

ReplyLike Shawn said, who has been enabling Venny the past number of years. Thank our soul-less friends on Wall Street and all the rich Venezuelans who now live in Miami. Its a shame what is going on there, but to be fair Venny has been a hallowed out country for years, the prime Dutch Disease example. and now Aramco is doing an IPO, and focusing on tourism. Too funny.

ReplyFor all its faults and crazy politics, when Buffett says dont be against america, when you compare it to so many other places, our problems dont seem so bad.

How far can this Euro go.

IPA you were right on ULTA, I still have a few shares short ;-) Looking to load up on CAT short too whenever China ever rolls over. But PMI is still strong, so need to be patient. Instead, buy the Chinese internet names into earnings. If Bidu beat, they are all gonna crush it

This came up yesterday and I was able to avoid sounding completely ignorant, so thank you Shawn!

ReplyDoes anyone know why Brazil's rates (10%) are so high relative to inflation (3%)?

Have caught a small swing in the Bovespa. Seems like there's a long runway here of lower rates, lower unemployment, valuation multiple appreciation...

Any thoughts?

Boring summer months are upon us... however I did see a picture of our old friend NicoG online: http://imgur.com/a/GzzRk

Reply@ adamantic, TMM2 has been knocking around ideas on a post about Brazil and we haven't quite gotten it together...now is the time. Thanks for the push...

ReplyShort answer is that real rates in Brazil are historically among the highest in the world, owing to the many structural inefficiencies in the economy, history of hyperinflation and profligate spending, and pretty shabby inflation targeting credentials. Wasn't too long ago inflation was 9%.

The longer answer would drill down into that 10% number (a 10yr bond benchy, I think?), and your points on the positive medium-term outlook. That's a little more complicated, but I am positive. The central bank just slashed rates another 100bps and looks set to do it again, w/ the mkt pricing something like 7.75% o/n rate by year end. I think that's a little optimistic, or at least a poor risk/reward, but there could still be value in duration depending on the success of reforms and next year's election. Watch this space!

Macro Man already made the flip flop joke about Carney today.... no surprise there, surely? Just the BoE being BoE.

ReplyLB thinks this might be the springboard for the dollar bounce we have been talking about. Maybe it starts today and then gets a boost from the jobs number tomorrow. A few too many bond longs for my liking here, there could be a mini-slaughter tomorrow as we haven't had one of those unfeasibly hot numbers from the BLS for a while and they just love to help MAGA... ;-).

We are sticking with our position that vol begins in the Treasury market soon and then spreads through other fixed income categories and then into riskier assets via a dollar rally. Small caps (IWM) are lagging. A vol spike almost definitely implies a dollar rally and vice versa since the vast majority of those vol selling positions would have to be covered using (leveraged?) USD.

OK, LB is out for the day. Sitting on some vol options, IWM puts, UUP calls and a honking pile of cash. That's dollars, y'all.

With you on the Dollar rally LB. Reversed my CAD long to a short now.

ReplyIWM and all stock are a crap shoot honestly. Reading too much into price action of transports, meh. EEM is more important, IMO. Samsung down the past couple of days, sitting at 50 day. Other DRAM plays looking similar and it seems to be a sell the news earnings season for tech but hardly a short (yet)

If Dollar turns I think EZ equities pick up the slack. Dax sitting at 150 day and France election gap. 200 day is 2% lower. Good risk reward, IMO.

re Brazil, service inflation is still running ~ 5%, food inflation is down big this year, so I would caution on your assumption of real rates in Brazil.

ReplyTry to open a business in Brazil, hire employees or pay taxes then you will understand why rates are so high. Its a bizzaro world, though to be fair real rates are a great trade if you can do it as its much higher than many other similar socialist countries.

Dollar rally? Does not look like today, Non-manufacturing PMI disappointment did not help...

Reply"God" is dead. Andy Hall proves yet again that there are no immortals in this business. Keep that in mind and we might all live another day.

ReplyInteresting thoughts posted at http://jonturek.blogspot.com/2017/07/post-july-24.html?m=1. In particular, I like the Korea idea. JPM wrote up a related idea, paying 5y5y NDIRS. Very flat curve, low roll, a convex sensitivity to the US 5y5y. And then there's the Korean macro story of Moon Jae-in, with all his inflationary policies, e.g. big minimum wage hikes, big public sector hiring, etc.. Chinese growth meanwhile is held up by property investment in 3rd and 4th tier cities. Not sure about timing though, as US curve has flattened in past debt ceiling showdowns.

9 up : 1 down in Sep 29 97-93% put spreads on SPY. Government shutdown, debt ceiling showdown, announcement of reverse QE, bad seasonality, and lots of YTD profits to take ... interesting setup.

Lots of USDJPY bulls out there, but US 10Y seems range-bound, Japan 10Y stuck, and Japanese break-evens keep falling, doing no favors for real rate differential. Besides some some DM term premium rejuvenation, this trade could really use Japanese inflation picking up and those break-evens moving higher. But don't see it for now ... hence my bearish USDJPY option trade from earlier this week.

I see a lot of incredulous commentary about EURUSD, especially pointing to rate spreads. Frankly, it just makes me think this thing can go further. I am curious though who the long-term players are that will step in and take the spec's longs off their hands with the 10Y EURUSD forward at 1.42 and rising (not cheap!). Does seem the odds of 40b/month (a cut, but not a taper) for all of 2018 is rising as the EUR goes higher too (a # the ECB could manage to sustain while respecting issuer limit constraints). My going hypothesis is DXY will circle the toilet bowl until the debt ceiling is resolved and Treasury boosts its cash holdings (thereby sucking a couple hundred billion of USD liquidity out and giving DXY a boost), a view put forward by Darth Macro.

Re LB's new view on US rates, I'll add that the run of negative inflation surprises is statistically pretty unusual/long and history suggests it ends with some payback before too long.

That's all I've got today. Nice trade in USDCAD, abee.

Well Trump's affair does not help either, Mueller mention grand jury and Dollar dips

ReplyWell, Mi Pa, with all the dollar-bearish news out there, USD barely moved if you looked at the DXY daily chart. When the reaction to the bad news is weakening every day, we should pay attention.

ReplyThe NFP could be another weaker than expected number and USD could even drop on the number. But I think that it should be a buy the dip opportunity for USD if it happens.

When it comes to USD these days one as to ask is this moment a fundamental issue or are we once again at a positionally driven point in time? The answer could well be different for different pairs and will be shown either by a continuing trend or a ranging chart.

ReplyFor the life of me I don't see the current justfication for the £/USD. The UK is distinctly soft on growth and by the year end could be dicing with recession. domestic right now as been offset to some extent by exports ,but with the £ where it is on the dollar that doesn't look particularly sustainable. The EURO /£ is a different question OF COURSE.

Where we are right now with the £/USDd tends to have more to do with misjudgement of the BOE's reaction to the spike in inflation. Well if that didn't get cleared up for you yesterday then I would get your earing aid adjusted.The spin about a possible rise within a year as to be a joke right? More likely just Carney playing the audience, but it's one to disregard given the growth data.

Across quite a few emerging market currencies I see it differently. Some not all are better positioned fundamentally than they have been in the past. They have not been chased for 'growth' in the same way in this 2011 onwards cycle so I don't think they have quite the same level of systemic exposure to the dollar. Inflows outflows tend to suggest that's likely the case. In other words weighting isn't the same in this monetary cycle so short psotions should be for see saw ranging action.

Europe as been on the 'up' relatively for a couple of years in terms of 'growth' and as only been held back by political risk. Lest we forget though it's coming from a long way economically. Fundamentally it's got a better trade surplus position albeit WTFK's what it's real budget position is. Downside I suppose it's surplus position is heavily dependent upon one country - Germany.

Separating the wheat from the chaff what I come down to is I'd probably rather be building a short £/USD position than any other. I think it's both fundamnetally wrong and positionally wrong right now.That's what gets my vote.

Risk to that is in a word 'Trump'. However, I'm always of the mind that we over rate the value or lack of when it comes to government and leaders. Oft it's the case that when a market goes spike on leadership issues then thereafter you should be fading the move. Economies and markets go on regardless of the mouthpiece in power. As Obama said (or so I believe) ' I didn't realise how little power the president had until I came to office'. Probably a slight misquote ,but the essence of it is it's a lot easier to talk about what you will do than it is to do it.

Checkmate-for some reason your post reminded me of 'The Curse of Kehama' I think it was "Risk to that is in a word 'Trump'" that triggered it.

ReplyAnyway, thanks,it has given a smile for the day.

Hello Everybody,

ReplyMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Hello Everybody,

My name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Hello Everybody,

ReplyMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

Hello Everybody,

ReplyMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

There aren’t many types of investments that allow you the option to save yourself the way real estate does if your careful, conservative and work hard.

ReplyRefinance Tampa

best mortgage rates in tampa

current mortgage rates tampa fl

Construction loan tampa

fix and flip loan tampa

Cash out refinance tampa

First time home buyer tampa

best home loan tampa

mortgage calculator tampa

I am email database service provider of (Latest Database) company.

Replyour company sale high quality email database

we have over 10 belion email list .

You can visit here for more info about our company…

Thank you So Much

Replyดูหนังฟรีออนไลน์