It seems quite clear that the

I believe that the inflation outcome can be easily dispensed with. Yes, commodities are coming lower and yes, TIPS breakevens have collapsed. But can anyone seriously doubt by this point that we are in the midst of a secular bull market in commodities? Not only has infrastructure investment been inadequate over the past decade, but demand growth from the BRICs and their buddies has been very large indeed, and looks set to continue for the forecastable future. Surely this story must be known by now, and yet one still reads stories blaming $75 oil (or even $64 oil, for that matter) on CTAs or geopolitical risk premia. Look, if geopolitics were a big deal, why were both the Lebanese pound and the Israeli shekel stronger at the end of the recent unpleasantness than they were when it kicked off? No, put Macro Man in the camp of a secular bull market in commodities (albeit with the occasional cyclical price decline), which is inherently inflationary.

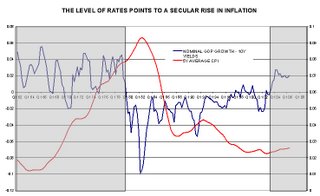

More intriguingly, after 17 Fed rate hikes, monetary conditions remain highly inflationary. The entire yield curve is now well below the level of nominal GDP growth, and has been for several years. The last time this circumstance persisted for more than a few months was in the 60's and 70's; as the chart below indicates, there has been a very strong relationship between the level of interest rates vis-à-vis nominal GDP growth and the secular inflation trend. Sure, globalization means that manufactured goods prices probably aren't going to rise very quickly. But as Mr. Euro himself, Jean-Claude Trichet, mentioned in an ECB pressie a few months ago, if commodity prices and services prices are being driven higher by the same factors that are depressing manufactured goods prices , why the hell would you strip them out to find 'true' inflation? If Ben persists in focusing just on what he wants to see (notice how the Fed hasn't said a dadgum thing about unit labour costs now that they convey the 'wrong' message?), at some point he's going to wake up to an enormous problem on his hands. The signs are not encouraging- just check out the trend in the median CPI from the Cleveland Fed.

So convinced is Macro Man that the bond market is smoking crack, he is a seller of 100 Dec 10yr futures at 107-08, the current price. Upside in the even of weak retail sales on Thursday or benign CPI on Friday is likely limited to 108. 105 and lower is far more likely in the weeks ahead.

Coming soon: How can there be a recession when everyone's making so much money?

1 comments:

Click here for commentsalmost 20 years...great stuff.