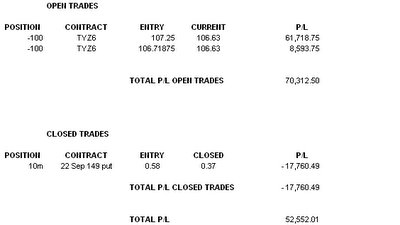

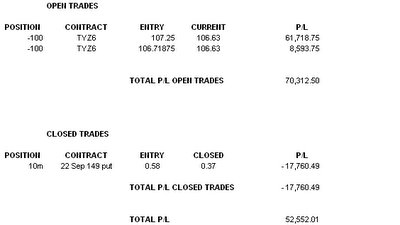

Record longs in the 10yr are beginning to tell, and there is no more room at the fixed income inn. The bond market looks set to do a bit of BASE jumping, and Macro Man is stopped into doubling his short at 106-23. The wretched rear view TICs data may have given the market the push it needed; all we need now is a surprising rise in the NAHB to snip the bungy cord and allow the bond market to plummet off a cliff a la Wile E. Coyote.