This weekend sees the semi-annual confabulation of IMF grandees, G7 finance officials, and lucky boondoggle recipients convene on Singapore. The last time this band of Merry Pranksters got together in April, something quite extraordinary happened. The IMF shrugged off 60 years of lethargy and seized for itself an apparent mandate of worldwide importance: the correction of the much-dreaded global imbalances. The initial manifestation of the IMF’s new hobby was, of course, the G7 finance ministers’ statement, which rapped China and the rest of the emerging current account surplus world for fiddling with their currencies (or, more to the point, not allowing us to fiddle with them as much as we’d like.)

In the intervening six months, of course, China has allowed the CNY to fizz around a bit more; 3 month historical vol has risen steadily from 0.8% in April to a whopping 1.35% today. And thanks to the softly-softly approach of ‘Hammerless Hank’ Paulson, USD/CNY has finally and decisively traded through ‘The Ocho.’ However, the focus on the level of emerging currencies is misplaced; what should be of much greater concern to the conventioneers are the distortions caused by emerging countries’ FX reserve management.

Simply put, EM FX reserves are now so big that their activities are setting the price of exchange rates, crowding out the private sector and pushing a number of pairs well beyond equilibrium. Looking just at the RICs (Russia, India, and China; Macro Man couldn’t find good data for Brazil), their FX reserves went from a combined $268 billion in June 1998 to $489 billion in June 2002 to $1.6 trillion in June 2006. The recent parabolic rise in reserve levels has accompanied a period of remarkably low market interest rates: the infamous Greenspan conundrum. Now, some of the blame for persistently low bond yields must accrue to Easy Al; after all, if you tell the market exactly what you’re going to do, you shouldn’t be surprised if there is no reaction when you do it. Nevertheless, the abject failure of Western bond yields to rise in line with historical norms suggests that at least a degree of monetary policy sovereignty has been ceded to the EM reserve accumulators.

In currencies, the effect is if anything more pronounced. Since May 2002, when the EUR broke out of a multi-year consolidation pattern, the level of EM FX reserves has exploded ($1.1 trillion just for the RICs!) Given that in many cases these are the very countries that are diversifying most aggressively out of USD (note that most of them don’t tell the BIS/IMF what they’re up to), the consequences for the currency market should be obvious.

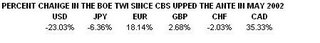

EM CBs are, on aggregate, consistently large buyers of EUR and GBP, and more moderate buyers (though not on a liquidity-adjusted basis) of commodity currencies like the CAD. They are sellers of USD, of course, have ignored the CHF, and largely stayed away from the JPY, particularly in relation to Japan’s importance in the global economy. If Macro Man is correct rather than paranoid, we would expect to see that the stuff they buy goes up, and the stuff that they sell or ignore goes down. As the table below suggests, that is exactly what has happened.

So while they enjoy munching on chili crabs in Singapore, perhaps French Finance Minister Breton and BOJ Governor Fukui, both of whom have recently commented on the rather high level of EUR/JPY, will spare a thought for the EM central banks. The reason that EUR/JPY is at 150 not because the Japanese are fiddling with the yen. Rather, it is simply that the EM nations that have accrued the most reserves over the past few years have bought an absolute truckload of euros but relatively few yen. Given that FX reserve levels in many of these countries can be comfortably described as ‘excessive’, perhaps instead of moaning about the level of the CNY they’ll encourage the likes of China to buy a few less bunds and a few more hospitals.

Is there a trade for G7? Macro Man’s preferred strategy would be to go short the FX market as a whole. Performance this year has been poor, and there is little to suggest that things will improve in the near term. This morning’s little yen rally on the back of yet another China band rumor smacks of desperation. Ultimately, things are setting up for some nice trades in the months ahead, but the market needs to endure more short term pain to bring those opportunities to fruition. For choice there appears to be little chance of a market moving outcome over the weekend. That having been said, there is nothing priced in, either. So risks must be skewed towards a constructive development taking the market by surprise. Given the recent focus on EUR/JPY, it’s worth taking a punt on: Macro Man buys 10m face worth of 1w 149 EUR puts versus JPY for 58 JPY pips.

Macro Man remains a stop loss seller of TYZ6 on a break of 106-24 to double the current hundred-contract short.

In the intervening six months, of course, China has allowed the CNY to fizz around a bit more; 3 month historical vol has risen steadily from 0.8% in April to a whopping 1.35% today. And thanks to the softly-softly approach of ‘Hammerless Hank’ Paulson, USD/CNY has finally and decisively traded through ‘The Ocho.’ However, the focus on the level of emerging currencies is misplaced; what should be of much greater concern to the conventioneers are the distortions caused by emerging countries’ FX reserve management.

Simply put, EM FX reserves are now so big that their activities are setting the price of exchange rates, crowding out the private sector and pushing a number of pairs well beyond equilibrium. Looking just at the RICs (Russia, India, and China; Macro Man couldn’t find good data for Brazil), their FX reserves went from a combined $268 billion in June 1998 to $489 billion in June 2002 to $1.6 trillion in June 2006. The recent parabolic rise in reserve levels has accompanied a period of remarkably low market interest rates: the infamous Greenspan conundrum. Now, some of the blame for persistently low bond yields must accrue to Easy Al; after all, if you tell the market exactly what you’re going to do, you shouldn’t be surprised if there is no reaction when you do it. Nevertheless, the abject failure of Western bond yields to rise in line with historical norms suggests that at least a degree of monetary policy sovereignty has been ceded to the EM reserve accumulators.

In currencies, the effect is if anything more pronounced. Since May 2002, when the EUR broke out of a multi-year consolidation pattern, the level of EM FX reserves has exploded ($1.1 trillion just for the RICs!) Given that in many cases these are the very countries that are diversifying most aggressively out of USD (note that most of them don’t tell the BIS/IMF what they’re up to), the consequences for the currency market should be obvious.

EM CBs are, on aggregate, consistently large buyers of EUR and GBP, and more moderate buyers (though not on a liquidity-adjusted basis) of commodity currencies like the CAD. They are sellers of USD, of course, have ignored the CHF, and largely stayed away from the JPY, particularly in relation to Japan’s importance in the global economy. If Macro Man is correct rather than paranoid, we would expect to see that the stuff they buy goes up, and the stuff that they sell or ignore goes down. As the table below suggests, that is exactly what has happened.

So while they enjoy munching on chili crabs in Singapore, perhaps French Finance Minister Breton and BOJ Governor Fukui, both of whom have recently commented on the rather high level of EUR/JPY, will spare a thought for the EM central banks. The reason that EUR/JPY is at 150 not because the Japanese are fiddling with the yen. Rather, it is simply that the EM nations that have accrued the most reserves over the past few years have bought an absolute truckload of euros but relatively few yen. Given that FX reserve levels in many of these countries can be comfortably described as ‘excessive’, perhaps instead of moaning about the level of the CNY they’ll encourage the likes of China to buy a few less bunds and a few more hospitals.

Is there a trade for G7? Macro Man’s preferred strategy would be to go short the FX market as a whole. Performance this year has been poor, and there is little to suggest that things will improve in the near term. This morning’s little yen rally on the back of yet another China band rumor smacks of desperation. Ultimately, things are setting up for some nice trades in the months ahead, but the market needs to endure more short term pain to bring those opportunities to fruition. For choice there appears to be little chance of a market moving outcome over the weekend. That having been said, there is nothing priced in, either. So risks must be skewed towards a constructive development taking the market by surprise. Given the recent focus on EUR/JPY, it’s worth taking a punt on: Macro Man buys 10m face worth of 1w 149 EUR puts versus JPY for 58 JPY pips.

Macro Man remains a stop loss seller of TYZ6 on a break of 106-24 to double the current hundred-contract short.