First lets look at EURUSD. For the bears we have had the influences of the US equity market followed by a heavy fall in Asia. The normal response is to see the Euro get hit along with all the normal FX candidates (looking at you AUD) and so it was when we came in to London time. But since then it has been the bulls gaining ground as it has reground its way back towards yesterdays highs. The Tug continues.

And as for those equity moves? Well it seems to us that yesterday was more about trying to find an excuse to sell a new highs or lighten positions rather than occurring on any really concrete catalyst. It was most interesting to see the great Soothsayer himself breaking cover onto the mainstream news-wires to put in a "Big Call" to then be held aloft by bears, many of whom who have never heard of him, as their new totem. Even Bloomberg TV is running pieces on his "Big Call". Is the Soothsayer selling out or just trying to step up his PR in Taleb style? Anyway, from speaking to quite a few people, it seems a lot of equity longs were lifted last week. But meanwhile, Credit is still performing well due to dealers being short and the SPX VWAP since 3rd Jan is 1278 (i.e. - there isn't any pain) while yesterday's futures volumes running at ~50% above 15day average seems like a lot of risk was either taken off yesterday or shorts were added at (so far) poor levels.

Today just looks as though its going to be like playing the decider.

As the tussle in equity markets appears to be ground zero we thought today would be a good day to elaborate upon the TMM call for Emerging Markets to under-perform Developed Markets in 2011. Whilst the DM over EM argument is becoming almost mainstream in western markets we feel that it is certainly NOT considered the trade in the East, so there can still be a world of pain to come.

As the “Asian inflation” story goes tabloid its worth delving into just where we can expect this trade to go. EM inflation tends to be driven more by food which is a volatile component of CPI to say the least, see China’s food CPI vs non-food CPI below. As a result of the fact that food price shocks tend to be exogenous (bad weather, pests, etc) CBs quite reasonably tend to ignore it and focus on “core” CPI – CPI ex-food (and energy, depending on where you are) to avoid chasing their tails. The result is that food prices have to bleed into general price levels before you get much of a response. And that bleed is well and truly underway judging by China’s core CPI print which is up to the heady days of 2008 again.

The problem with this kind of inflation scare type of trade is that unless you are a commodity and particularly a softs specialist it can go away as quickly as it came, just like in 2008 when broader deflationary forces and more planting quickly overwhelmed a short term squeeze in agriculture.

So naturally the question is how does one tell the difference between the real thing and the phantom food inflation that comes as quickly as it goes? TMM’s worry right now is that much of what goes into food inflation and non-core CPI is going to be far from a passing problem like in 2007-2008. The reason is below: normally when agricultural products get “squeezed” they spike up, people plant a lot more and that is reflected in futures contracts a year out. As such, when the spike is temporary and not structural the orange line (spot rough rice) is high and the white line (the fair value spread between the front and 5th rice contract) is also high. That isn’t happening now, indicating that higher prices we are seeing are likely to stick around. Rough Rice is below and doesn’t look like its coming back anytime soon...Nor does wheat...

Soy doesn’t look like its over…

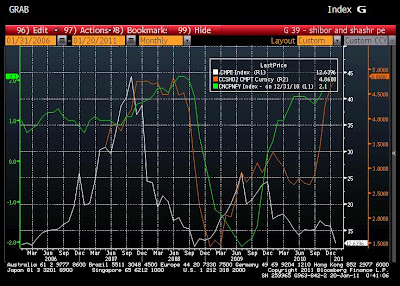

Which to TMM looks like it has pretty dire implications for CPIs in a lot of EM markets. China’s core (non-food) CPI is already at 08 highs (green below) and policy is finally catching up in 2 yr SHIBOR swaps (orange). The problem is that excluding the price controls on vegetables put in place last month food is still moving a lot faster and housing costs just printed 6% YoY. As a result, PEs of the market are coming off and coming off hard (Shanghai A Shares forward PE in white). Buying low PE stuff only works if you think the cycle is going to turn – if you want to know how low valuations can go in a strongly inflationary environment ask your parents or someone who remembers the 1970s. It was an unalloyed bad time for equity investors. TMM’s concern is that if we are early into a rate hike cycle this is going to get much, much worse before it gets better.

And for those of you who want to know what India looks like it is way worse. TMM’s India “Fed model” chart is below (inverse PE of Sensex – 1 year swap rates). If rates surprise on the upside it hard to see this market being more expensive at any time in the last few years to onshore rates.

But we hope to have a update on India for you soon after a recent visit.

In the meantime ladies and gentlemen, lets take ouur seats for todays Bull vs Bear cage fight.

One last thing, after yesterday's foray into the Menagerie, we will soon be addressing the balance and visiting the "Sell Side House".

13 comments

Click here for commentsEuro not holding up and SPX first stop at 56. I disagree with your analysis with respect to equities. Lots of denial at this stage. One more percent down and the mood will change dramatically. Let's see....

Replywho is the soothsayer you reference?

ReplyDon't know what I'd do without your daily witty commentary, only thing that keeps me sane :)

ReplyAgreed on SPX, it feels like the bull is here to stay for a bit longer, Mr. Market might turn later this year, but I don't think it's done yet. I am trying to think when did my put options expire in the green last, it's been a long time. I am a bit worried about current Asian dump, does not bode well for commodities complex, so AUD could be vulnerable, but still like CAD as a play on US strength.

so ... earnings stay stable and inflation resulting in tightening of monetary/fiscal conditions causes PE compression ... right? so i guess that means that equity bull market in EM is over and now comes the part of picking the right sectors that will outperform on a relative basis ... any ideas here?

Replyyeah who is this soothsayer ... not the squid?

and perhaps the other trade is simply to sell copper and buy oil

ReplyApocolypse = a small apocalypse?

ReplyYes, the bears got some vindication yesterday and just from observing that the damn thing (the SPY) is not straight back in the 1290s makes me feel that there might be something to it... But I might just be wishing on a star here or something.

ReplySpeaking of double bluff here (vis a vis the earlier TMM call on equities which turned out quite apt), I think the real surprise will be the relative shallowness of this dip. I for one am not getting my hopes up, let us test that 50 day mov av first and then I will turn more bearish if we break that decisively. Other than that it looks like a very small shake.

Those who jumped to gun calling for a correction to 1150ish, well I don't buy it for now.

as for the "soothsayer" could it be this

http://seekingalpha.com/article/247401-10-decline-predicted-for-s-p-500

I couldn't help but notice this from the comments too;

"This months expiration option gamblers want a lower market or their contracts expire worthless."

Claus

Fading short-term apocalypse calls is invariably a profitable strategy. Even soothsayers have trouble nailing the timing, and by the time the apocalypse shows up at the front door, most of us can see the whites of their socks.

ReplyThree trades for 2011.

Rotation from EMs/PMs to DMs, imminent. Check.

Rotation from high P/E stocks to dividends.

Rotation from high yield to munis (this may be later).

Anons …

ReplyOh bgr. crp typing .. corrected the title thanks for your gentle reminder!

As we mention in our Glossary,

Soothsayer Signals – Reference to a form of technical analysis that is so well copywrite protected by its developer we dare not speak its name. But the number of the beast is 13 …or is it 9?. Or is it 9139? Or is it 9139139139?

We dare say no more unless he smite us down..

Oh and re oil -- is there anyone out there that isn't long or want to be long? We do agree that it should head higher, but it would be nice to hear from someone who disagrees. We don’t like it when we can't find a dissenter along the lines of the old saying "when you can't work out who the mug is ....Its probably you"

But we have to say, this afternoon is actually looking as though it is commodity led.. that caught us out.

The soothsayer? DR of GS (don't be fooled, it's not the squid).

ReplyTMM, remember reading the random trasher of T/A opinion of the 70's, that it was only 'perception' and that divvies would've carried you along nicely.....maybe put it down to normacly bias related to previous markets(low rates)

ReplyYou think we may see something similar throughout EM entities.....if EZ turn quasi FED?

They don't won't that over the long run, I'm pretty sure of that.

O,I forgot PoLEMIC,in your non-predictions you mention FX as teh second derivative, son ,there fighting words.

The market is entering a correction in the short term, but the primary support according to the Dow Theory should hold. Sentiment is very bullish and the market is overbought, but I think we can go a bit higher after the correction. We are in a cyclical bull, but a secular bear, so the run from March 09 lows is becoming quite mature. Therefore, I am not sure how much higher we will go, as majority of the gains are now gone!

Reply