In the end, yesterday's central bank trifecta was a lot like price action in the S&P 500: a lot of sound and fury, but you pretty much ended up where you started. Neither the BOE nor ECB moved rates, which was hardly a surprise. M. Trichet did, however, manage to introduce a new term to the financial market lexicon, in describing the current high level of Eurozone inflation as a "hump" which will eventually be unwound. Macro Man was left to wonder if, in the late 80's when he used to go out clubbing with Credit Lyonnais bankers, M. Trichet ever used to do the Humpty Dance.

M. Trichet also resurrected a term from three and a half years ago in mentioning that any "brutal" currency moves would be unwelcome. However, he declined to opine on whether current moves represent brutality, aggravated assault, a gentle love tap, or a walk in the park. Gee, thanks Jean-Claude! It looks like "brutal" is the new "vigilant". Perhaps we need to put the Plain English Campaign in touch with M. Trichet....

Big Ben's comments, meanwhile, more or less represented a fleshing-out of the statement from the October 31 FOMC announcement, with the added injunction on lawmakers to ecnourage cooperation between distressed borrowers and their lenders. Unfortunately for Mr. Bernanke, the dollar and ABX indices continue to plummet, and the costs of credit and living continue to rise. While he denied that the current set-up is a replay of the 1970's stagflationary scenario, in point of fact it is resembling the 70's more every day.

Ominously, Macro's Man's gas-price model has risen very sharply this week, thanks to rising oil prices and much higher crack spreads. If retail prices converge with his model, the outcome for growth, inflation, and risk assets will not be pleasant. Ultimately, Ben may be forced to choose whether he wants to be William Miller or Paul Volcker; unfortunately, the early signs are that he is pursuing the former option.

Perhaps unsurpsingly, the dollar has received a fresh battering today, with the yen in particular outperforming. That having been said, the buck has also reached fresh lows against the euro and the RMB, and speculation is mounting that China may be preparing for another one-off revaluation. Not only is the next strategic economic dialogue with the US slated for next month, but PBOC's 3rd quarter monetary policy report suggested a new synthesis of currency and interest rate policy to manage unwelcome inflation.

To be sure, the RMB has strengthened against the dollar this year....but then again, that doesn't exactly put it in terribly select company. What's interesting to note is that the RMB has fallen more against the euro than it has risen against the USD. And while it's true that the dollar is more important on a trade weighted basis, the gap may not be as big as you think. In September, for example, Chinese exports to the US + Hong Kong were 42% larger than its exports to Europe. Just two years previously, that gap was 80%. So EUR/RMB is an important exchange rate for China, and it's been dropping like a stone.

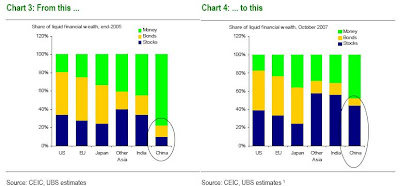

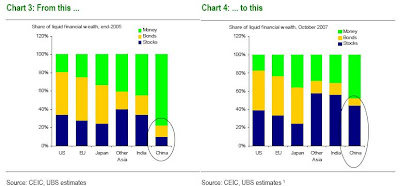

Elsewhere, it appears that Macro Man isn't the only one getting antsy at China's equity bubble. Goldman has downgraded H shares to neutral for the first time in three years, citing valuation as a primary rationale for the less aggressive posturing. Earlier this week, UBS observed that Asia ex-Japan equities are getting close to bum-clenchingly overvalued, driving largely by Shanghai and Hong Kong. The macroeconomic impact of China's share-price rise shouldn't be ignored; from representing an inconsequential share of financial assets as recently as end-2005, Chinese stocks now comprise a greater share of financial wealth than in the US or Europe. Look out below!

Elsewhere, it appears that Macro Man isn't the only one getting antsy at China's equity bubble. Goldman has downgraded H shares to neutral for the first time in three years, citing valuation as a primary rationale for the less aggressive posturing. Earlier this week, UBS observed that Asia ex-Japan equities are getting close to bum-clenchingly overvalued, driving largely by Shanghai and Hong Kong. The macroeconomic impact of China's share-price rise shouldn't be ignored; from representing an inconsequential share of financial assets as recently as end-2005, Chinese stocks now comprise a greater share of financial wealth than in the US or Europe. Look out below!

Finally, some new readers may be wondering what this blurry little box is at the end of every post. Macro Man runs a model portfolio of trades, both as a laboratory to try out new ideas /products, and as an objective test of the accuracy of the views that he expresses in this space. He may or may not have any of these positions in his real job portfolio, so please do not construe these trades as recommendations, because they are not. But his view is that the ultimate arbiter of success for the analytical efforts of any financial market participant is the P/L...so Macro Man bares all, at least in the context of what you read here, every day in the blurry box (which you can click to enlarge.)

Finally, some new readers may be wondering what this blurry little box is at the end of every post. Macro Man runs a model portfolio of trades, both as a laboratory to try out new ideas /products, and as an objective test of the accuracy of the views that he expresses in this space. He may or may not have any of these positions in his real job portfolio, so please do not construe these trades as recommendations, because they are not. But his view is that the ultimate arbiter of success for the analytical efforts of any financial market participant is the P/L...so Macro Man bares all, at least in the context of what you read here, every day in the blurry box (which you can click to enlarge.)

M. Trichet also resurrected a term from three and a half years ago in mentioning that any "brutal" currency moves would be unwelcome. However, he declined to opine on whether current moves represent brutality, aggravated assault, a gentle love tap, or a walk in the park. Gee, thanks Jean-Claude! It looks like "brutal" is the new "vigilant". Perhaps we need to put the Plain English Campaign in touch with M. Trichet....

Big Ben's comments, meanwhile, more or less represented a fleshing-out of the statement from the October 31 FOMC announcement, with the added injunction on lawmakers to ecnourage cooperation between distressed borrowers and their lenders. Unfortunately for Mr. Bernanke, the dollar and ABX indices continue to plummet, and the costs of credit and living continue to rise. While he denied that the current set-up is a replay of the 1970's stagflationary scenario, in point of fact it is resembling the 70's more every day.

Ominously, Macro's Man's gas-price model has risen very sharply this week, thanks to rising oil prices and much higher crack spreads. If retail prices converge with his model, the outcome for growth, inflation, and risk assets will not be pleasant. Ultimately, Ben may be forced to choose whether he wants to be William Miller or Paul Volcker; unfortunately, the early signs are that he is pursuing the former option.

Perhaps unsurpsingly, the dollar has received a fresh battering today, with the yen in particular outperforming. That having been said, the buck has also reached fresh lows against the euro and the RMB, and speculation is mounting that China may be preparing for another one-off revaluation. Not only is the next strategic economic dialogue with the US slated for next month, but PBOC's 3rd quarter monetary policy report suggested a new synthesis of currency and interest rate policy to manage unwelcome inflation.

To be sure, the RMB has strengthened against the dollar this year....but then again, that doesn't exactly put it in terribly select company. What's interesting to note is that the RMB has fallen more against the euro than it has risen against the USD. And while it's true that the dollar is more important on a trade weighted basis, the gap may not be as big as you think. In September, for example, Chinese exports to the US + Hong Kong were 42% larger than its exports to Europe. Just two years previously, that gap was 80%. So EUR/RMB is an important exchange rate for China, and it's been dropping like a stone.

Elsewhere, it appears that Macro Man isn't the only one getting antsy at China's equity bubble. Goldman has downgraded H shares to neutral for the first time in three years, citing valuation as a primary rationale for the less aggressive posturing. Earlier this week, UBS observed that Asia ex-Japan equities are getting close to bum-clenchingly overvalued, driving largely by Shanghai and Hong Kong. The macroeconomic impact of China's share-price rise shouldn't be ignored; from representing an inconsequential share of financial assets as recently as end-2005, Chinese stocks now comprise a greater share of financial wealth than in the US or Europe. Look out below!

Elsewhere, it appears that Macro Man isn't the only one getting antsy at China's equity bubble. Goldman has downgraded H shares to neutral for the first time in three years, citing valuation as a primary rationale for the less aggressive posturing. Earlier this week, UBS observed that Asia ex-Japan equities are getting close to bum-clenchingly overvalued, driving largely by Shanghai and Hong Kong. The macroeconomic impact of China's share-price rise shouldn't be ignored; from representing an inconsequential share of financial assets as recently as end-2005, Chinese stocks now comprise a greater share of financial wealth than in the US or Europe. Look out below! Finally, some new readers may be wondering what this blurry little box is at the end of every post. Macro Man runs a model portfolio of trades, both as a laboratory to try out new ideas /products, and as an objective test of the accuracy of the views that he expresses in this space. He may or may not have any of these positions in his real job portfolio, so please do not construe these trades as recommendations, because they are not. But his view is that the ultimate arbiter of success for the analytical efforts of any financial market participant is the P/L...so Macro Man bares all, at least in the context of what you read here, every day in the blurry box (which you can click to enlarge.)

Finally, some new readers may be wondering what this blurry little box is at the end of every post. Macro Man runs a model portfolio of trades, both as a laboratory to try out new ideas /products, and as an objective test of the accuracy of the views that he expresses in this space. He may or may not have any of these positions in his real job portfolio, so please do not construe these trades as recommendations, because they are not. But his view is that the ultimate arbiter of success for the analytical efforts of any financial market participant is the P/L...so Macro Man bares all, at least in the context of what you read here, every day in the blurry box (which you can click to enlarge.)

9 comments

Click here for commentsHi MM, have you heard of a giant oil find in Brazil the other day? Wonder if it could help the energy complex bit lower? Plus the diverging momemtum on the Crude chart...

ReplyHv a great w/e!

Bitr

Bitr, yeah saw that and meant to mention it, but was overcome by unfolding events (i.e. dollar going to zero.)

ReplyI'm not sure if it should have any impact on front end of the curve-they still have to exploit the asset-but one could, I suppose, argue that it should increase backwardation at the back end of the curve.

I don't think Ben and friends have any real choice. The only way of working off a massive debt bubble is growing out of it i.e. keeping nominal GDP growth up. If you let nominal GDP growth collapse, then you risk depression. It does not appear that real GDP is going to be growing very quickly over the next couple of years. That means inflation will have to do the work instead. Once the debt / income ratios come down in a few years, they will then have to push up rates a la Volcker to get inflation under control. It's a two-stage process.

ReplyHi,

ReplyWould you happen to remember the original post about the gas/crack spread calculation? Or the ratios behind it again. Thanks.

Andrei, the original post is linked in the text. And if you click on the chatr in this post, you will see the regression formula on the chart.

ReplyBitr, MM,

Replyfor what it´s worth, it´s common sense right now in Brazil that Petrobras is overshooting due to extraordinary foreign demand... the discovery is already probably more-than-fully priced in.

cheers!

a. goldfish

PS: and the economist gave the falling dollar at least one more week to slide...

Interesting insight, Avinash. FWIW, the find was NOT priced into British Gas, which owns a minority of the rights, so BG stock received quite a tasty fillip yesterday on the announcement.

ReplyRe: The Economist: I, too, noted that the dollar escaped cover-boy status, but felt churlish at "celebrating" a rather distressing situaiton in Pakistan which made the cover instead.

The "ump" (who is getting to "hump" whom here?) is around 30% on staples and non.

ReplyNo depression here ..(a theory is being advanced that its prevalence on the lips of so many is due to excessive 90's Prozac dosages turning to dependence) rather "monetary and credit growth robust".

Tricky demands (like some new sun king).. no "secondary effects". But surely even no effect is a secondary effect (unless you are excused by a Sellerian accent)). Perhaps he means no secondary effects I and my friends do not like (housing bubble anyone?), the obvious retort being... and what are you going to do about it!

Oh yes and at the end of Q&A... no review of turds being backed up to ECB door.

But surely someone gets to say "Not now Cato"? Who, when, to whom or what?

Time to buy "primary effects" I guess, if they are to be permitted, nay encouraged.

after all they are only a secondary expense!

macro man -- wouldn't some Chinese exports to HK then be shipped on to Europe? My sense is that if you look at the broadest measure of Europe's import data (EU-25) and the US import data (both of which adjust for HK trans-shipment), Europe and the US are importing almost as much from China. I need to check that tho. and in any case, it reinforces your point.

Reply