Energy...

Sometimes I think I'm runnin' out of energy

Seems like we use an awful lot for

Heatin' and lightin' and drivin'

Readin' and writin' and jivin'

Energy ... You'd think we'd be savin' it up.

- "The Energy Blues", Schoolhouse Rock

Did you ever think that your financial future would be dictated by something called a "crack spread"? The more that Macro Man thinks about this issue, the more he reckons that the single most important economic variable in the United States these days is the energy crack spread.

This, for the uninitiated, is a measure of refining margins: how much refiners earn for buying crude oil and turning it into gasoline and heating oil. The higher the spread, the bigger the margin; the lower the spread, the smaller the margin.

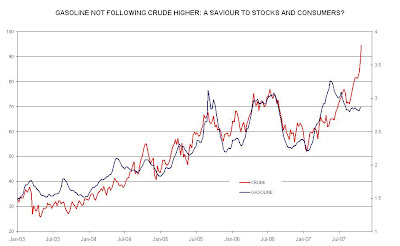

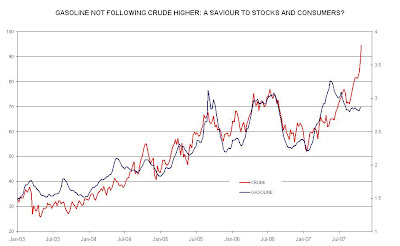

At the moment, crack spreads are well below the average of the past couple of years, and way, way below the highs of earlier this year. The upshot is that despite the record high and stunning rise in oil prices, the US consumer has not really felt the pinch in motoring or heating bills. Updating a chart posted a couple of weeks ago reveals the massive disparity between crude and product prices.

Why is this important? The lack of energy pass-through has provided a very significant buffer to consumers by maintaining or even raising growth of disposable income. At the same time, it has kept a lid on headline inflation and, by extension, inflation expectations, thus allowing the Fed to reflate by 0.75% over the past six weeks.

Why is this important? The lack of energy pass-through has provided a very significant buffer to consumers by maintaining or even raising growth of disposable income. At the same time, it has kept a lid on headline inflation and, by extension, inflation expectations, thus allowing the Fed to reflate by 0.75% over the past six weeks.

Imagine, however, what would happen if crack spreads, pictured above, were to normalize. Eyeballing the top chart, it would appear to imply gasoline prices in excess of $3.75: a full dollar higher than recent levels. How important would that be?

Imagine, however, what would happen if crack spreads, pictured above, were to normalize. Eyeballing the top chart, it would appear to imply gasoline prices in excess of $3.75: a full dollar higher than recent levels. How important would that be?

Even the commodity trades performed, though in typical fashion Macro Man turned a potentially great month in the space into a merely good one by turning $750 gold calls into $740 gold puts with bullion at $760.

Sometimes I think I'm runnin' out of energy

Seems like we use an awful lot for

Heatin' and lightin' and drivin'

Readin' and writin' and jivin'

Energy ... You'd think we'd be savin' it up.

- "The Energy Blues", Schoolhouse Rock

Did you ever think that your financial future would be dictated by something called a "crack spread"? The more that Macro Man thinks about this issue, the more he reckons that the single most important economic variable in the United States these days is the energy crack spread.

This, for the uninitiated, is a measure of refining margins: how much refiners earn for buying crude oil and turning it into gasoline and heating oil. The higher the spread, the bigger the margin; the lower the spread, the smaller the margin.

At the moment, crack spreads are well below the average of the past couple of years, and way, way below the highs of earlier this year. The upshot is that despite the record high and stunning rise in oil prices, the US consumer has not really felt the pinch in motoring or heating bills. Updating a chart posted a couple of weeks ago reveals the massive disparity between crude and product prices.

Why is this important? The lack of energy pass-through has provided a very significant buffer to consumers by maintaining or even raising growth of disposable income. At the same time, it has kept a lid on headline inflation and, by extension, inflation expectations, thus allowing the Fed to reflate by 0.75% over the past six weeks.

Why is this important? The lack of energy pass-through has provided a very significant buffer to consumers by maintaining or even raising growth of disposable income. At the same time, it has kept a lid on headline inflation and, by extension, inflation expectations, thus allowing the Fed to reflate by 0.75% over the past six weeks. Imagine, however, what would happen if crack spreads, pictured above, were to normalize. Eyeballing the top chart, it would appear to imply gasoline prices in excess of $3.75: a full dollar higher than recent levels. How important would that be?

Imagine, however, what would happen if crack spreads, pictured above, were to normalize. Eyeballing the top chart, it would appear to imply gasoline prices in excess of $3.75: a full dollar higher than recent levels. How important would that be? Let's put it this way. The phrase "US house price fall" yields 15.7 million search results on Google. The recent Case/Schiller 20-city house price index was down 4.4% year-on-year. According to recent research from Morgan Stanley, the consumption effects of a 10% decline in house prices is the same as that from a $0.70 rise is gasoline prices. So to put it another way, another dollar on the price of gas would have the same impact as a house price decline more than three times as severe as the current one.

The impact would leave the Fed perched on the horns of a dilemma. Should they ease to mitigate the potential recessionary impact of the negative income shock? Or should they raise to offset the clear threat of letting the inflationary genie out of the bottle? The 1970's Fed chose the former option with disastrous results.

As Macro Man wrote in the comment section of Cassandra's blog last night:

"If (and some would say 'when'), however, crack spreads widen out and gas prices go from $2.75 to $3.75 before you can say the phrase "Chevy Dreadnought", the moment will come when Ben must choose whether to deploy the full capacity of his Sikorsky, or whether to take the train instead (an infinitely less pleasant, yet socially responsible, option.)

Let's just say I'm not expecting to see him on the 6.33 to London Bridge any time soon."

Either way, a rise in crack spreads should be bearish for risky assets; indeed, Macro Man would now identify crack spreads as the single largest threat to his constructive worldview. Therefore, they merit close attention.

Elsewhere, three interesting energy-related observations:

* The major GCC countries all followed the Fed in cutting rates. The UAE must surely be approaching negative real interest rates in the double digits. No doubt the IMF analysts are high-fiving each other to see such prudent policy-making

* Chinese inflation won't just be about food anymore. The government sanctioned a 10% rise in energy prices, which should immediately add 0.3% - 0.4% to headline CPI, and serves as a reminder that one of the reason that non-food inflation has been so low is administered prices.

* The IEA has called on the world's governments to devise ways to reduce energy consumption. Arthur Pigou, please report to the United States. Paging Arthur Pigou.....

October, meanwhile, was a pleasant month for Macro Man, as he made just over 3%: his best month of the year. Virtually every return compartment performed, with equity alpha the sole losing segment courtesy of some of Macro Man's hedging activities.

Even the commodity trades performed, though in typical fashion Macro Man turned a potentially great month in the space into a merely good one by turning $750 gold calls into $740 gold puts with bullion at $760.

Crack spread commentary notwithstanding, Macro Man is not a commodity expert and knows it. The relatively small risk allocation appears justified given the poor intramonth trading.

A source of pride, however, was the performance of the beta plus strategies, which correctly stayed with FX carry during the mid-month hiccups. Macro Man's preferred indicator remains firmly planted in risk-seeking territory, unsurprisingly, so he remains positioned even at apparently nosebleed levels.

A source of pride, however, was the performance of the beta plus strategies, which correctly stayed with FX carry during the mid-month hiccups. Macro Man's preferred indicator remains firmly planted in risk-seeking territory, unsurprisingly, so he remains positioned even at apparently nosebleed levels.

Perhaps a recvoery in crack spreads will be the very thing to push Macro Man and and others off of the FX carry bandwagon....

19 comments

Click here for commentsFascinating perspective Macro Man, crack spreads!? :) now, there is a data point I have not been watching.

ReplySo, we still have some headline inflation firmly tugged in the pipeline (which seems clogged at the moment) it seems.

I agree that at the current USD level any real passthrough would have a very real and very significant effect. But really, with the structural headwind coming from inflation this is going to be felt all over the board I think.

So, stagflation is coming it seems. In my opinion we are entering a very interesting time now and it will be most spectacular to see how central banks deal with this one.

Claus

In the scheme of things, this oil move is still a bee-sting and not a wolverine mauling, since (1) US energy taxes are virtually non-existant and so petrol, heating oil etc. are coming from the lowest non-subsidised base in developed world (including oil exporters like Norway & Canada!), and (2) oil in non-USD has been far less aggressive coupled with lower economic intensity to begin with.

ReplyWhat ruminators should be contemplating - not as the probable, but the entirely possible - is what happens when when/if the Saudi's come clean and concur with Matt Simmons view on their reserves, or stop denying it? $200? $250/bbl? OR The USD really tanks, but the BRICs with new found purchasing power more than make up for lost demand and send oil price soaring. The thing is that $200 oil, under the current tax regime in the US will still not equate American pump prices with those of Europe. And even then, just look at the M25 on any given day and see even THOSE prices do little to curb demand.

The BBC this morning was confirming my worst fears about green conciousness: savings are rarely seen as permanent reductions, but used to subsidise other less-than-green pursuits - e.g. conservation gains are simply ploughed back to subsidize yet another Ryanair vacation.

And in case you think you can hedge this with oil shares, understand that the political risk of expropriation rises perhaps linearly or exponentially with the price. The Candadians just ramped-up the Royalty rate huge, and I would reckon that there is a price point at which no private investor is safe in their ownership of oil assets, save the rigs, platforms, pipelines, and refineries.

Perhaps Mother Earth is merely a proponent of market economics. To wit, she'll provide us with enough fossil fuels to develop, but as soon as we start doing serious damage to her...WHAM! We start to run out.

ReplyCass,

ReplyI concur with the take that the private ownership of resources is always at risk. But that kind of thing mostly takes place when retail prices go berserk as a demagogic political response to accusations of gouging, and the like.

Curiously (and maybe OT) in the case of the Moral High Ground, the two shots the oil industry has taken recently - the dismantling of income trusts and the new royalty grab - have come directly or indirectly from within Alberta itself.

More interesting for petro prices would be a shift to payment in euros, eliminating the fuel subsidy the USD is providing outside its own borders.

Equally interesting would be the impact on EUR/USD from the absence of oil country euro purchases. Somebody wrote a paper figuring that higher oil is bearish dollar if oil producers keep less than 60% of their revenues in the buck.

ReplyThe calculus would presumably change should substantial revenues be accrued in euros....

MM,

ReplyPerhaps the explanation for the tightening crack spread is too many speculators in crude? It's been rumored that hedge funds control a rather large chunk of storage at Cushing.

The price of crude has been going up as net speculative longs have been going down. I don't think it's speculators that are responsible for the crack spread. I think it's too many refineries competing for declining amounts of the grades they can refine.

ReplyI agree with the risk of expropriation. But I'm no longer sure that the service companies are a better bet, because nobody's out there drilling (relatively speaking, that is--you'd think there'd be a lot more action with prices where they are). I think peak oil may mean peak oil services as well.

Sorry to sound so dumb, but what is a "beta plus" strategy?

ReplyBTW, I'm learning a lot from reading your posts, thanks.

Greek high-complexity refiner MOH GA sporting div yield of 7% & EV/EBITDA of 9x. Not too shabby, hey? worth a punt on crack spreads widening here? Waddya tink?

ReplyAnonymous, it's essentially a beta strategy that has some market-timing features. I discussed the concept here, here, and here.

ReplyAnon, my own track record of using equities as a proxy for a commodity view is pretty execrable, so it's not somethign I feel comfortable with.

ReplySurely it's simpler to buy some calls on gasoline and puts on crude? Or just use the underlying futures?

"crack spreads?"... What about the cracked spreads?"...

ReplyBut you are right something being swallowed.

http://www.energy.ca.gov/gasoline/margins/index.html

Who is doing it? Was it not justover a year ago that there was a "cracking crisis" excacerbated by hurricane damage.

All back online and refine? I guess if you are integrated its a penny here vs a penny there but its going to show up somewhere...

If crack spreads widen, they may make the Invisible Man once more visible, and he won't be smiling. While I was making happy returns today as the Dow fell 362 points, my neighbor turned down a job at a distant Walmart due to his computation of gasoline transport costs, and their likelihood to rise. He'd lost his steady job to factory migration to China, and has five years to fund medical care till he turns 65.

ReplyCracks at $5 are not sustainable. Neither are they at $25 (or, better yet, at 30% of a barrel of oil).

ReplyIf North American cracks are narrowing more than is seasonally apt now (this is left as an exercise for the student; try http://tonto.eia.doe.gov/dnav/pet/xls/pet_pri_fut_s1_d.xls if you don't have bloomberg), perhaps it says more about NA product demand as it intersects world crude supply.

Or maybe not. Let's just say I am not short crude-exposed equities, but I am short NA-crack-exposed refiners.

FD: I've been wrong before.

Hi, thanks for alerting us to a potentially key data point to watch. 'Just looked into it though, and I think the impact of crack spreads or --more to the point and leaving the heating oil part of the spread aside-- gasoline refining margin returning to its average may not be as dramatic as suggested above. That spread currently stands close to $5 per barrel (HUCL1 on bbrg). A more average level would be closer to 15% of the Crude price (although admittedly we see spikes above 30% almost every year), with crude close to $100, not so different from just taking a raw $15 spread so let's say a tripling in margin from here. Pricing gasoline at $110 per barrel would imply $2.61 per gallon, an 11% rise from current levels. Not pleasant, but not a 1$-per-gallon shock. Am not a commodities specialist and my arithmetic isn't great pre-second morning coffee, so apologies if I'm wrong somewhere, I'd be the first to appreciate having it pointed out to me.

ReplyMC, to a degree I am learning on the fly here as well; see today's post for an attempt at quantifying the impact.

ReplyMacro Man, Also do not forget the hefty 12$

Replydiscount Saudi Arabia now provides to US shipments.

Imho that's the reason for low spread. The actual price refineries get oil is lower than the quotes.

My thought on the narrow crack spread is that pump prices for gasoline have reached the level where substitution is taking place. That is to say, commuters may be carpooling, taking public transit or just staying home rather than driving somewhere. Commercial users of gasoline are likely doing everything possible to increase the fuel efficiency of their vehicles and reducing the amount of mileage put on their vehicles. There was some publicity earlier this year regarding Wal-mart's efforts to reduce fuel costs.

Reply