1) Just when you think that BAA cannot possibly get any worse, they make an absolute pig's ear of managing difficult weather conditions ...

Read More

Risky business

Is the risky asset sell-off beginning? As he heads off on holiday, Macro Man's financial distress seismograph is beginning to twitch. OK...

Read More

Endangered species?

So New Zealand GDP was indeed worse than expected . The NZD should suffer here; if it doesn't, it may actually present a nice opportunit...

Read More

Thai'ed up

It appears that the Thai generals are quick studies, and the swift reversal of the THB lockup for equity investment appears to have staved o...

Read More

Land of confusion

Macro Man's IT department is currently residing in the land of confusion, so the P/L is unavailable today. However the "better reb...

Read More

Twas the night before....the day after?

The dollar continues to correct higher today and is rapidly approaching "put up or shut up time." Today's CPI release may tel...

Read More

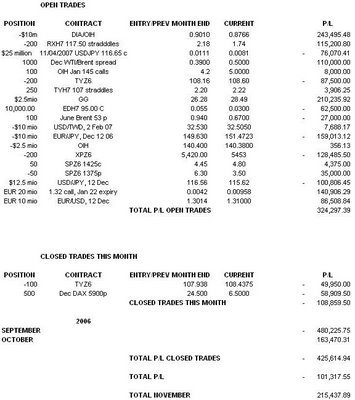

Portfolio post-mortem

The good news: Trimming short equity and short dollar risk was the right thing to do. The bad news: The remaining equity longs aren't bi...

Read More

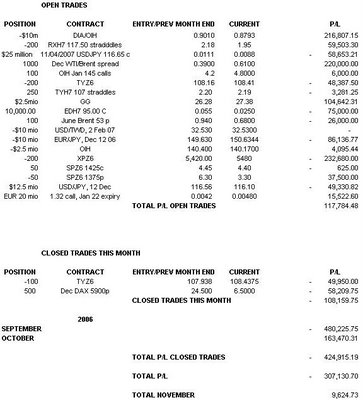

Portfolio surgery

Per recent comments, Macro Man jettisons the following losing trades: * Buys back USD/TWD at 32.425 for 2 Feb * Buys back the Aussie equity ...

Read More

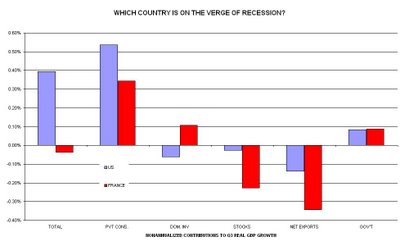

Fun with statistics

Today's retail sales figures looked strong across the board, surprising both Macro man and the market. Fixed income has not liked the da...

Read More

Wednesday bullet points

* The Fed statement was perhaps slightly softer than Macro Man was expecting, though Lacker's continued dissent prevented it from being ...

Read More

Stock studies extended

Markets have gone into lock-down mode ahead of today’s FOMC announcement (and, to a lesser degree, the US trade data.) Most trades appear t...

Read More

Beta release

Ouch. There’s no other word to describe it. Over the last 24 hours, virtually everything that could have gone wrong, has. The dollar bet has...

Read More

Curiouser and curiouser.....

No one that Macro Man spoke to had any clear idea why the dollar staged such a dramatic and forceful rally late in the day on Friday. Some ...

Read More

Summon Harry Potter!

Voldemort is all over the place today!

Read More

Identity crisis

Imagine Macro Man’s surprise when he observed his name splashed across the front of the latest edition of Bloomberg Markets magazine . Like...

Read More

Is the dollar about to undermine the stock market?

It’s been a nervous start to the day as markets shift risk ahead of the ECB rate decision/press conference, a slew of Japanese data tonight,...

Read More

Wednesday bullet points

* The P/L has taken a hit overnight as equity markets continue to perform strongly. Blogger is once again having upload problems, so Macro M...

Read More

If non-manufacturing ISM is 53 or below....

...Macro Man will buy £10 million verus USD at best. If not, he will wait.

Read More

A cautionary tale

The impressive resilience of equity markets has surprised Macro Man and dented the monthly P/L. Following on from Friday afternoon’s late ra...

Read More

De-(odd)-couple

It’s been a quiet start to the week, with stocks, bonds and currencies consolidating after Friday’s explosive moves. The equity consolidatio...

Read More

Macro Man sells 10million EUR/USD at 1.3342

Take profit. 1.3361 for Jan 4 date.

Read More

Treasury short stopped out

The sub 50 Chicago PMI has prompted the 109 stop loss on the short Treasury position to get filled at 109-01. Fortunately, short equities an...

Read More

'Tis the season

December 1 is always a significant day chez Macro Man, as it marks the first day that holiday music is played on the stereo. Macro Man full...

Read More

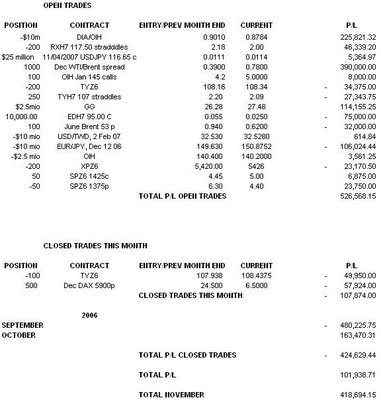

Tidy up time

Well, the good news is that the bond short avoided being stopped out by one tick, as the TYZ6 high yesterday was 108-31. The bad news is th...

Read More

Adding to $ short

Macro Man buys another 10 million EUR at 1.3144. Voldemort is reportedly bidding below that level, and barriers at 1.32 beckon....

Read More

Awaiting confirmation

Yesterday saw the S&P halt an impressive winning streak, as the index registered a decline of more than 1% for the first time in 95 trad...

Read More

DAX/SPX ratio spread filled

Macro Man bought 100 SPH7 at 1400 and sold 170 GXH7 at 6384.

Read More

Judgment Week

The importance of this week in guiding financial market trends for the rest of the year and possibly beyond cannot be overstated. The raft o...

Read More

Mind the gap

The USD gapped sharply lower in the Asian opening, a relative rarity in foreign exchange. Although the buck has retraced much of its loss ag...

Read More

Whither the dollar? Reply to a poster

Is this the big dollar downmove? Well, that is what I am wrestling with. While the dollar's price has changed, that is a necessary but n...

Read More

FX explosion!

Ranges have finally broken in FX, with EUR/USD surging above 1.30. Macro Man was filled at 1.3005 on his 10 million stop loss. He will now...

Read More

Turkey Day

As Americans prepare to settle into their annual orgy of food and televised sport, financial markets are surprisingly (and irritatingly) vol...

Read More

Dollar downtrend?

Currencyland has risen from its long slumber today as the dollar has gotten creamed against most of its G10 counterparts. While most curren...

Read More

Limp out of EUR/JPY

Macro Man will attempt to leg, rather than limp, out of the EUR/JPY 'hedge' by buying $12.5 million USD/JPY at 116.80 and then biddi...

Read More

Chinese whispers

As the holiday season moves swiftly towards us, the noise-to-signal ratio in financial markets approaches infinity. The level of frustration...

Read More

Random shots

What would you rather be: a financial market trader or an American turkey? The lack of action in these markets is so dire, Macro Man is swi...

Read More

Subscribe to:

Comments (Atom)