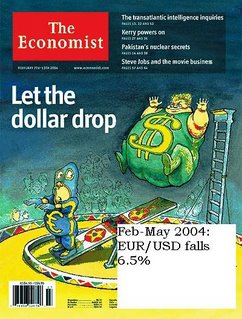

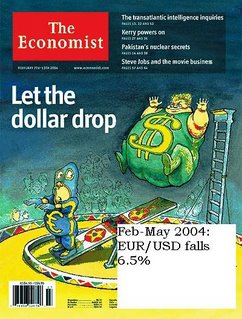

The pictures below speak for themselves....

Given the Economist’s execrable track record of forecasting, is it time to take profits on the dollar short already? Some people evidently seem to think so, as the buck is back, for this morning at least. However, in contrast to prior episodes where dollar weakness has gone tabloid, Macro Man remains of the belief that positioning is modest and tailwinds (i.e. central bank and corporate sales) remain strong. So Macro Man is going to give the position a chance to keep performing.

Indeed, given its size, the short equity position is a source of more worry than short dollars at the moment. So far it has paid off, but Macro Man is concerned that an upside surprise to US data would be construed as equity positive, as it would reduce the hard landing tail risk to equities. Given the markdown to ISM expectations after yesterday’s Chicago number, risks surely point to a stronger than expected national release. After all, not every district has an industry in such dire trouble as the auto sector in the Midwest.

From a risk/reward perspective, Macro Man favours playing a topside surprise through fixed income, despite being recently chucked out of a short bond position. Jan 94.75 puts (March future) at 3 ticks look a good bet from a risk/reward perspective, especially as 3m LIBOR remains 5.37%. Macro Man therefore buys 20,000 at 0.03, giving him a ratio strangle.

November closed on a good note, as short dollars, short Aussie/German stocks, and long US and energy stocks all paid handsome dividends. The only bummer was a compression of the Dec 07 WTI/Brent spread, which kept the November P/L just below 1%. However, Macro Man still likes the trade, and thus stays in. The long EUR/USD position was also rolled out to Jan 4; over the next couple of weeks, the short Aussie futures will need to be rolled to March, assuming the position is kept.

There’s lots more to consider that will have to wait for next week: the peak in the US profit cycle, the return of deflation to Japan, and the incredible disappearing house-price crash. Meanwhile, Macro Man can watch his screens in anticipation of hearing that holiday music when he returns home this evening.

Indeed, given its size, the short equity position is a source of more worry than short dollars at the moment. So far it has paid off, but Macro Man is concerned that an upside surprise to US data would be construed as equity positive, as it would reduce the hard landing tail risk to equities. Given the markdown to ISM expectations after yesterday’s Chicago number, risks surely point to a stronger than expected national release. After all, not every district has an industry in such dire trouble as the auto sector in the Midwest.

From a risk/reward perspective, Macro Man favours playing a topside surprise through fixed income, despite being recently chucked out of a short bond position. Jan 94.75 puts (March future) at 3 ticks look a good bet from a risk/reward perspective, especially as 3m LIBOR remains 5.37%. Macro Man therefore buys 20,000 at 0.03, giving him a ratio strangle.

November closed on a good note, as short dollars, short Aussie/German stocks, and long US and energy stocks all paid handsome dividends. The only bummer was a compression of the Dec 07 WTI/Brent spread, which kept the November P/L just below 1%. However, Macro Man still likes the trade, and thus stays in. The long EUR/USD position was also rolled out to Jan 4; over the next couple of weeks, the short Aussie futures will need to be rolled to March, assuming the position is kept.

There’s lots more to consider that will have to wait for next week: the peak in the US profit cycle, the return of deflation to Japan, and the incredible disappearing house-price crash. Meanwhile, Macro Man can watch his screens in anticipation of hearing that holiday music when he returns home this evening.