Imagine Macro Man’s surprise when he observed his name splashed across the front of the latest edition of Bloomberg Markets magazine. Like J.D. Salinger, he treasures his privacy very dearly. However, he can safely confirm that he is not, in fact, Peter Thiel, erstwhile PayPal honcho and current hedge fund manager. Macro Man’s identity remains safe after all....

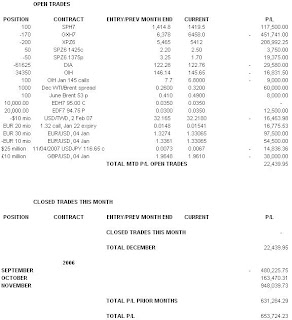

The past 24 hours have not been especially kind to the portfolio. Despite a 25 bps tightening and relatively hawkish commentary from Mr. Euro, the DAX performed strongly even as the S7P 500 floundered. As such the spread position has faltered badly. Elsewhere, profit-taking in the dollar and some stop losses in EUR/GBP have eroded much of the month’s currency trading profit, essentially taking the portfolio back to flat on the month.

Today, of course, sees the release of nonfarm payrolls in the US. The data has become more and more useless recently, as the underlying trend of payroll growth comprises a smaller and smaller percentage of the statistical error in the series. Macro Man prefers to watch the unemployment rate, which is more trending and less prone to peculiar outliers. That having been said, the October data may have witnessed just that, with a strange dip in the unemployment rate down to 4.4%. Macro Man expects that to correct back up to 4.6% today, which should undermine the dollar to a degree. The impact on equities is less obvious, however, and bears watching.

Last night saw the release of a slew of data in Japan, almost all of it negative. Q3 GDP growth was revised down from 0.5% q/q to 0.2%, machinery orders rose by a lower than expected 2.8%, and the economy watchers survey slipped below 50 for both the current and forward looking components. Only bank lending figures provided any modicum of comfort, rising by a slightly greater than expected 2.1% for adjusted y/y lending. On the other hand, the benchmark revision to GDP suggested that the trend rate of growth over the past few years has been substantially lower than previously thought.

The past 24 hours have not been especially kind to the portfolio. Despite a 25 bps tightening and relatively hawkish commentary from Mr. Euro, the DAX performed strongly even as the S7P 500 floundered. As such the spread position has faltered badly. Elsewhere, profit-taking in the dollar and some stop losses in EUR/GBP have eroded much of the month’s currency trading profit, essentially taking the portfolio back to flat on the month.

Today, of course, sees the release of nonfarm payrolls in the US. The data has become more and more useless recently, as the underlying trend of payroll growth comprises a smaller and smaller percentage of the statistical error in the series. Macro Man prefers to watch the unemployment rate, which is more trending and less prone to peculiar outliers. That having been said, the October data may have witnessed just that, with a strange dip in the unemployment rate down to 4.4%. Macro Man expects that to correct back up to 4.6% today, which should undermine the dollar to a degree. The impact on equities is less obvious, however, and bears watching.

Last night saw the release of a slew of data in Japan, almost all of it negative. Q3 GDP growth was revised down from 0.5% q/q to 0.2%, machinery orders rose by a lower than expected 2.8%, and the economy watchers survey slipped below 50 for both the current and forward looking components. Only bank lending figures provided any modicum of comfort, rising by a slightly greater than expected 2.1% for adjusted y/y lending. On the other hand, the benchmark revision to GDP suggested that the trend rate of growth over the past few years has been substantially lower than previously thought.

Despite this, the hot rumour in Tokyo is that the BOJ is itching to tighten rates this month. Perhaps they know that next week’s Tankan will be strong, but it still seems a strange decision in the face of such consistently weak activity data recently. Moreover, in the grand scheme of things, it shouldn’t really matter if they hike in December or wait a month or two for the data to improve before pulling the trigger in Q1.

There is some suggestion that they wish to tighten rates early to put the kibosh on carry trades. Perhaps there is some truth to this, but if so, Macro Man believes that they are barking up the wrong tree. Although it seems to be an article of faith amongst non currency specialists that the yen carry trade is massive, Macro Man believes that it is relatively modest in size. Moreover, he also thinks that tightening rates by 100 bps will do little to disturb such carry trades that are extant. Look out next week for a deeper analysis of the subject. In the meantime, we are left to wait for this month’s sacrifices at the altar of statistical insignificance, the nonfarm payroll and Michigan consumer sentiment surveys.

There is some suggestion that they wish to tighten rates early to put the kibosh on carry trades. Perhaps there is some truth to this, but if so, Macro Man believes that they are barking up the wrong tree. Although it seems to be an article of faith amongst non currency specialists that the yen carry trade is massive, Macro Man believes that it is relatively modest in size. Moreover, he also thinks that tightening rates by 100 bps will do little to disturb such carry trades that are extant. Look out next week for a deeper analysis of the subject. In the meantime, we are left to wait for this month’s sacrifices at the altar of statistical insignificance, the nonfarm payroll and Michigan consumer sentiment surveys.