Long-time no post - hope everyone's been well. Was away on a 3 week+ trip to China (the 6th country I've traveled to this year!). Had some difficulties overcoming the great firewall. Good to see Shawn holding things down!

A long one today, so please bear with me.

Cuckoo For Cocoa

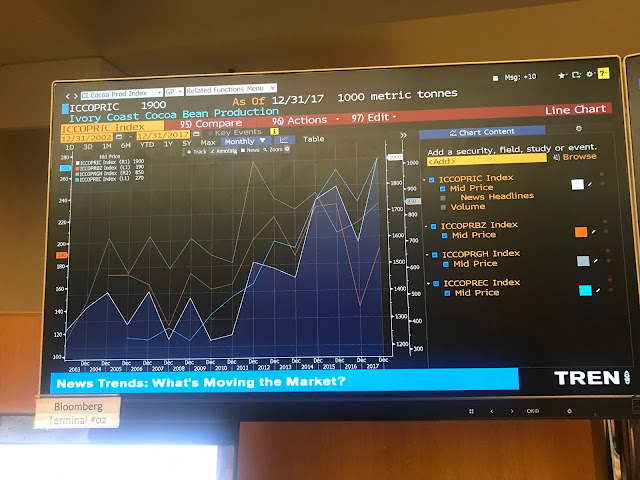

This picture can sum up how I feel about Cocoa:

We've talked about grain commodities in past by looking at supply and inventory numbers to gauge risk-reward and general surplus vs deficit of crops.

As I have stated in the past, the growing cycle of grains is relatively shorter than that of softs. Rips are usually less sustained in grains - long bear markets and short sharp spikes - than in softs - as there are massive cycles of bull and bear markets in softs.

We had a sizable rip in grains, specifically in wheat, but it was not sustained. Still too much supply out there and we might have to wait until next year before we start falling into deficit and price can sustain an up move.

Moving along.

Sitting here now looking for opportunities to gain diversified returns, I think there are opportunities setting up to get long softs, specifically cocoa, and to an extent sugar as well.

The reasoning is similar to things I've cited in the past grains post - these are two commodities have fallen so much in price that they are bound to return from a stage of surplus to deficit as production cuts back due to low prices.

In cocoa, the previous shortage from 2014-2015 has been replaced by a supply glut. There are even talks that the current levels in prices are leading South American producers to abandon cocoa for cocaine!

That leads me to think the bottom is in or pretty close.

General Commodity Catch Up

First, looking at the commodity world as a whole. Commodities have been a hugely undervalued versus stocks. This trend doesn't last forever and historically will mean revert.

It is hard to time this trade as the overall commodities "bucket" encompasses many things - each subcategory of commodities, and even different commodities in each subcategory can possess stark differences in the underlying supply and demand dynamics.

With that said, there should be general lift off in commodities soon.

There is something peculiar here to note.

The base metal index has tracked US Breakevens well. But recently, we've started to see a break.

Copper supposedly has a Ph.D. in economics and I assume the other base metals are its colleagues.

Copper's data is more easily procured so from this point on in the post, I'll just use that as a proxy.

Copper has been drifting higher and higher after a long period of consolidation post-Trump elections win. Obviously Trump = building stuff, better economy, etc. so it made perfect sense. Breakevens also exploded higher as the above would mean inflation.

However, interestingly, the break of correlation can mean a few things: either

1) Copper supply and demand dynamics are so in support of a higher price that it is meant to trade higher regardless or...

2) Ph.D. copper disagrees with Ph.D. interest rates.

Funny, it's not like we ever have Ph.D.s disagreeing with each other when it comes to the economy.

Combining inventory data from LME, COMEX and the Shanghai Metal Exchange, we can see that there could be some fundamental reasons why copper is getting bid.

Whether that draw inventory is driven by real economic growth requires more digging - I recall a time when Red Kite drew record amounts of inventory as a speculative ploy, only to lose their shirts and possibly their kites when prices did not respond accordingly.

Something is definitely fishy here. Don't have a strong inclination - need to ponder some more. Ready the bathtub.

Stock MarketTopping Process

Got some flak for the Nassim Taleb Vix post. The market ran up 270bps-ish against me and is now back down.

Face not ripped off? Check.

Shirt still on me? Well, more like a tank top but...Check.

Most of you who have ample experience in the market knows that a market top and bottom is usually a "process". With a not much higher high in the Nasdaq and Spooz and clear lower highs in the Russell (read leading indicator of risk) and transports, I feel pretty good.

How good?

Good enough to build on the position. I'm getting conviction that even if we haven't seen the top of the bull market, we will at least have a proper correction (at least 15% to 20%)

I'm up on the trade for now - we will see how things go. Keep looking for this lower lows and lower highs.

Back in the spring, I thought this bull market still had a year plus to run. Now? I am not so sure. There are some cracks there in the economy and nobody can argue whether we are at the beginning of the end of our current cycle.

Trust me, as somebody still trying to land a seat at a proper macro fund - I would strongly prefer that I am wrong here and the bull market continues.

But as speculators, we play the cards dealt and like I said, we will see how things go.

Oh, and obviously keep an eye on the VIX. like we've detailed in the past, there are market structure reasons alone where a sustained higher VIX can lead to a selloff.

China From Ground Level

My trip was purely recreational so I would be selling you guys short if I was to make up intelligent sounding, yet bogus market insights.

With that said, whether you find them insightful or not, some observations:

- We all know China is huge in its consumption of all things. But being there. Standing amongst seas of people is awe-inspiring.

- The transition for China from a producer nation to a consumer nation is a massive undertaking - but it might not be as difficult as people think. The population there has been living under the monotony that comes with communism for so long, they yearn for consumption.

- Everywhere I went, people bought the best things, wore the best brands and drove the best cars (that they could afford) - so it's not just the foreign luxury brands, it's also the Chinese brands. The population has a much more pent-up urge for things, for goods.

- People take pride and enjoy their work, even it's menial. I'm not sure if it's a cultural thing or a standard of living thing. For example, a Mcdonald's employee here gives you attitude. While there, they are respectful and seems, on the surface, happy. The job in both countries is considered a minimal salary type of role.

- I visited a lights factory when I was there. Although machinery and automation are starting to take over, labor is still relatively cheap for semi-automated, semi-skilled type of factory jobs.

- The public bathrooms are disgusting.

- The snacks are so much better.

That's it, guys.

As much as I love traveling, it feels pretty damn good to be back. Happy Monday.

A long one today, so please bear with me.

Cuckoo For Cocoa

This picture can sum up how I feel about Cocoa:

We've talked about grain commodities in past by looking at supply and inventory numbers to gauge risk-reward and general surplus vs deficit of crops.

As I have stated in the past, the growing cycle of grains is relatively shorter than that of softs. Rips are usually less sustained in grains - long bear markets and short sharp spikes - than in softs - as there are massive cycles of bull and bear markets in softs.

We had a sizable rip in grains, specifically in wheat, but it was not sustained. Still too much supply out there and we might have to wait until next year before we start falling into deficit and price can sustain an up move.

Moving along.

Sitting here now looking for opportunities to gain diversified returns, I think there are opportunities setting up to get long softs, specifically cocoa, and to an extent sugar as well.

The reasoning is similar to things I've cited in the past grains post - these are two commodities have fallen so much in price that they are bound to return from a stage of surplus to deficit as production cuts back due to low prices.

In cocoa, the previous shortage from 2014-2015 has been replaced by a supply glut. There are even talks that the current levels in prices are leading South American producers to abandon cocoa for cocaine!

That leads me to think the bottom is in or pretty close.

Cocoa surplus is now well telegraphed. We've experienced a notable build up in stockpiles. As these inventories start trending off the highs, we are in danger of seeing a reversion in price as well. Below is a chart of 1/x price vs ICE cocoa inventory.

The last production print for cocoa is still high but that is a slow-moving factor and should be priced in. In fact, it is slow enough for you to potentially fade it.

Outside of the commonly documented turmoil in the Ivory Coast (the biggest cocoa producer in the world), you can see other big cocoa producers (Ghana, Indonesia, Brazil etc.) also fluctuates based on price cues. With prices declining, then bottoming over a year's time, cocoa production should start fading accordingly.

Oh yeah, and people are heavily short this thing. Squeeze, anyone?

Sugar has similar fundamentals to cocoa.

We've had the boom back in 2011 when there were 300+ sugar mills in the South of Brazil. By the end of the bust, mills and companies were mired in debt. You basically had 90 mills left in Q4 of 2015. The thing with sugar mills is that they need to be retrofitted every few years.

The many mills left in Brazil needed to go through this process. However, retrofitting a sugar mill is like replacing ink for those old cheap printers - the ink cartridge itself would be $20 for a printer that only costed $25.

So it was safe to assume that a number of mills in the group remaining would shut down due to a combination of too much debt and a much-lowered sugar price.

The long bottoming process meant sugar had moved from a surplus crop to a deficit crop. On Feb 22, 2016, there was huge buying interest in sugar going into the close. After markets were closed, ISO announced a surprise sugar shortage. Sugar ran up from the lows to ultimately hit 24 handle. Turns out the catalyst was El Nino.

After the price surge, stockpiles printed the lowest they've been since 2011. Production declines in Brazil stopped and started to trend higher, although India production still didn't show a clear nadir. That was enough to send prices back down.

Turn the page to today, The height of the price move has led to a turn of the fundamentals. Brazil production increased but Indian production is still low. If we sustain lower prices a while longer, Brazil production would be in danger of pulling back again.

This one might be a little early - we should eventually see the sugar surplus move back into deficit and witness a surge in prices again.

One concern here is that stockpiles have only increased modesty - which is why I think we are a little early here. And since the market is short, we could potentially see a squeeze that materializes as a fake out for longs.

Something to keep in mind.

General Commodity Catch Up

First, looking at the commodity world as a whole. Commodities have been a hugely undervalued versus stocks. This trend doesn't last forever and historically will mean revert.

It is hard to time this trade as the overall commodities "bucket" encompasses many things - each subcategory of commodities, and even different commodities in each subcategory can possess stark differences in the underlying supply and demand dynamics.

With that said, there should be general lift off in commodities soon.

There is something peculiar here to note.

The base metal index has tracked US Breakevens well. But recently, we've started to see a break.

Copper supposedly has a Ph.D. in economics and I assume the other base metals are its colleagues.

Copper's data is more easily procured so from this point on in the post, I'll just use that as a proxy.

Copper has been drifting higher and higher after a long period of consolidation post-Trump elections win. Obviously Trump = building stuff, better economy, etc. so it made perfect sense. Breakevens also exploded higher as the above would mean inflation.

However, interestingly, the break of correlation can mean a few things: either

1) Copper supply and demand dynamics are so in support of a higher price that it is meant to trade higher regardless or...

2) Ph.D. copper disagrees with Ph.D. interest rates.

Funny, it's not like we ever have Ph.D.s disagreeing with each other when it comes to the economy.

Combining inventory data from LME, COMEX and the Shanghai Metal Exchange, we can see that there could be some fundamental reasons why copper is getting bid.

Whether that draw inventory is driven by real economic growth requires more digging - I recall a time when Red Kite drew record amounts of inventory as a speculative ploy, only to lose their shirts and possibly their kites when prices did not respond accordingly.

Something is definitely fishy here. Don't have a strong inclination - need to ponder some more. Ready the bathtub.

Stock MarketTopping Process

Got some flak for the Nassim Taleb Vix post. The market ran up 270bps-ish against me and is now back down.

Face not ripped off? Check.

Shirt still on me? Well, more like a tank top but...Check.

Most of you who have ample experience in the market knows that a market top and bottom is usually a "process". With a not much higher high in the Nasdaq and Spooz and clear lower highs in the Russell (read leading indicator of risk) and transports, I feel pretty good.

How good?

Good enough to build on the position. I'm getting conviction that even if we haven't seen the top of the bull market, we will at least have a proper correction (at least 15% to 20%)

I'm up on the trade for now - we will see how things go. Keep looking for this lower lows and lower highs.

Back in the spring, I thought this bull market still had a year plus to run. Now? I am not so sure. There are some cracks there in the economy and nobody can argue whether we are at the beginning of the end of our current cycle.

Trust me, as somebody still trying to land a seat at a proper macro fund - I would strongly prefer that I am wrong here and the bull market continues.

But as speculators, we play the cards dealt and like I said, we will see how things go.

Oh, and obviously keep an eye on the VIX. like we've detailed in the past, there are market structure reasons alone where a sustained higher VIX can lead to a selloff.

China From Ground Level

My trip was purely recreational so I would be selling you guys short if I was to make up intelligent sounding, yet bogus market insights.

With that said, whether you find them insightful or not, some observations:

- We all know China is huge in its consumption of all things. But being there. Standing amongst seas of people is awe-inspiring.

- The transition for China from a producer nation to a consumer nation is a massive undertaking - but it might not be as difficult as people think. The population there has been living under the monotony that comes with communism for so long, they yearn for consumption.

- Everywhere I went, people bought the best things, wore the best brands and drove the best cars (that they could afford) - so it's not just the foreign luxury brands, it's also the Chinese brands. The population has a much more pent-up urge for things, for goods.

- People take pride and enjoy their work, even it's menial. I'm not sure if it's a cultural thing or a standard of living thing. For example, a Mcdonald's employee here gives you attitude. While there, they are respectful and seems, on the surface, happy. The job in both countries is considered a minimal salary type of role.

- I visited a lights factory when I was there. Although machinery and automation are starting to take over, labor is still relatively cheap for semi-automated, semi-skilled type of factory jobs.

- The public bathrooms are disgusting.

- The snacks are so much better.

That's it, guys.

As much as I love traveling, it feels pretty damn good to be back. Happy Monday.

12 comments

Click here for commentsGood to see you back Detroit Red, I like your outlook and conviction. If life experience has taught me one thing... if you are good enough, the seat will find you.

ReplyBest wishes.

@abee, I am out of ULTA short on this $10 plunge. This was a trade for the books. Almost stopped out in the very beginning and to get this reward - simply a gift!

Reply@Detroit Red, really hope your equity market prediction is correct. It would help to complete the SVXY trade I am in (selfish wish). While I am with you on the short-term correction, I disagree on the magnitude. Feels like ousting of alt-right from the WH is going to accelerate tax cuts proceedings and cushion the fall in equities for the duration of the sausage making. Trump knows that it's his last chance to regain any ground in polls. He wants to be liked, it's his nature. Tax cuts will give him much-needed love from all sides. It'll also give GOP the boost in possible votes in midterm election. Once the sausage is prepared, i.e. tax cuts are announced (leaked), we'll then have the deeper correction you are looking for, imho. Let's say sometime in the very beginning of 2018?? Why would equities sell off? Tax cuts won't be as deep as anticipated. Congress will get them done but will have to compromise on the rate, size, and everything else that comes with it, possibly a much reduced repatriation windfall, if any.

I like your points on commodities--today a former colleague linked to a note written by a friend that noted how the world is still growing....and consuming stuff...stuff that is made of wood, steel, iron, zinc, etc. And supply in these sectors hasn't seen the innovation that oil has in the past few years. in fact it is getting harder and harder to find quality grades of copper in places where you don't need an army of mercenaries to guard your mine. This guy also highlighted that it is not only supply/grades that are deteriorating but also talent---the people that know how to get this stuff out of the ground are getting old and not being replaced by a generation that thinks mining isn't green enough. (and working for goldman is? --ed.)

ReplyRe: job searching in this industry at large--I had an interesting conversation with a recruiter today. We discussed a position that was titled something like "fixed income strategist". We went over the basics of the position, and my experience. It all seemed to be a good fit until we talked about compensation. They are looking to pay what I was paid when I got my first job in the business, despite wanting someone that makes asset allocation and portfolio level decisions and recommendations!!

I wished her the best of luck and went back to my spreadsheets and database.

But my point is this--the business was one that supports advisors for HNW and small-mid-sized corporate clients. They charge whatever on AUM...1%, maybe more? They advisor is a sales guy, not an asset manager. But the firm "sells" that the advisor has access to the vast resources of this huge corporation, which is supposed to have the scale to hire and pay bright, experienced people to help make good decisions for advisors and clients. But for whatever reason, they've decided to outsource this to people with no experience managing assets.

This is their strategy for fighting robo-advisors. Kinda reminds me of Blockbuster.

Oh my...

ReplyNorway’s $970 billion wealth fund has been ordered to raise its stock holdings to 70 percent from 60 percent in an effort to boost returns and safeguard the country’s oil riches for future generations.

https://www.bloomberg.com/news/articles/2017-08-22/world-s-biggest-wealth-fund-gains-26-billion-on-stock-rally

from above article...

Reply“We don’t have any views on whether the market is priced high or low, whether bonds and stocks are expensive or cheap,”

he said in an interview after presenting second-quarter returns in Oslo on Tuesday. The decision to add stocks “was made at a strategic level, on a long-term expected excess return that we’re willing to take risk to achieve. And parliament has said that they wish to spend some time to phase in that increase.”

More or less in agreement with IPA and Detroit Red here - that for the time being we are in the early stages of a correction in risky assets, based on the charts of main interest at present: IWM, VIX and (derivative) SVXY. As long as we continue to see higher lows in vol and lower highs in the small caps, we are going to go in and out on the short side of the market. Spoos and FANG etc., are a sideshow for us, as our trade is focused on the small cap index. Days like today warn everyone to be cautious. We have been out on the sidelines, pondering a re-entry today or tomorrow once VIX has been crushed a bit lower.

ReplyWe are neutral to slightly bearish on fixed income for now, just going to sit and watch that market while J-Hole occurs and the tea leaves are read. Charts have turned more constructive but can still be viewed either way, and for now our most important data point was the bearish "abandoned baby" candle in TLT that we saw back in July. That was a top, and we haven't seen anything definitive happen since that time in terms of momentum or sentiment. The usual response to the debt ceiling debates is as follows: complacency (yield seeking), then a flight to safety (bid in the belly of curve to long end of USTs) as the deadline approaches, followed by a return to risk (high yield and short-term) once the deadlock is resolved.

Nice post Detriot Red, thanks for the comments. Cocoa does look interesting. I have actually been interested in the chocolate makers (hershey and lindt). Seems like if anyone can ever crack the Chinese taste for chocolate it could be great business, but alas China apparently doesnt like chocolate (though with startbucks ALL-IN with coffee, perhaps its just time). But back on cocoa I do like the chart set up but would need a buy signal still to get in

Reply@IPA, I am still in ULTA, will play earnings tonight. They will probably beat. But I am in it for the long term. The multiple is still too high. Lets see. Oil is a train wreck still but some like RRC and GPOR look to be bottoming, IMO. I will hold what I have for now. Craptastic

Regarding an equity correction, well we are setting up nicely. Almost too nicely. HYG at 50 day. Russell and Transports below 200 day. Dax at 200 day. Bund at 200 day. Notes/TBond near range lows. S&P near short term support. If we get the next impulse lower and the bottom falls out, look out below.

But where is the weakness really coming from? EU bc the EURO is too high (but PMI's still great). Not in EEM. Not in China (ie hard commodities). In the US, lagging sectors are oil and retail, nothing really new here. And unless NFP / claims start surprising I think market doesnt care. But what is more interesting to me is if this sell off starts taking industrials (looks very toppy and is damn expensive, but still geared towards China) and financials down with it. Then we have a correction.

Very nice blog. Thank you for sharing. Finding trustworthy packers and movers in Chandigarh is not an easy task. It can be stressful. Here we also provide household relocation, warehouse services and packers and movers in Chandigarh at a very reasonable price.

ReplyPackers and Movers in Mohali

Packers and Movers in Panchkula

Packers and Movers in Chandigarh

Packers and Movers in Zirakpur

Packers and Movers in Derabassi

Packers and Movers in Jaipur

ReplyNice blog post for reading and Thanks for sharing the wonderful article

No1 Packers and Movers Bangalore

Top Packers and Movers in Banashankari

Affordable Packers and Movers in Bommanahalli

Best Packers and Movers Domlur

The Admission at Bangalore Website is the most attractive Website for those planning to get admission in some of India's reputed educational institutions. This Website provides the student with a lot of information about India's various universities and colleges and their respective rankings. These rankings are provided by various leading educational institutions in India, which can keep track of the progress and the advancement in education and research in all the educational institutes throughout the country. The results of these rankings will help you choose the best college for you.call us @ +91-7760-371-890

ReplyRV College of Engineering Admission

Bms College of Engineering Admission

Ramaiah Insitute of Technology Admission

Dayandasagar college of Engineeirng Admission

Mechanicrew offers 2- wheeler repair services in Bangalore. You can repair your bike and scooty with our expert mechanic, who has multiple years of experience with any issues related to bikes and scooters. We also provide car painting in bangalore You can visit RK Hegde Nagar, Bengaluru, Karnataka 560077 or call us on +91 9739308409

Replymechanicrew

https://mechanicrew.in/expert-car-denting-and-painting/

<a href="https://mechanicrew.in/expert-car-denting-and-painting/”>car painting in Bangalore </a>

Very Interested One, precise technique and thanks for sharing this form of precise blog and take a look at this interesting sales and marketing Trends.

Reply