"Proviamo questo nuovo, eh?" Macro Man can only assume that thought will be the first thing that pops into Mario Draghi's head when he wakes up this morning. Having made a hash of their previous easing in December, given recent developments the ECB will no doubt be keen to get back on the front foot. Putting aside the ongoing issues with the banking system, on a more prosaic basis CPI has dipped back below zero (from 0.1% at the time of the December meeting.) While we can have our debates about tilting at windmills and the impotence of isolated monetary authorities to combat secular disinflation, from the ECB's perspective this unwelcome development deserves and demands action.

So what are the options? Let's examine a few in turn.

*Deposit rate cut. The easiest and most obvious option, and also one that was apparently confirmed by recent "sources" stories. There is a very legitimate concern that in many ways deposit rates do more harm than good at these levels, for reasons that Macro Man discussed in the posts linked above. Nevertheless, why let empiricism get in the way of a good model, so a depo rate cut is almost certainly forthcoming. As far as Macro Man can make out, markets are priced for roughly 12.5 bps of depo cut (judging by the spread between spot EONIA and 1m1m); that's somewhat less than the 16 bps priced just before the December meeting. Still, a cut of 0.10% will be seen as a disappointment (unless you own Eurozone bank shares.)

* Increase in Asset Purchase Program size. Adjusting the APP is the obvious next port of call for the ECB. It's somewhat difficult to quantify how much is in the price, but the very minimum quantum of increase to register would be EUR 10 billion per month, and even that would probably be seen as a disappointment. Still, it's probably the most likely outcome, at least for government bond purchases.

* Increase in APP maturity. Another six months seems like an easy call here. They may try to extend further to get ahead of the market; one thing they could do that would surprise might be to introduce an Evans rule-type threshold, i.e. asset purchases will continue until CPI is 1.9% (given that the target is "close to, but under 2%" and the Germans would never countenance further easing with inflation above target.)

* Broaden assets being purchased. When asked about a potential broadening of the assets to fall under the APP's remit, Draghi has been remarkably coy, refusing to rule anything out. It seems ludicrous to think that they would buy equities, and frankly Macro Man cannot see it without a number of intermediate steps in between. High-quality corporate bonds would be an obvious avenue to explore, though ultimately that would just channel more credit to those that can already access it. Hoping for the portfolio balance channel to work would seem a little optimistic from where Macro Man sits. Really, the best thing that they could do on this front would be to mitigate the negative impact of NIRP on the banking system, perhaps by purchasing bank debt (especially Cocos!) It's hard to see it happening, but if they did manage to help banks it would be seen as a huge positive. Generally, however, high quality corporates would appear to be the most likely outcome, and one that is probably halfway in the price already.

* Allowing larger purchases of bonds currently in the portfolio. The ECB currently faces some difficulties in executing its program, insofar as there are limits on percentage of each individual bond that the ECB can hold. Moreover, the ECB cannot currently purchase bonds with yields below the deposit rate. It certainly looks like something along these lines is being priced; the margin of Schatz yields below the depo rate is the largest since the ECB's ill-fated tightening campaign of 2011. Moreover, even Bobl yields are trading on a par with spot EONIA, below the current deposit rate.

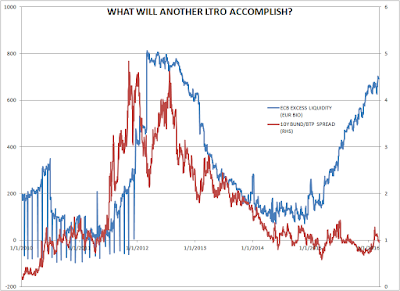

* Another LTRO. Sure, why not? It's worked in the past, right? On the other hand, excess liquidity in the Eurosystem is more than ample at EUR 691 billion, and peripheral spreads are no longer a problem and probably aren't getting any tighter.

It's not like EONIA is exactly mispriced against the depo rate, either.

So in many ways, it's difficult to see what the point of another LTRO might be. Why would banks borrow more cash when their primary options for it are negative carry from the deposit facility or negative carry from government bonds?

Of course, the ECB could be cute and dangle a carrot or two. Preferential borrowing rates can be offered for banks that demonstrate loan growth beyond a certain threshold, thus offering them the prospect of positive carry. Of course, with both the regulators and the market telling these same banks to de-lever, it's hard to see how such an enticement will have much of an impact. Just look at the BOE's Funding for Lending scheme, which was an abject failure.

Still, old horses like to drink from the same well, so an LTRO could well be in the offing. It's hard to see why the market should shed tears if one is not, however.

* Tiered deposit rates. With excess liquidity rising inexorably thanks to the APP, the ECB could well introduce a tiered deposit rate system. This could be something fairly innocuous, like the Japanese system whereby only marginal increases in the deposit facility would be impacted by the (more) punitive depo rate, or something sexy like tying the level of loan growth to the level of the deposit rate. Macro Man even heard one suggestion that the ECB should allow some multiple of any new LTRO takeup to be deposited at the ECB at zero rates. While this would certainly help the banks and encourage a bigger LTRO take up, it may be a little too radical and/or complicated. While tiering may not be a base case option, it remains a possibility. Market reaction may be dictated by whether it helps or hurts the banking system.

* Helicopter money. In such a program, Eurozone banks would credit each account by say EUR2000 and create an offsetting asset that could then be sold to the ECB for the same amount. Voila! Everyone's richer! Macro Man would ordinarily say that the chances of this are as remote as some relegation fodder 2500/1 outsider winning a major football league, but on recent evidence they're much more remote than that.

Obviously, the more of the above boxes get ticked, the happier the market will be. While it seems clear that the market expects at least a few of these options to be employed today, unlike in December Macro Man does not have a sense of foreboding that that street is all one way. Having been burned so badly three months ago, how could it be? While it's true that EUR/USD has sagged recently, the magnitude of the move is nothing like that preceding December's meeting...and there's even been a squeeze the last few days.

While the IMM is hardly the end all and be all of EUR positioning, given how the whippy market has turned lots of punters into momentum traders it's probably not a bad proxy at the moment. The message there is pretty healthy, actually....the EUR short was recently smaller than at any point last year.

On a broad basis, the EUR TWI is closer to its highs than its lows of the last year...unlike in December, when it was near the latter.

Given economic and market developments over the past three months, the current set-up looks more favourable in many ways than it did in December. Macro Man can't see much of a high quality trade being long rates at these levels, but the currency set-up looks a bit more favourable. Perhaps shorting both the euro and Schatz/Bobls makes some sense, as to a degree it takes getting the ECB right out of the equation, and the latter seems to have quite a bit more priced than the former.

Macro Man cannot shake the thought, however, that Draghi must look wistfully at countries like New Zealand, where the central bank still has the opportunity to deliver a genuine shock to markets by cutting a positive nominal interest rate. And just look at the effect it's had...you reckon Mario would accept a similar shellacking of the euro when all is said and done?

(As aside, Macro Man reckons it's probably time to take a little profit in this one if you've been long for the last 5-6%.)

So what are the options? Let's examine a few in turn.

*Deposit rate cut. The easiest and most obvious option, and also one that was apparently confirmed by recent "sources" stories. There is a very legitimate concern that in many ways deposit rates do more harm than good at these levels, for reasons that Macro Man discussed in the posts linked above. Nevertheless, why let empiricism get in the way of a good model, so a depo rate cut is almost certainly forthcoming. As far as Macro Man can make out, markets are priced for roughly 12.5 bps of depo cut (judging by the spread between spot EONIA and 1m1m); that's somewhat less than the 16 bps priced just before the December meeting. Still, a cut of 0.10% will be seen as a disappointment (unless you own Eurozone bank shares.)

* Increase in Asset Purchase Program size. Adjusting the APP is the obvious next port of call for the ECB. It's somewhat difficult to quantify how much is in the price, but the very minimum quantum of increase to register would be EUR 10 billion per month, and even that would probably be seen as a disappointment. Still, it's probably the most likely outcome, at least for government bond purchases.

* Increase in APP maturity. Another six months seems like an easy call here. They may try to extend further to get ahead of the market; one thing they could do that would surprise might be to introduce an Evans rule-type threshold, i.e. asset purchases will continue until CPI is 1.9% (given that the target is "close to, but under 2%" and the Germans would never countenance further easing with inflation above target.)

* Broaden assets being purchased. When asked about a potential broadening of the assets to fall under the APP's remit, Draghi has been remarkably coy, refusing to rule anything out. It seems ludicrous to think that they would buy equities, and frankly Macro Man cannot see it without a number of intermediate steps in between. High-quality corporate bonds would be an obvious avenue to explore, though ultimately that would just channel more credit to those that can already access it. Hoping for the portfolio balance channel to work would seem a little optimistic from where Macro Man sits. Really, the best thing that they could do on this front would be to mitigate the negative impact of NIRP on the banking system, perhaps by purchasing bank debt (especially Cocos!) It's hard to see it happening, but if they did manage to help banks it would be seen as a huge positive. Generally, however, high quality corporates would appear to be the most likely outcome, and one that is probably halfway in the price already.

* Allowing larger purchases of bonds currently in the portfolio. The ECB currently faces some difficulties in executing its program, insofar as there are limits on percentage of each individual bond that the ECB can hold. Moreover, the ECB cannot currently purchase bonds with yields below the deposit rate. It certainly looks like something along these lines is being priced; the margin of Schatz yields below the depo rate is the largest since the ECB's ill-fated tightening campaign of 2011. Moreover, even Bobl yields are trading on a par with spot EONIA, below the current deposit rate.

* Another LTRO. Sure, why not? It's worked in the past, right? On the other hand, excess liquidity in the Eurosystem is more than ample at EUR 691 billion, and peripheral spreads are no longer a problem and probably aren't getting any tighter.

It's not like EONIA is exactly mispriced against the depo rate, either.

So in many ways, it's difficult to see what the point of another LTRO might be. Why would banks borrow more cash when their primary options for it are negative carry from the deposit facility or negative carry from government bonds?

Of course, the ECB could be cute and dangle a carrot or two. Preferential borrowing rates can be offered for banks that demonstrate loan growth beyond a certain threshold, thus offering them the prospect of positive carry. Of course, with both the regulators and the market telling these same banks to de-lever, it's hard to see how such an enticement will have much of an impact. Just look at the BOE's Funding for Lending scheme, which was an abject failure.

Still, old horses like to drink from the same well, so an LTRO could well be in the offing. It's hard to see why the market should shed tears if one is not, however.

* Tiered deposit rates. With excess liquidity rising inexorably thanks to the APP, the ECB could well introduce a tiered deposit rate system. This could be something fairly innocuous, like the Japanese system whereby only marginal increases in the deposit facility would be impacted by the (more) punitive depo rate, or something sexy like tying the level of loan growth to the level of the deposit rate. Macro Man even heard one suggestion that the ECB should allow some multiple of any new LTRO takeup to be deposited at the ECB at zero rates. While this would certainly help the banks and encourage a bigger LTRO take up, it may be a little too radical and/or complicated. While tiering may not be a base case option, it remains a possibility. Market reaction may be dictated by whether it helps or hurts the banking system.

* Helicopter money. In such a program, Eurozone banks would credit each account by say EUR2000 and create an offsetting asset that could then be sold to the ECB for the same amount. Voila! Everyone's richer! Macro Man would ordinarily say that the chances of this are as remote as some relegation fodder 2500/1 outsider winning a major football league, but on recent evidence they're much more remote than that.

Obviously, the more of the above boxes get ticked, the happier the market will be. While it seems clear that the market expects at least a few of these options to be employed today, unlike in December Macro Man does not have a sense of foreboding that that street is all one way. Having been burned so badly three months ago, how could it be? While it's true that EUR/USD has sagged recently, the magnitude of the move is nothing like that preceding December's meeting...and there's even been a squeeze the last few days.

While the IMM is hardly the end all and be all of EUR positioning, given how the whippy market has turned lots of punters into momentum traders it's probably not a bad proxy at the moment. The message there is pretty healthy, actually....the EUR short was recently smaller than at any point last year.

On a broad basis, the EUR TWI is closer to its highs than its lows of the last year...unlike in December, when it was near the latter.

Given economic and market developments over the past three months, the current set-up looks more favourable in many ways than it did in December. Macro Man can't see much of a high quality trade being long rates at these levels, but the currency set-up looks a bit more favourable. Perhaps shorting both the euro and Schatz/Bobls makes some sense, as to a degree it takes getting the ECB right out of the equation, and the latter seems to have quite a bit more priced than the former.

Macro Man cannot shake the thought, however, that Draghi must look wistfully at countries like New Zealand, where the central bank still has the opportunity to deliver a genuine shock to markets by cutting a positive nominal interest rate. And just look at the effect it's had...you reckon Mario would accept a similar shellacking of the euro when all is said and done?

(As aside, Macro Man reckons it's probably time to take a little profit in this one if you've been long for the last 5-6%.)

69 comments

Click here for commentsIt's getting ultralow borrowing rates out into joe public land rather than getting swamped in finance land that is so hard. What is given in rate cuts is taken away in credit spreads at the personal level. Leaving your average joe charged for deposits and charged for loans still. Unfortunately the only way I can see them helping your mr Av Joe is my lowering their credit requirements for qe until they end up effectively lending to the public more directly rather than via banks or large corps.

ReplyWould l9ve to see an ECB credit card issued. Why not? They represent the whole of Eurozone so why not be egalitarian and lend 10k to everyone at 0 and wear the risk. 'It s helicopter money.. but not as we know it'. Could even fool the germans.

One wonders whether USD will turn after next weeks fed meeting. No one is expecting a rate hike but the possibility of one at the meeting after will start to be priced in at some stage. One of the more attractive expressions of long USD currently, to me anyways, appears to be short eur.usd.

ReplyThe pressure must be on for Draghi to deliver. And unlike the last ECB meeting the bar is set very low. Short eur.usd is looking attractive to me here. It seems like pretty easy money just sitting there and I'm wondering, what's the catch ??

Checking in with some brokers this morning... retail have most positions in Euro and are net short. The financial media and bank strategists predict a large rate cut from the ECB (apparently it's a one-way bet). The only logical conclusion is that they are all correct and the market is just waiting to pay them handsomely no?

ReplyYesterdays 20 questions:

Reply1) Short squeeze. My pick: a few more kick in the guts for commodity bears for good measure over the next week before resumption of a downtrend.

3) The market might come to price in 1-2 rate increases, so 1 further rate increase beyond what is expected here. Particularly if unemployment falls to 4.7% which is not hard to imagine in the next 4 months. The thing is, although the slowdown from the rest of the world has affected industrial production, it has had less than expected effect on leading employment indicators, so why would the fed not hike again, particularly if PCE ticks up a notch between now and July ?

6) USD/JPY: too hard to call

10) Which comes first in WTI crude, $20/bbl or $50/bbl? Might be hard to get past $42 before resumption of downtrend

12) Back to the philosophical question of to what degree Chinese numbers are made up. Who knows.

14) Have we seen the top in EUR/GBP : probably

17) Will Donald Trump? Pretty amazing that he could be controlling the nuke button eh? But that is what the facts on the ground suggest. The masses want to vote against the republican and democrat establishment candidates and Trump taps into that. I think it is like Brexit, no one wants to see it until the day approaches. Then the market will have a fit.

18) Is the next move from the RBA a cut or a hike? Very good question. Macrofundamentally, they should be at 3% rates and they are at 2%. But everyone expects the Australian economy to crater at some stage due to commodity prices. I tend to agree with that and am looking for a reversal around 0.755 but employment has remained strong so that and the property market are the key to when things turn (if they do)

20) Will the ECB deliver the goods tomorrow or will it be December redux? December already happened, but recency bias might be providing a good entry price here.

What happened to all the parity calls ? If the ECB delivers 10-20B QE expansion and the fed hikes by July, we could well be talking about parity again.

MM- REGARDING ECB, i agree bonds and rates - short bobls and bunds and short euros....bunds look like they wan to come off here and risk on sentiment might just kick them lower and positioning unwind and december kick has euro shorts looking ok here..worth good rr here

Replyto finish above..dollar bid probably sees oil down and spoos pop sold as well

ReplyECB decision already leaked to market by the looks of Dax...

ReplyAs I told you all... stocks will go up. Buy the dip, wait for CBs to push stocks up. I know you all believe it doesn't work, well look what just happened (again).

Replyeur.usd: looks like the market is still skeptical, 100pips for delivering appears a bit underdone. I think I will add to the position here as I don't think the move is done. Draghi still has his presser where he may be able to dispense with the easiest part which is to say that there may well be moar in the future, we will do double what it takes etc etc.

ReplyEurusd is a pig of a way to play this and nearly always disappoints. Rate diff -ve vs stimulus positive. stocks and commodities more defined. gain on stimulus and rate diffs

ReplyMM - I think the IG credit purchase is actually quite significant - in the current market paradigm it amounts to opening a lending channel for lower grade debt (in energy) - plus these things have a way of becoming the new CB fad, so the market should justifiably place some probability on a similar thing happening in the US if conditions warrant. Way better step than just doing negative rates.

ReplyLook forward to your thoughts post the presser.

ALL IN. Full stop.

Replypunter: Retail and the news channels were right ! hahaha

Replyhttps://twitter.com/LorcanRK/status/707914452167950337

ReplyNo more NIM worries ?

And just remember folks, "we're in a bear market" (as certain misfits on this blog like to tell us). Stocks won't go up ok? Turn your charts upside down and pretend equities are falling... I guess if you try hard enough some people will believe anything (even if they have been wrong for 7 years and counting)...

Replyhttps://twitter.com/nanexllc/status/707917413031895041

ReplyLooks like the ECB info was leaked to the market again (see above)...

Re Corporate purchases, I do agree that is a surprise but I was reading some notes that said when the BOE did it it was very hard to get allocations and didnt really amount to much. Lets see if the markets remember that

Replyyes jbft you can keep buying, however the day isnt done. You should know that ECB days have a higher probability of reversals than most other days.

Classic definition of a bull market is higher highs and higher lows. Not sure how anyone can look at major equity indexes and say confidently we are still in a bull market, especially with just about all BELOW their 200day. I'm not trying to pound the bear case, as I think valuations are reasonable and the recent rotation is often a sign of a bottom. But just bc oil rallied $10 from the lows is hardly reason to assume its 2013 again

abee - you make sound points, but Draghi & Kuroda are engaging in currency wars and the Fed is too weak to counter them. Stocks will reclaim their 2015 highs in the next 3 months and make new highs before 2017.

Reply@ washed and abee bear in mind it's IG nonfin corps...ie the cohort least in need of ECB assistance. Yeah, OK maybe Total etc get a bit of a boost, but I don't see how this helps smaller high yield energy cos in Europe. To me it's more of a signalling mechanism than anything else.

Replyabee - Excellent call on the reversal ! V good call.

Reply@MM correct its only IG non fin corps, and thats about as far as you would expect them to go for now - but remember IG credit is in some sense the weakest link in the risk-on chain right now, being the fulcrum of the so called 'dollar squeeze' and repeatedly cited as being 'disconnected' from lofty equity prices. ECB formally opened the door to a more explicit put on credit, and would in any case have to set up the mechanisms to execute these purchases in the market, which is significant in and of itself. It lowers the odds (but not to zero!) in my view that CBs are bumbling fools with no grasp of where the vulnerabilities in the system lie.

ReplyWe will see - if HYG and JNK outperform equities today it could be a very interesting signal.

Did you its just signaling? Well what else do they got bro??

Actually, I only have 5 dollars of my own to invest each week. My mommy won't increase my allowance. But I know my stuff!

Reply@Abee good call on the short term reversal call, but still believe that it is good levels to sell EURUSD as the policies announced by the ECB will push the Euro lower over the next couple of weeks. In addition, see the FOMC meeting next week being slightly hawkish supporting the dollar side of things.

Replyso- post ecb surprise i get to sell euro high ron the day???

Replywhat am i missing??

( have sold some but is it too farking obviuos>))

I didnt call a reversal, just said it has a higher probability than normal occurring. Just like I am not calling for a bear market, just saying that at current prices and with current price action, I think the set up is higher probability than normal. Most investors who are over confident in their market calls, IMO, end up taking a massive loss at some point. Maybe too many ppl watched moneyball and think its obvious to spot and trade tops/bottoms. Every investment is easy in hindsight but there are only a few great investors, bc in the real world nothing is that easy.

ReplyThe next few days we learn whether the markets still trust CB & QE policies. if so then I agree with you jbtf, then markets go up. I am personally skeptical but trying to listen to the markets & not my own views.

I dont need to pick bottoms or tops, I just need to ride along the middle part of the trend, like Bernard Baruch and AL said

sorry, watched the big short... not moneyball

Reply@abee, excellent point! cant agree more.

Replyall your eur stops r belong to us

ReplyNice to see people here commenting in my name & falling back on puerile insults. If they were making money they would have no need to do so, so we have a 99% sure bet they are sitting in their moms basement having just blown their trading account for the umpteenth time lol. Remember guys, we're laughing at you, not with you... as you were.

Replyso sign in with an account... you already have a handle you post under anyway...

Reply"sign in with an account" - posted by anon. classic.

ReplyEUR govt liquidity is the worst I have ever seen today. 10 year bund contract roughly 30 by 30. Air pockets ahead, please fasten your seatbelts.

ReplyJTFB, let me know when to buy again please.

ReplyThanks.

well hats off to abee for calling a Draghi reversal

Replymirror (reverse) image of july 2012

Smell a lot of VaR shock in EUR rates world, risk parity and carry trade here under pressure..

ReplyDAX is retracing March 1st impulse - this is a lethal 5% high to low intraday run that cleans many amateur hands and puts trolls on silent mode here, at last

Replyanon 4:45pm - I hope we get a bigger retracement than this, so we can load up properly before spoos move higher...

ReplyAny thoughts on Euribor sell movement?

ReplyJBTFD, do you have a targeted level/retracement that provides a good risk/reward entry point on spooz?

ReplyI'm a little nervous given earnings trajectory, but curious to see where you think the line in the sand is.

Tom - I don't do targeted levels as such, however it would be nice if spoos dropped back to around 1950 - 1900 areas (preferably the latter).

ReplyTom the 50ma around 1950 is the first candidate. When nervous, don't trade.

Replyif you look for input you have to specify your timeframe - which sounds like swing stuff - because longer term the 2007 top will be tested. We're talking 1580 so listen to the dip clique at your own peril, they will all be looking for a new, serious job in a couple of months time. Those guys never give you their entry, they only show off when market is up, you never know if they are really long but the various PPT units of the world sure appreciate their effort since they manage to bring nervous newbies like you to the poker table. Expect tolose everything

Yes, it's strictly swing trading this year in our opinion, so if you want to get long you'd better have your entry and exit levels worked out in advance, mental stops set and still you are going to have to pick your spots with care.

ReplyWas this the most obvious Sell The News day in ages? Hope for Dr Aghi's bazooka now replaced by fear of the Fed? Dame Janet's turn to get into the Hawk costume? The one with a soft felt beak and claws? She's still La Paloma Blanca underneath it all.

Hammock Time here. Tiny hedges on. Watchful waiting.

Anon 550 Are you expecting something fundamental to break somewhere ? 1580 Is an extreme move down without something breaking in the real world.

ReplyIe went we went down to 1800, waited for a bit & Nothing broke and so we come back up.

The don't fight the FED meme continues to fade.

ReplyRetail is losing their taste for risk.

IMX TD Ameritrade

The voting machine looks like it is slowly morphing into the weighting machine.

buying some euro puts here ...and plan's is to buy the dip on eu open tomorrow( equties) ...will add to some calls bought on close...have a strong gut feeling this move reverses to local highs within a week...its that kind of market which is farking up a lot of minds ....gamma is silly cheap....

Reply

ReplySo www have up down carnage in rates, fx and equities and meanwhile oil doing a 'DILLIGAF', copper messing around but nothing serious at all and gold doing heading for the log cabins.

If today is about 'ECB have done everything they can and have no bullets left there fore we are doomed' just don't confuse that with 'we don't have to do anymore'. It feels as though the market really does want a recession and won't top jumping up and down on prices until it gets one. Or is hit over the head with a large stick of growth and inflation and is carried off to markets A+E.

But oil not joining in the we are doomed theme only adds up if we really really really are at that point where anything other than money is a store of value . Fits with gold but Oil though?? Jeez things must be bad.

It has been a monster day and the technicals LB has been mentioning played out well and on a tech basis this is looking pretty much on course. But I am probably one of those poor lonely sods who really don't get the sudden panic from a macro perspective. Probably because I am on an empty train racing through the English countryside rather than drowning in positive feedback in a dealing room.

yes we can wheel out the toys from the bear cupboard to play with but .. God this is going to be hard to say.

I have just bought this dip

Welcome to the group polemic please introduce yourself

"My name is polemic and I am a dip buyer.. " Right that was the tough bit

"Anon 550 Are you expecting something fundamental to break somewhere ? 1580 Is an extreme move down without something breaking in the real world."

ReplyThat is a -26% decline from the tip top of the market. It is a rare decade that doesn't see two declines of that size. A decline of this size should be the expectation not the exception for any equity investor.

heypol; anon 632 here,,, i fully agree...the cause up could deb very fierce esp as opex looms...

Reply*chase up

Replyinteresting to see credit tighter

ReplyAnon 5:50 PM - Speak for yourself. I posted entry after we re-tested the Aug 2015 low this year, I posted continued bullishness on 100+pt spoos rally, I posted partial exit (75% of my posn) a few days ago (and intent to re-load on retracement).

ReplyAnyway Polemic is right, the world is not ending. As previously mentioned, I confine myself to US equity indexes, and I believe we see higher prices in spoos down the road.

Yeah i'm a micro guy so i'm looking at this more from a factor management standpoint (I try to avoid macro punting). Those broad sell-offs seem to introduce a lot of HF pain that pushes those guys into liquidating certain trades. My horizon tends to be pretty short term as a result (1wk-1mo) as i try to think about managing PNL vol to avoid redemptions.

ReplyAnyway, i'm trying to reconcile deteriorating earnings in spooz and the historical recession correlation there with mkt price action.

Again, not a hill i want to die on or profess any real edge in but did want to check how guys are thinking about the world.

Folks point to payrolls and stuff, but all of that is usually lagging right?

Until something goes "Uh oh" I like LBs view, twine but the same applies to the upside (But lack of bulls and sidelines cash I guess could take us through... ?)

ReplyYes TWINE. I mean come on, the VIX is 18. 18! The panic out there is crazy. Come on 18! These put buyers are going to feel some cold steel. TWINE!!!!!!!!!!!!!!!!!!

ReplyActually the world is ending. Scientist know the exact date at which the sun will devour the Earth. It is a long way off, but with negative interest rates it matters more than you think.

Replyso here's the thing- any further easing from ecb will be other will be other unconventional measures rather than more negative cutes_ isn;t that a win win?/aren't eu equity futures just a major MINE???i have shipped in fair bit of calls on close....looks insane esp given level of vol- thoughts guys?

ReplyTom, at the factor level is where all the fun is, IMO. you can postulate all you want that QE will save the day, but investing is all about process and finding the mispircings. Having a hunch on direction when frankly markets look range bound is a good recipe for churn

ReplyDrilling down into the factors/sectors we have some really interesting developments. Dr Copper and the metals complex, who you could consider hyper cyclical s and have tended to do well both in very early and late stage economic growth are perhaps pointing to a rise in PMI's, from so-so PMI data have had since last autumn. Though PMI's in Feb were generally disappointing. Bosltering that argument is we have industrials doing pretty well which are very sensitive to economic growth. Add to that the stability in Oil, HY and EM FX and you take care of a lot of negatives that were pressing growth from last year. So there is your bullish argument. Ideally you'd want to see financials join in the party, though they might have to wait for higher rates (starting) before they really get going.

On the flip side, you can easily look at the rebound in commodity prices as simply a bounce from deeply oversold conditions. The problem with commodities is not demand but supply. So using the aforementioned argument is perhaps misleading bc Dr Iron Ore is still way over supplied. You could easily chalk up the recent rally as Quant short covering facilitated by taking markets down to distressed level. But the fundamentals hardly argue for sustained high prices, IMO. Plus you have the former leaders in the S&P 500, NKE, SBUX, AMZN etc, breaking down and right near their LT moving averages. The leaders always fall last in a bull. On the flip side you have all the underperformers bouncing right towards thier 150/200 moving averages. For sure you could just see rotation work out this excess but I think its a big overhang right now. Especially since Financials and Tech are the ones expected to be the biggest source of earnings growth in 2017 /2018 and now look pretty vulnerable

High yield credit rallied and outperformed equities today after the ECB announcement, which I haven't seen in a while - felt like some macro flows into the long credit short equity idea has been finding some traction with the illuminati - that will be super tough to risk manage and not my thing, but I suppose there are braver (and much wealthier) souls out there…

ReplyI honestly think the IG bond buying idea is a big deal, even if it was discussed in the past I never thought a CB would do it - clearly I am in a minority.

We will see if the credit move sticks, but remember this has been the big reason for the risk off light to be flashing red for the last 6 months - we will see where all this goes. Got a spare hammock LB?

What a clusterf'ck ... I am pretty happy, I did the square root of xxxxxxx ... lets see what happens when the dust settles. This was a significant move by Dr. Strangelove and his GC buddies. Surely the EUR will not grind much higher than 1.15!

ReplyFor chart pattern followers the pattern we have seen on the dow today is exactly the same as as really important formation we have had many times before. You only have to take a look to realise that it's obvious what happens next for the dow .... T wave repolarisation of the ventricles.

ReplyWhy bother mapping overlays with previous years' disasters when it fits an ECG so much better.

(The pic's on my twitter stream if you need the evidence.)

Best regards JBTSW ( Just buy the S wave) Pol

Euribor?

ReplyMy full thoughts on ECB here - It's impressive http://polemics-pains.blogspot.co.uk/2016/03/ecb-its-impressive.html

ReplyStanding buy for European equities to put in a big rally

Pol - just read it - good piece - the big takeaway here is that the ECB has opened a side door for monetization to occur without the euro sliding, thereby preventing the dollar from turning into a giant wrecking ball for EM and turning the exercise into a zero sum game. It doesn't look like that's how the market (other than the obvious exception of EURUSD) interpreted it, but it may in due course - like MM often says, the first reaction in risky assets is rarely the right reaction.

ReplyReading the ECG as you did Pol, it looks like the T wave repolarization is starting from an elevated ST-T segment, and you know what that means...

ReplyWith the Chinese and European intervention, I would have expected the market take-off to be sustained today...the fact that it wasn't is a little concerning..

Libertarians wake up...

Replyhttp://finance.yahoo.com/news/fbi-threatens-to-demand-apple-s-secret-source-code-214832611.html#

Perhaps the market has a case of Long QT Syndrome, B in T and Pol? [What a clever lot we have in here, MM!].

ReplyWill we see European companies finally join the buyback mania?

ReplyMy initial thoughts were, they have a solution for the banks & buybacks are coming.

I didn't know until recently that stock buybacks were not allowed prior to 1982 in the U.S.

Replyhttp://www.economist.com/news/business/21616968-companies-have-been-gobbling-up-their-own-shares-exceptional-rate-there-are-good-reasons

FRRR

Reply(face ripping risk rally)