1) Was that it? Just as some were calling this the biggest short squeeze ever, with more to come, we have a nasty roll over, particularly in commodity stuff. Is this a pause that refreshes or the end of the squeeze?

2) What's behind the stunning collapse in productivity growth in the US and elsewhere? Tempting as it is for financial market practitioners to blame it all on an ever-increasing emphasis on compliance over revenue generation, obviously there's a wide world outside of finance being impacted by the same malaise.

3) That was quite a nasty reversal in fixed income as well yesterday, though the market is still pricing one full Fed rate hike by year end. How many will they actually deliver?

4) Did you know that US economic growth per unit oif credit has actually improved since the crisis?

5) With JGBs the latest government bonds to make headlines for their ridiculous yields, is NIRP about to reassert its dominance over the global banking sector after the recent squeeze?

6) Which comes first in USD/JPY: 105 or 120?

7) Did you know how non-normal USD/JPY daily returns actually are?

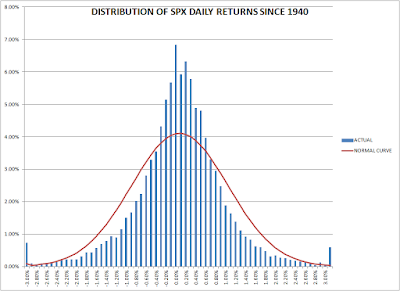

8) Or those of the SPX, for that matter?

9) Does anyone else feel that if Maria Sharapova were in finance, not only would she not be holding briefings to at least a somewhat sympathetic press, but that she would be frog-marched out the door by the Old Bill to a hearing on a very different type of court? If ignorance is no excuse in finance, why should it be in sport?

10) Which comes first in WTI crude, $20/bbl or $50/bbl?

11) Was that abysmal Chinese export figure a rogue print or the beginning of the end of China's ginormous reported surplus?

12) Philosophically, if China cannot compile accurate GDP expenditure breakdown or employment data, how can we credibly believe trade figures that are collated a mere week after the end of the month?

13) Did Mark Carney change anybody's mind at all in his TSC testimony yesterday?

14) Have we seen the top in EUR/GBP?

15) Who will win the Premier League this year?

16) Will Dilma be in office this time next year?

17) Will Donald Trump? (or Donald Drumpf, if you prefer)

18) Is the next move from the RBA a cut or a hike?

19) Is there any solution to the migrant crisis?

20) Will the ECB deliver the goods tomorrow or will it be December redux?

2) What's behind the stunning collapse in productivity growth in the US and elsewhere? Tempting as it is for financial market practitioners to blame it all on an ever-increasing emphasis on compliance over revenue generation, obviously there's a wide world outside of finance being impacted by the same malaise.

3) That was quite a nasty reversal in fixed income as well yesterday, though the market is still pricing one full Fed rate hike by year end. How many will they actually deliver?

4) Did you know that US economic growth per unit oif credit has actually improved since the crisis?

5) With JGBs the latest government bonds to make headlines for their ridiculous yields, is NIRP about to reassert its dominance over the global banking sector after the recent squeeze?

6) Which comes first in USD/JPY: 105 or 120?

7) Did you know how non-normal USD/JPY daily returns actually are?

8) Or those of the SPX, for that matter?

9) Does anyone else feel that if Maria Sharapova were in finance, not only would she not be holding briefings to at least a somewhat sympathetic press, but that she would be frog-marched out the door by the Old Bill to a hearing on a very different type of court? If ignorance is no excuse in finance, why should it be in sport?

10) Which comes first in WTI crude, $20/bbl or $50/bbl?

11) Was that abysmal Chinese export figure a rogue print or the beginning of the end of China's ginormous reported surplus?

12) Philosophically, if China cannot compile accurate GDP expenditure breakdown or employment data, how can we credibly believe trade figures that are collated a mere week after the end of the month?

13) Did Mark Carney change anybody's mind at all in his TSC testimony yesterday?

14) Have we seen the top in EUR/GBP?

15) Who will win the Premier League this year?

16) Will Dilma be in office this time next year?

17) Will Donald Trump? (or Donald Drumpf, if you prefer)

18) Is the next move from the RBA a cut or a hike?

19) Is there any solution to the migrant crisis?

20) Will the ECB deliver the goods tomorrow or will it be December redux?

30 comments

Click here for comments21. Aud/usd ... 0.65 or 0.85 first

Reply14) No

Reply15) Leicester

2) What's behind the stunning collapse in productivity growth in the US and elsewhere?

ReplyLow birth rates meet overinvestment in capital goods and underinvestment in human capital over decades.

Old people don't need more stuff. They want services. Human capital is needed to provide better and more valuable services. Due to chronic underinvestment in human capital (education, skills) we're now in a situation where the lowest earners, least educated are in services. Also the highest educated and highest earners! There is a death valley in the middle. The traditional middle class is dying because they were taught to work in factories and not how to provide quality high value added services. To create a new middle class, we need to teach people with middling IQs how to perform services.

In the future industry's share of GDP will relentlessly fall and its share of workforce will absolutely plunge until almost nobody works in factories.

Until investments meet permanently falling demand for goods (for dying populations) and increasing demand for services (for dying populations), the balance favors deflation and stagnation.

Unfortunately the old paradigm still reigns and will continue to do so until the economies rebalance and we wake up in new world. We'll know when we get there.

19) Is there any solution to the migrant crisis?

ReplyYes. Europe could take all the refugees in the world (60M or so) within say 10 years if the load was divided evenly amongst European countries. This would require enormous investments in housing, education, security, health care etc to the tune of several trillion euros. Something that can easily be afforded. In fact there probably wouldn't be an upper limit in economic terms.

Socially it would be intolerable. Nor would it fix the main issue which ruins everything long term, which is low birth rates. There's a reason why Elon Musk said it was one of two top problems humanity faces.

Productivity equals demographics. Old people and I am one don't buy more stuff we use up what we have more and more. When we work which we do to an older and older age guess what, we don't work quite as well as we used to ..stuff aches and goes slower in everything we do. Now unless there's a deluge of new younger people coming in to offset all of that the world has a problem with productivity and indeed with demand. I suspect both are grinding down ,but hey JBTD . Well you could if the idiots in charge could work out how to retire people out of the work force without bankrupting them.

ReplyPunchline for you...just because I'm told I am going to live longer doesn't mean my bits can actually produce much for longer.

Yours Sincerely

Old Rheumatoid

20) ECB will deliver something, but probably fail the expectation.

Reply1) BTMU (allegedly) bid aggressively in yesterday's auction then sold bonds back to BoJ today.

Reply

Reply2) What's behind the stunning collapse in productivity growth in the US and elsewhere?

I was cogitating on this the other day, as the productivity numbers are quite surprising. It appears we were doing pretty well until 2004 or so and I think I can explain it.

I think in future crises we need to either stimulate the economy by monetary means or fiscal means, but not both. When we had the tech bubble and subsequent Great Financial Crisis, early on we used both arms to stimulate. We ran up massive deficits in the national government, such that the talk became no government has recovered when Debt/GDP was >1 and then this was disputed, and then it wasn't and yada, yada. But the fact is that we do have a much larger Debt/GDP than we used to (I think the last time was WWII) and it makes spending agility by the government much more problematic. The debt is always there. We are also encouraging people to increase spending, and this, as time has gone on, is problematic. Probably works ok short term, but when debt is not paid back, you got your problems.

Then monetary stimulus has benefited stocks, maybe houses, but hurt the older folks, savers, and so forth. The two burst equity bubbles have made certain segments of the population leery of equities at this point. You all know the good/bad of monetary stimulus.

So what we used to read about...the Long Tail....has come about in the last few years of the new century. QE, deficit spending, low rates of return on saving, decreased velocity of money, lack of risk taking....I think these all result in lack of productivity, and I'm afraid it was because we weren't paying attention to the lasting results of QE, ZIRP, deficit spending, etc. all together IF we didn't get the explosion of new growth Dr. Keynes suggested we would.

I look at Japan and wonder....

It's all good I tell you...

ReplyCNBC: "Consumers amassed $71B in credit card debt in 2015. Could 2016 be the next 2008 for credit card debt? It's possible, according to new research by CardHub. America's outstanding credit card debt surpassed estimates in 2015, climbing to $917.7 billion, up from a forecast of $900 billion, the credit card comparison website said on Monday. In 2015, consumers amassed around $71 billion in credit card debt, up 24 percent from the previous year. In the fourth quarter alone, consumers racked up $52.4 billion in credit card debts, nearly the cumulative amount of debts owed to credit card companies in 2014, which reached $57.4 billion."

What's percent of bank assets is credit card debt?

ReplyActually, does anyone have a breakdown of bank assets by borrower type/industry? It would be interesting to see the breakdown for US banks vs European Asian Chinese etc

Oh and 6) USDJPY 105

ReplyWSJ: “...about 3.1 million vehicles will return to dealer lots off leases this year, up 20% from 2015 [and] the number will climb to 3.6 million in 2017 and 4 million in 2018.”

Reply2) If productivity is the output/input ratio, depending on the context, e.g. industry it might generally mean that the easy productivity enhancements which are driven by tech advancement and optimizing ways of doing things have already been exhausted. After the "easy, obvious stuff" it might get exponentially more complex and hence more expensive. Everything can be made but the question is is it worth it. If you look at aggregate demand growth for many industries it probably isn't. So in the current tech level context things are already working at skeleton crews.

ReplyOTOH (or in addition) if it's true the "service sector" is taking the baton from manufacturing it might mean that because services are always quite labor intensive and harder to automate, no matter what you do. Of course there should still be things like self serving store cash registers, applying mortgages from an algorithm becoming mainstream, and it should be a major contributor to productivity growth. And self driving cars could displace a good chunk of the transport industry labor force but haven't seen any concrete development how they could go really mainstream so far.

Of course those are just a couple of very vague points but generally I have no reason to believe why they couldn't be on top of things. In any case combined with the lackluster AD growth, resulting from the aging population (and if that's not the case because immigration, then the young immigrating population stuck with low wage jobs and can't spend), this can't be a very good things for profits. If you presume profits will remain relatively more stable than before it might pay to pay more attention to valuations which by definition become more a function of price movement and trading ranges again. In that case doesn't the Shiller P/E seem to be rather high?

MM, on 2) the productivity puzzle

ReplyYes same situation in the UK in terms of labour productivity.

My observations (at work, friends' business, etc) are that I see a lack of drive to improve productivity via processes improvements and systems automation aka 'capital investment' versus labour.

My rough hypothesis is it's due to (a) stagnant wage costs and (b) low debt costs from QE preventing reallocation of assets into more productive firms.

The lack of wage inflation removes a former 'push' to drive productivity per employee (which I used to see in the past pre QE - we used to moan about our increasing wage bill and do something about it).

Second point on low debt costs from QE - this is allowing the low end of companies with poor returns on equity to survive. In a normal interest rate regime such companies would fall into losses after financing costs and either become more efficient (i.e. productive) to survive or go out of business which would release their assets (staff and capital) to be available for other more productive firms to use which drives up the average over time.

Or its a long winded way of saying QE traps peoples and capital into low productivity Zombie firms

If true, it's the serious and damaging side of long term QE

"(9) Does anyone else feel that if Maria Sharapova were in finance, not only would she not be holding briefings to at least a somewhat sympathetic press, but that she would be frog-marched out the door by the Old Bill to a hearing on a very different type of court? If ignorance is no excuse in finance, why should it be in sport?"

ReplyYou're kidding....right? Remind me: how many bankers / central bankers / hedgies are in jail for their part in the (ongoing) GFC? Which pens did they send messrs. Dimon, Applegarth etc., etc. to? Did I miss the Old Bill marching Bob Diamond somewhere? How about all the good folks at HSBC who seem not to have known that Sonora isn't just a person who sleeps loudly?

@Cowboy 1:39

ReplyFor the UK, retail lending to individuals total is £1,460b split 88% mortgages, 4% credit cards and 8% other unsecured (mainly personal loans)

It's typical for retail lending to be heavily skewed to mortgages because of the large loan sizes

But these are gross outstandings and the regulators try to true up the capital requirements to risk via IRB models and requiring banks to hold capital against the undrawn credit card limits

@ Anon 3.43. Anyone who breaks the rules deserves opprobrium. Of course, while it is easy to wave your hand and say Dimon, Diamond etc deserve to go to jail, it's a little more difficult to cite the specific law that they broke. The dirty secret of financial regulation is that the authorities have little interest in prosecuting the most egregious offenders/offenses, but rather those that are easy to prosecute and/or play well with the press.

ReplyI have a friend who is a senior FX dealer, who is a great guy, a good trader, and who vociferously spoke out against some of the practices in the FX market (which were commonly accepted and broke general rules rather than specific ones.) To cover their ass during the Fx investigations, he was put on paid leave for a year and a half while not being accused of anything. (Needless to say, anyone who's suspended has their reputation in tatters). Eventually he was reinstated and made redundant. He is now unemployable despite having done nothing wrong. Sorry, I have a lot more sympathy for him than a past-her-best marketing machine who knowingly broke the rules.

Oil lingers higher while equities retreat is really telling something. As many here have pointed out the correlation breaks down, I find the lead lag relation is more interesting.

ReplyRe the diamond / sharapova thing. I suppose it's the same as saying her coaches/manager should be banned as well as her.

ReplyMarkets - messy. oily correlation breakdown intraday but they have never verged that far apart when stretched to days ..yet.. so still not sure on anything at these levels . happy not to call a resolution yet and wait of a break. Meanwhile AUD/JPY keeps on climbing so no stress indicated in that pair.

the oscillation/volatility in markets is that in the real economy similar to the slack in the steering in a 1976 Holden ( aussie Ford like car) Have to keep swing the steering left and right just to stay in a straight line.

"Sorry, I have a lot more sympathy for him than a past-her-best marketing machine who knowingly broke the rules."

ReplySo... you're talking tennis, right?

All eyes on Dr Aghi now. Will he just glaze over and give Mr Market a prescription or will he pull out the Big Bazooka? We have our doubts that he can deliver everything the liquidity addicts are clamoring for. Specifically the QE extension, what govies can he buy that they are not already buying, for a start? Deeper, more negative front end rates? Maybe, but perhaps not now.

ReplyWe'd prefer not to be short EURUSD or long Stoxx going into this lot.

I dont really understand how you get productivity measurement, since everything is tied to GDP. So if all you care about is GDP, then yes financial productivty sucks. But if you care about other factors perhaps productivity isnt so low (social, education etc)

ReplyRelated to why our financial productivity stinks, could it be perhaps that most of the new service jobs we create suck. waiters, retail and health care workers..great

ECB tom will be interesting. Will be a good gauge to see how markets are positioned. For a surprise on the upside, which i think most find hard to see, Euro banks look interesting having not really participated in the commodity risk rally, though they are probably the easiest to sell as well if he dissapoints.

Cad doesnt stop!

LB your ref to Dr Aghi had me reminiscing about him in A+E I just reread this from 2014 http://polemics-pains.blogspot.co.uk/2014/11/dr-aghis-department-part-ii.html It's frightening how so little has changed.

ReplyOh dear thats too many questions to do justice to - some (such as the english premier league) i am not even remotely qualified on - here are some selected ones:

Reply2) For 20 years (1990-2010) you had EM labor combining with western capital to create disinflation and high productivity - thats over - we will grow, but it will just take more per unit of growth - treat the last 25 years as an outlier and you will gain a new perspective. The next big mega trends will be in bio-tech, but its not obvious to me they are necessarily productivity enhancing in the conventional sense.

3) 2 Rate hikes - I am a bit more sanguine on inflation in the next 3-6 months than the market, and quite rabidly so for the next 4-5 years.

5) Not a chance - US will not do NIRP - pundits will talk about it till our ears bleed though.

6) 105

10) Neither - just because something can move $60 in a year doesn't mean we will see that move every few seconds - crude vol may be the most overvalued underlying on the planet - spreads may be more volatile than flat price for the next couple years.

11) Outlier

12) Don't believe it - or do - it won't make a difference - the china trade is a sentiment trade - facts don't matter either way.

14) Yes - GBP is a better bet long term than EUR

16) No, Dilma is toast - she may have to seek asylum in Portugal by the time its all over

17) Trump will be the next president - having traded markets for two decades I recognize a lasting sentiment wave when I see one - trump deniers are basically shorting crude at $50 in 2005 because 'how could it possibly…', and scant else - voter turnout will be a record too, btw. I could elaborate but MM will complain about too much politics - wait a second, tell me again who is asking the question?????? :)

19) It doesn't need one - the first generation of immigrants will be constantly accused of raping and pillaging as a tiny fraction of their kids become world beating entrepreneurs and innovators for western societies in the next 3 decades instead of going to madrassas, which is all it takes to make it all worth the pain - btw just like it has for the last two centuries

20) Can't believe I am saying it, but for the first time I feel like expectations are so low for draghi that all he has to do is not totter in drunk in a pink mini-dress and 9 inch heels….sorry LB I know you feel otherwise

Only one tiny bit of love for Leicester so far? 2500:1 odds at the beginning of the season? That's, pardon the expression, yuuuge.

Replywonder if a hedge fund could hit 2500/1 in yuuuuuge.. then gift the club new players and still make a profit? In reverse, do football club managers, or even the club, hedge their own performance by betting against themselves? Which would distort the price/probability relationship but hey, its just the same with CDS.

ReplyPerhaps that was what that Italian bloke who used to manage Chelsea did.

@ Marie S While that description could easily apple to a number of high profile PMs whose frequency of TV appearances is inversely correlated with their investment performance, in this particular case I am indeed referring to the tennis.

Reply@ Pol Harry Redknapp may well be the dodgiest geezer on the planet. Whilst managing Portsmouth, out of nowhere a big bet was placed at a bookie's for 'arry to manage archrival Southampton....lo and behold, guess what was announced later that day?

The problem with your business model is that even at those odds most footballers cost too much to make it worth it...other than, ironically enough, uber bargains like Mahrez and Vardy...

Would be fun football players could be hired out by the week. Going to have some good players on the bench this week? Hire them to to clubs in lower leagues for the next game.

ReplyNo big relative bets into tomorrow's roulette. If recent history is a guide in terms of market reaction to CBs' actions then we are in for a rough ride (see ECB in December and BOJ in January), but I assume that in Frankfurt they are well aware of this.

ReplyWhile a depo cut and an increase of roughly 10 billion in monthly purchases are, I believe, baked into expectations, I would expect a new TLTRO and/or the introduction of corporate bonds being the big surprise. Now TLTRO kind of straightforward in terms of implementation, while corporate bonds a lot more tricky: do they eventually buy stuff where a national government owns at least X%?

Nevertheless it feels to me that the market is a lot less positioned today than it was before the announcement in December: positioning in EUR is much more balanced and cash percentages in portfolios are pretty high in my opinion.

Watching 2940 below and 3060 above as next directional triggers in SX5E, staying neutral in between.

Mauldin on Trumph nomination if anyone cares to read.,,

Replyhttp://www.mauldineconomics.com/this-week-in-geopolitics/the-roots-of-trumps-strength