Macro Man finds himself in a rather unusual spot these days. Despite the recent bout of market volatility, and despite a horribly timed foray into a long duration bet, he finds himself making more money than expected so far in June. It's a welcome change, in his experience, from the usual situation; this in turn is perhaps down to the human tendency to remember one's winners with crystal clarity (thereby forming expectations of profitability) while compartmentalizing the losers in the dim recesses of the psyche, subject to recall only with an effort.

Yesterday featured more ups and downs than Space Mountain, with an early-session bond market rout reversing sharply after bond-unfriendly data. A market-friendly Beige Book simply added fuel to the fire, propelling US equities to their largest point gain of the year. Fortunately for Macro Man, his short SPM7 call position looks set to settle within shouting distance of strike (so he is collecting decay this week), while his equity sector bets are also paying off. Meanwhile, EUR/USD vega continues to tick higher, generating more value for the FX powerball tickets. And of course, the G10 carry trade remains alive and well.

That having been said, the week is only 2/3 over, with the most difficult period (US PPI today, CPI, IP, TIC, and Michigan tomorrow) to come. Macro Man remains of the view that inflation is an issue, and was frankly somewhat surprised at how little attention was paid to the import price data yesterday, which showed a larger-than-expected 0.9% rise in May. Perhaps most remarkably, the US is now importing inflation from China for the first time in the (admittedly short) history of the price series. While the y/y change is barely positive, the year-to-date change is running at a 1% annualized pace. If and as this trend intensifies, expect more discussion about the potential end of the Great Goods Price Disninflation trend.

However, that's a theme that will play out over quarters, if not years. It won't necessarily impact financial market prices in the near term, however much Macro Man might wish it to be so.

However, that's a theme that will play out over quarters, if not years. It won't necessarily impact financial market prices in the near term, however much Macro Man might wish it to be so.

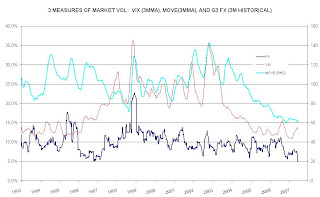

Taking a step back, it's probablyalso useful to put the recent bout of volatility in context. Macro Man looked at the 3 month moving average of VIX, MOVE (a measure of fixed income vol), and a rolling average 3m historical vol of USD/JPY and EUR/USD.

Simply put, the recent bout of volatility in fixed income doesn't even register. This may smack of complacency, and a visit to a left-hand-side fat tail in the not too distant future. On the other hand, it may simply reflect the ongoing glut of financial liquidity, which would imply that more gains are in store for risky assets.

Simply put, the recent bout of volatility in fixed income doesn't even register. This may smack of complacency, and a visit to a left-hand-side fat tail in the not too distant future. On the other hand, it may simply reflect the ongoing glut of financial liquidity, which would imply that more gains are in store for risky assets.

Yesterday featured more ups and downs than Space Mountain, with an early-session bond market rout reversing sharply after bond-unfriendly data. A market-friendly Beige Book simply added fuel to the fire, propelling US equities to their largest point gain of the year. Fortunately for Macro Man, his short SPM7 call position looks set to settle within shouting distance of strike (so he is collecting decay this week), while his equity sector bets are also paying off. Meanwhile, EUR/USD vega continues to tick higher, generating more value for the FX powerball tickets. And of course, the G10 carry trade remains alive and well.

That having been said, the week is only 2/3 over, with the most difficult period (US PPI today, CPI, IP, TIC, and Michigan tomorrow) to come. Macro Man remains of the view that inflation is an issue, and was frankly somewhat surprised at how little attention was paid to the import price data yesterday, which showed a larger-than-expected 0.9% rise in May. Perhaps most remarkably, the US is now importing inflation from China for the first time in the (admittedly short) history of the price series. While the y/y change is barely positive, the year-to-date change is running at a 1% annualized pace. If and as this trend intensifies, expect more discussion about the potential end of the Great Goods Price Disninflation trend.

However, that's a theme that will play out over quarters, if not years. It won't necessarily impact financial market prices in the near term, however much Macro Man might wish it to be so.

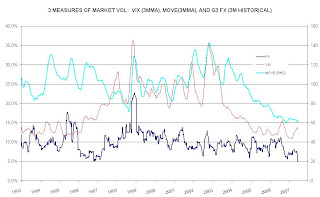

However, that's a theme that will play out over quarters, if not years. It won't necessarily impact financial market prices in the near term, however much Macro Man might wish it to be so.Taking a step back, it's probablyalso useful to put the recent bout of volatility in context. Macro Man looked at the 3 month moving average of VIX, MOVE (a measure of fixed income vol), and a rolling average 3m historical vol of USD/JPY and EUR/USD.

Simply put, the recent bout of volatility in fixed income doesn't even register. This may smack of complacency, and a visit to a left-hand-side fat tail in the not too distant future. On the other hand, it may simply reflect the ongoing glut of financial liquidity, which would imply that more gains are in store for risky assets.

Simply put, the recent bout of volatility in fixed income doesn't even register. This may smack of complacency, and a visit to a left-hand-side fat tail in the not too distant future. On the other hand, it may simply reflect the ongoing glut of financial liquidity, which would imply that more gains are in store for risky assets. Macro Man spoke to another risk-taker yesterday who joined the chorus of old hands bemoaning the lack of risk premia in financial markets. While he clearly has sympathy for that view, he also recognizes that there are forces at work today that were not in place in 2002 or 1998 or 1992. And it's also important to recognize that historically, a 70 bp move in the US ten year is only a little more than a rounding error.

The moral of the story? It's important to be prepared for an expansion of risk premia, but it's also pretty darned important to have some skin in the game during the (longer-lasting) benign periods. And every once in a while, you'll get alpha and beta working together, at which point you get an all-too-rare pleasant surprise.

13 comments

Click here for commentsMacro Man,

ReplyI thought the "beginning of the end" of the period of falling import prices should not come as a surprise to you (that's one of the underlying reasons why your local CB has been forced to step on the breaks recently). This said, the chart on US import prices from China is a really very nice finding - suggesting that its becoming a global trend (as was to be expected).

Have you read this week's article in BusinessWeek on how US economic statistics underestimate the impact of offshoring (see weblink below)? The most striking thing about the article is that the BLS acknowledges that the import/export price indices are not designed to measure substitution between domestic and foreign goods. In other words, the import price data may be capturing the fact that a table from China that cost USD 1000 last year now costs USD 1050, but does not account for the fact that the US made table that it is replacing cost USD 1500. Thus, while import prices may be rising, the disinflationary gains from substitution are not being captured at all. Very bullish global mega caps...

ReplyI've been watching this trend for some time- not only in the US, but also in the UK. 'Twill be interesting to see if the trend continues or even accelerates; if so, it will add weight to Brad Setser's ongoing campaign to convince the world that exchange rates matter, as does Chinese domestic inflation.

ReplyAnonymous, I've not read the article buy am familiar with the argument. Indeed, in my view, this is the singular largest factor behind the record level of corporate profits as a % of US GDP. Multinational corporations are in the catbird seat to explouit globalization, whereas a significant proportion of the labour force in the West are likely to see downward pressure on nominal and especially real wages as a result.

ReplyThat having been said, that import price inflation from China (and indeed import price inflation for manufactured goods generally) is now rising, rather than falling, would still indicate that at the very least, the force of the disinflationary tailwind is receding. And when you consider the ancillary impact on commodity prices from China, I would argue that in aggregate, the disinflationary tailwind on the real cost of living has vanished altogether.

A late comment on your 'science versus myth' post, which was quite interesting.

ReplyThere's a deeper bias that is a common companion to the hindsight one - certitude.

Certitude is an affliction that runs through both ex post analysis and ex ante forecasting. Its become endemic and apparently compulsory in a sound bite financial communication culture (e.g. CNBC).

The antidote to certitude of course is an intelligent assessment of risk, which is correspondingly rare in this culture, or at least in its communication of financial ideas.

My impression is that your own style in writing (and probably your decisions in trading) are well grounded with a sensible awareness of risk, which increases the value of your blog content, in my view.

Anonymous, good point. While I would not say that I am a practitioner of or expert on behavioural finance, I do find some of its precepts to be quite useful. Chief among these is the folly of forecasting, with the attendant overconfidence that most people have in their forecasts.

ReplyOne of the things I try to avoid like the plague is the error of overconfidence; rather, I prefer the Socratic approach of knowing that I do not know.

I highly, highly recommend printing and reading James Montier's Seven Sins of Fund Management in your spare time.

Macro Man,

ReplyYou mention forces in place that didnt exist until 2002. I assume you are talking about CB's becoming dominant forces in financial markets. There presence scares the heck out of me. I feel like we are all living in the matrix. Its hard to argue globalization when some much effort is being put into motion to prevent adjustments from taking place.

You are correct in your assumptions, James. What might be really scary (for those of us in financial markets) is if/when countries begin to use their financial leverage over other countries in an overt and hostile fashion.

ReplyWe've already seen a snippet of that with Russia and its gas supplies, but it doesn't require a terribly vivid imagination to envisage a scenario wherein financial market hostilities replace the military hostilities of the 20th century and earlier. Some might argue we're already there...

I totally agree. I think there are too many unchecked printing presses competing for a finite amount of resources which is a recipe for some very unstable geopolitical situations.

ReplyMM, did you receive the excel file with the Global Dollar Liquidity Measure? Also, where can I get data on MOVE? Regards, Agustin.

ReplyAgustin, I got the file, but there was a problem- see your email. If you have Bloomberg, the MOVE is simply MOVE Index GO. It's a Merrill Index on basis point vol...I'm not entirely sure of how it is calculated, to be honest, but I like it as a quick and dirty proxy for fixed income volatility.

ReplyIrrespective of "global financial forces", true global adjustments start at home with each and every consumers being given a minimum living allowance and shelter across the globe "eventually" rendering the "power" of any money printing presses, FX regime, resource/money hoarders completely obsolete - thus, a New Order begins.

ReplyAsian Man

MM, I think that you shoud read about the real reasons of Putin's leverage, and Gazprom and so on.

ReplyI just remember you that britain was an oil exporter few yaers ago, an now you are importers.

And MS. Blair's alliances didn't help much!

A couple of links, from an energy banker, with a lot of knowledge in that matter:

http://www.dailykos.com/story/2007/4/28/104613/996

I put an excerpt of that info in bsetser blog:

http://www.energybulletin.net/31004.html