2017 has been a rocket ship type of year, from Bitcoin to FAANG to High Yield, to EM FX, pretty much everything has done well. Even the Deflationists have had a decent year as long they weren't in the front end. The question for 2018 though is can we expect it to continue

To be fair, your author was writing a similar post early in 2017 arguing that this was probably close the the top in economic growth as proxied by the ISM. Clearly I was wrong, so take the rest of this post for what is worth.

1) Spreads. Take a look at HY and BBB spreads.

While not outright bearish as there is room for more compression, we are clearly near the expensive part of the range. And of course it makes sense, corporate profits are killing it. But under the hood, a lot of CCC and B bonds are not doing well. Retail, telecom and parts of health care are all under performing.

I took all the issuers in the HYG and split them up by ratings, and made an equally weighted equity portfolio for each. You can see HYG - B issuer's stock prices have been ugly. Not a good sign for the bonds going forward. While bond guys might be the smartest, individual names are usually best left to the equity jocks, IMO, until they get to distressed levels.

Whereas the BB issuers have doing a quite a bit better and trading more or less in line with HYG but under-performing the Russell 2000 (though there are some different sector weightings so not sure Russell is the best benchmark)

Flag number # 2, corporate earnings have been rising due to synchronized global growth. And while the multiple has expanded, when you have rising earnings, its the fuel to the equity rally. This is an earnings driven market IMO. Figure out where earnings are going, first, and then prices follow

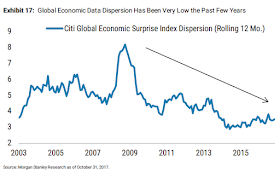

You can see the 2017 synchronous global growth story show up a lot of measures, including economic surprises, global PMI, commodity prices, EM FX, earnings revisions and others. But we are pretty much at peak levels for most

For me, the elephant in the room is China. We know they are slowing heavy fixed asset investment and trying to reign in the housing market in Tier 1 and 2 cities. Supply side reforms are for real and they are having the intended effect of boosting corporate profits. In addition, a tight labor market with wage increases is helping consumer spending and the dynamic transition towards internet businesses. Clearly BABA, Tencent, JD, Weibo and others are doing something right and the Chinese consumer is healthy. But its the industrial and manufacturing sectors that are the cyclical ones to watch, in particular exports. And for 2018, I'm sticking with my guns and assuming China slows down, particularly after Q1.

Happy Holidays

Thanks for the post, abee. Nice break-down of HY. Seen surveys lately suggesting US HY is where investors are looking to reduce next year. Makes sense, as spreads usually reach their tights before stocks peak.

ReplyDeleteAgree on China non-consumer. I'm long consumer and consumer-tech (loving this JD action), but not the rest. My understanding is shutdowns are ahead-of-target, so I wouldn't expect much upside to prices from further rationalization here for old economy stocks.

Hurrah for Ramaphosa. Went long 30Y SAGBs into the ANC Conference. Too bad I FX-hedged it. Not involved in Chile, but Pinera came through with a 10-point lead. And Argentina passed some pension reform. Good things happening in the world!

Tomorrow is the big day. Riksbank meeting. My Karate Kid replica head band arrived in the mail, just in time. Expectations to target, inflation printing at target, currency weak (which will cause lagged inflation), output gap positive. Still, people expect some trap because it's the Riksbank. The "inflation nutters" as RBA's Lowe would call them. We'll see ... you have to expect these guys to do their worst to you and with my current position-sizing, I've just dared them to punch me in the face. Saw some poll on one platform earlier today where modal expectation is they "leave options open [on QE]" or something like that, with more hawkish and dovish expectations equally balanced around it.

Tax reform. So we're tacking on like $10 to SPX EPS. Personally, I hate the reform, it being custom-made to screw me (and fiscally a disaster that I'll end up paying for in a few years), but did hear today that marginal effective rate on investment in manufacturing and services goes from 35% to 19%, which is more in-line with other competitors. Also, big break for pass-throughs making 200-600k, which I presume is a lot of small business that hopefully hires people. There's also the 100% deductible capex people talk about (does it make a difference given how low rates are?). That said, why anyone wants to invest when your end-demand is from a bunch of over-indebted aging Americans beats me, but you've got to be a bit of a whack job to start most businesses anyway, so who knows ... I wait for the future to reveal itself.

Yen vol (1Y, for example) getting whacked. Any views?

sagb's into the conf but fx-hedged? Come on, man!! :) I was surprised by the margin in Chile, but not the result.

ReplyDeletere: tax reform, yeah I get screwed on this one too--look, I'm not the libertarian I used to be, I don't whine about every tax hike...but if you're going to hike my taxes, it should at least be to bring some fiscal sanity to the government rather than the other way around. But cheerio to oil men in Texas and Florida property barons, I'm happy for you guys, you deserve it after what you've been through.

The rest of the reform seems like moving the deck chairs around to me. Does it help some people/investment at the margin, sure--but it isn't bold enough to restructure the way people operate at large in a way that really moves the needle for structural growth. For corporates, they seem pretty excited--I can see $$ being brought back from abroad but devoted to buybacks. Does that money trickle into some other pocket? Sure, but again, I just don't see it being a game changer.

Riksbank decision looks pretty good for short EURSEK position. Added on the snap-back to 9.94. We'll see .. easily end up with egg on face here. And have to expect Ingves is going to be dovish in presser. But still, QE ended and they kept the rate path (instead of moving the first hike out, as some expected). The whole bringing forward of re-investments had been whispered about and some kind of fudge like that was expected, I think.

ReplyDeleteSold calls on EURNOK. Beyond any temporary position-squaring on breaching 10.00, I figure it'll have trouble staying above that level for long. The vol seems (as vol goes, these days) pretty rich too.

ReplyDeleteSo, any views on buying the dip in THBUSD, CZKEUR, or ARSUSD?

2018 prediction in 2 words.

ReplyDeleteCarry creep

Prediction 2. In 3 words

Until it ien't.

Love your fancy clever cross trades but .. like arguing about which lane to be on the freeway.

Ha! Truth in that :)

ReplyDeleteHa! indeed , Polemic. Those predictions are worth considering in particular markets.

ReplyDeleteI would say about the disputing of which cross trades to trade with people is tantamount to worry about being called a wanker on the Sydney trading floor some months back. Who are the "international" wankers now. Merry Christmas traders, from my trading desk on a beach in South East Asia through our tor network.

Oh shit! what have I done Polemic. I've left my self wide open for a dis song to be written about us. Oh jezz, I'm going to wish Santa to bring me a bag of Xanax this Christmas before I crack and fall apart. Oh dear.

ReplyDeletei dunno, those seem like real ccy trades to me...not some corny cross like cadmxn, which always got a pen thrown at me anytime I brought it up.

ReplyDeleteMy view on usdars is well known, I still like the argy story, but with Polemic's debbie downer view on carry well heeded (i'd have preferred you to say "the road to hell is paved with carry")

Elsewhere in Latam, interesting to see PPK getting turfed out on Odebrecht allegations/bribes in Peru. Should serve as a warning to how quickly a "market-friendly" government can go down. Mexico is still way behind the curve here--the sharks are circling there and nobody in the entire hemisphere, maybe except for US real money holders of Mbonos, believes Mexico is the one place untouched by Odebrecht corruption. And as much as they would like to argue otherwise, Mbono holders don't get a vote in 2018.

EURCZK, I think czk can keep appreciating, although not that much. still value in payers.

This comment has been removed by the author.

ReplyDeletePost very interesting, most of us like your content.

ReplyDeleteแทงบอล sbobet

sbobet mobile

รับแทงบอล

you did a job well done this article is very informative and helpful.you explained everything everything well and i also love the way you represent your blog.so keep posting more blogs.

ReplyDeleteget your samsung phone screen repaired only from roobotech click now to visit

Learn a new way to gamble.

ReplyDeletesportufabet.net