Gundlach, a fellow Macro Clown?

Chuckling to myself at Gundlach throwing twitter shade at our very own Macro Man.

This is the same Gundlach who thought EM equities was going to fall 40% or more back in 2016. Oops. EEM has been up 40%+ since then. My Pnl is pretty glad I didn't listen to Gundlach on that one.

Now Gundlach has switched views, talking EM outperformance, citing valuation, growth differentials, and recent outperformance. Maybe he is secretly a fan of this blog - we'll know if he comes out soon endorsing a GBP long ;).

I'm not going to disagree with Gundlach here. But it's so key to anticipate while trading - the markets themselves are quick to discount, thus the best opportunities risk reward wise in markets are ones with high convexity/high gamma situations - those usually happen at the market turns. A lot of the easy money has been made in the EM trade.

Alright, alright. Let's get down to business.

Regardless of the blog topic, it seems like the comment section always reverts back to some talk about China. Thought I should take a look and see what the big deal is.

China has undoubtedly been the driver of global growth. The engine of said growth comes from China's once ever expanding (now recently, contracting) FX reserves. The FX reserves come from the country's trade surplus. The country uses the money to stockpile financial assets in the US and other countries, fueling economic growth.

When most people think China FX reserves - they immediately tie said thinking to US treasuries. However, I have on good word from an ex-SAFE Investment Company trader who was involved in the FX reserves liquidation, that they actually sold mostly emerging market assets during the move in 2014 to 2016.

I believe that was the main reason for emerging market decline we saw in 2015 (this was well telegraphed at the time). Back then, China was in a tightening cycle, in an attempt to defend against capital outflows and tried to reduce its spare capacity.

Looking at the world now, we are at a place where said decline in reserves seems to be bottoming. Whatever reserve contraction that has already taken place, should have been priced in.

Moving on to the different ways that the PBOC controls the Chinese economy. Such methods are numbered and in my opinion, byzantine.

The above are only some of the rates set by the PBOC - but from my understanding, the most important rate to watch out for is the 7-Day Repo Fixing. The majority of Chinese credit (from mortgages to hard money loans to credit cards) are tied to that 7-Day rate - we've currently seen a spike in said rate, hinting at a contraction of liquidity in China. The current spike is within historical precedence but should be monitored.

Looking at a few other indicators of liquidity, I do not see any canaries in this coal mine (....yet). M2 growth continues to decline as China seems like they want to lessen liquidity, but nothing out of the ordinary is evident versus the past couple of years. However, corporate lending rates are alarmingly elevated (over 8% for 1-day interbank corporate fixing) and look to be heading higher. This is by far the biggest concern I see.

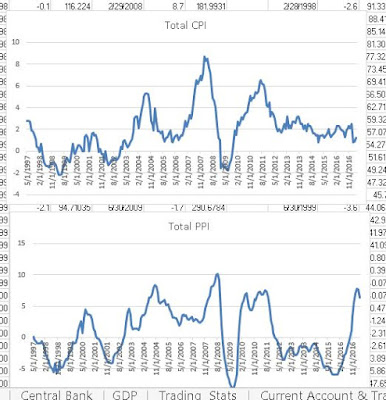

Lastly, looking at inflation. Hot off the press after the latest print a day ago.

Don't see a big deal here yet. CPI is still very tame as food inflation has collapsed. PPI's spike in the past year has tapered off and came in below expectation. The recent PPI spike was due to China's policies to reduce spare capacity, and thus will be transitory. Overall, there doesn't seem to be a huge need for China to tighten in the near term from an inflation perspective.

With all things considered: long-term, China is looking to rein in misallocation of resources vis-à-vis bad debt and to stimulate more consumption as it tries to shift its behemoth economy from an export-driven one to an import-driven one.

This means a couple of things: (Again keep in mind this is a very long-term phenomenon) a shrinking current account as trade surplus becomes a deficit. This, in turn, would increase the capital account, moving it from negative to positive - one way this occurs would be the liquidation of foreign reserves.

Undoubtedly, our EM thesis will be put to the test if that occurs. As a shifting Chinese economy will have impacts globally - and we will see which is more negatively affected: the US or EM.

Chuckling to myself at Gundlach throwing twitter shade at our very own Macro Man.

This is the same Gundlach who thought EM equities was going to fall 40% or more back in 2016. Oops. EEM has been up 40%+ since then. My Pnl is pretty glad I didn't listen to Gundlach on that one.

Now Gundlach has switched views, talking EM outperformance, citing valuation, growth differentials, and recent outperformance. Maybe he is secretly a fan of this blog - we'll know if he comes out soon endorsing a GBP long ;).

I'm not going to disagree with Gundlach here. But it's so key to anticipate while trading - the markets themselves are quick to discount, thus the best opportunities risk reward wise in markets are ones with high convexity/high gamma situations - those usually happen at the market turns. A lot of the easy money has been made in the EM trade.

Alright, alright. Let's get down to business.

Regardless of the blog topic, it seems like the comment section always reverts back to some talk about China. Thought I should take a look and see what the big deal is.

China has undoubtedly been the driver of global growth. The engine of said growth comes from China's once ever expanding (now recently, contracting) FX reserves. The FX reserves come from the country's trade surplus. The country uses the money to stockpile financial assets in the US and other countries, fueling economic growth.

When most people think China FX reserves - they immediately tie said thinking to US treasuries. However, I have on good word from an ex-SAFE Investment Company trader who was involved in the FX reserves liquidation, that they actually sold mostly emerging market assets during the move in 2014 to 2016.

I believe that was the main reason for emerging market decline we saw in 2015 (this was well telegraphed at the time). Back then, China was in a tightening cycle, in an attempt to defend against capital outflows and tried to reduce its spare capacity.

Looking at the world now, we are at a place where said decline in reserves seems to be bottoming. Whatever reserve contraction that has already taken place, should have been priced in.

Moving on to the different ways that the PBOC controls the Chinese economy. Such methods are numbered and in my opinion, byzantine.

The above are only some of the rates set by the PBOC - but from my understanding, the most important rate to watch out for is the 7-Day Repo Fixing. The majority of Chinese credit (from mortgages to hard money loans to credit cards) are tied to that 7-Day rate - we've currently seen a spike in said rate, hinting at a contraction of liquidity in China. The current spike is within historical precedence but should be monitored.

Looking at a few other indicators of liquidity, I do not see any canaries in this coal mine (....yet). M2 growth continues to decline as China seems like they want to lessen liquidity, but nothing out of the ordinary is evident versus the past couple of years. However, corporate lending rates are alarmingly elevated (over 8% for 1-day interbank corporate fixing) and look to be heading higher. This is by far the biggest concern I see.

Lastly, looking at inflation. Hot off the press after the latest print a day ago.

Don't see a big deal here yet. CPI is still very tame as food inflation has collapsed. PPI's spike in the past year has tapered off and came in below expectation. The recent PPI spike was due to China's policies to reduce spare capacity, and thus will be transitory. Overall, there doesn't seem to be a huge need for China to tighten in the near term from an inflation perspective.

With all things considered: long-term, China is looking to rein in misallocation of resources vis-à-vis bad debt and to stimulate more consumption as it tries to shift its behemoth economy from an export-driven one to an import-driven one.

This means a couple of things: (Again keep in mind this is a very long-term phenomenon) a shrinking current account as trade surplus becomes a deficit. This, in turn, would increase the capital account, moving it from negative to positive - one way this occurs would be the liquidation of foreign reserves.

Undoubtedly, our EM thesis will be put to the test if that occurs. As a shifting Chinese economy will have impacts globally - and we will see which is more negatively affected: the US or EM.

Hope this China post can spur some more lively discussion. Thanks guys,

58 comments

Click here for commentsI have to say, this Gundlach Twitter saga is such a sign of the times. Speaking of... Does Trump read The Wall Street Journal? Probably not, as it costs to subscribe and it's all about cutting federal spending now. Anyway, maybe it's time for him to tweet something like this: "China hides aluminum stockpile. China bad, very bad. Why Comey did not investigate?"

Replyhttps://www.wsj.com/articles/money-from-chinese-state-giants-helped-fund-aluminum-stockpile-1494500580

Thanks for the post, DR. Agree that reserve selling is likely behind us. China's reserves fell to point where they got serious about closing capital account outflows. That's the end game in an autocratic regime that runs a current account surplus but has capital outflows -- not, giving some windfall profit to Corriente's Nth fund launched to buy OTM puts on the RMB. These Texans are too fundamentalist/purist.

ReplyRe inflation, they've got it big time, in assets. Being Chinese, they're smarter than us Americans and so, instead of taking a "nothing to see here, move along" (that's you, Bernanke) or just outright "party on, dude" (that's you, mob-baiting, finger pointing, responsibility-shirking politicians) attitude as we have, the Chinese are doing something about it now. Asset bubbles are extremely dangerous when you have a highly levered economy. They understand that. Once the 19th National Congress is past and Xi's gang have solidified power, they're going to go further than people expect -- that's my view, at least. No accident/blow up, but much slower growth. And seeing that so much of EM growth is a derivative of Chinese growth, EM equities will have a hard time with that. Still, there's some time for EM equities to outperform perhaps (thanks to abundant liquidity pushing up anything that could be called "cheap"), but 1) markets are forward looking and 2) the second derivative here has already turned negative.

F-ck Gundlach and all the rest like him. There are no market heroes. Everyone is heading for the graveyard, and if we don't forget that, we may just survive that much longer.

Interesting little opinion piece on oil in the FT today, suggesting Saudi should sell forward. Doubt they do it, but there's a key tangential point here (made by GS, actually). What is OEPC trying to do with these cuts? "Get the oil price up." WRONG ANSWER. They're trying to get stocks down. Why? Because Saudi and most of OPEC sells at the front of the curve (spot) while the shale guys sell forward. High stocks => contango => Saudi sells at low prices while its shale competitors sell at high prices. What they're trying to achieve is low stocks => backwardation => Saudi sells at high prices and its competitors sell at low prices.

Who shot the dentist? DDS is down 17% today. Let's be honest, these brick and mortar retail companies are on life support. You have to pick your spot and short the life out of them. Yes, there will be rallies in a bear market. That's your opportunity to enter, add to your position, get out if you were lucky to pick a bottom. You blink, you missed the opportunity. Look at those freaking charts! You can't make this stuff up. What an Armageddon. New lows everywhere. Some of them you gotta go back 6-7 yrs to see the same price. It's a blood bath. My favorite - KSS. It does not get any clearer than this outside reversal, folks. JCP reports tomorrow, new low. M set all animals free today, new low. Sagging SSS are the culprit and I don't care what they do with store closures and layoffs. It's a same store sales abyss out there across the board and they can't keep up with cost cutting saving the bottom line. JWN is being smacked extra hard after-hours on that. Oh, and we have retail sales in am tomorrow. Short XRT, target 35. Next rally comes, you'll know what to do. Mr. Gundlach, are you listening? We don't really care :) How many interns does it take to monitor the entire web for negative comments on your funds? What a waste of human resources, what a shame!

ReplyFirst day on Twitter, he attacks MM.

ReplyTrump Copy Cat attack!!!!

China: Yield Curve inverted overnight. You know that usually indicates a slowing economy. 6% GDP my elbow….

ReplyWe bought some TLT calls today before the long bond auction.

I usually agree that China fears are way overblown.. but the falls in iron ore, oil and copper add a bit of weight to the Chinese tightening story.

ReplyAlso seems to be markedly slowing credit growth in the US, with a rate rise next month and 4.4% unemployment. Add rising US bond yields, overextended positioning on the long side... I'm not selling any of my stocks, but am adding to hedges, though these have been expensive.

JBH, HVN and MYR have been good retail shorts in Aus, where the online retail game has barely started.

IPA

ReplyOn the retail note. What shortside opportunities are there for commercial Reits? Excuse my unfamiliarity with the 'names' in the US , but it seems to me these companies stand to fall on the same 'sword' of technical obsolescence.

Johno,

We must have reading the same tealeaves and reaching similar conclusions. Why |I thought there would be a better time to back EM and opted for discretion removing from the portfolio much quicker than I usually act.

@checkmate, DDR, KIM, KRG, MAC, SRG.

ReplyIPA

ReplyClearly they are all getting kicked. Substantial downtrends. That being said although yearly markdowns are heavy it should be remembered that existential threats can often see 75% (!) capital drawdowns before any lasting signs of a base kick in. So , there may be a long way to go for names in that sector.

I suspect the FTSE would have been marginally down today if it were not for the big two Pharms. Which from a short perspective is fine because that's very much a defensive day.

Reply8% on AstraZeneca in a day. What can one say !

ReplyMr Bond seemed to get a kick out of the weak retail sales and CPI data…. we sold some TLT calls this morning.

ReplyMarkets seem to be looking ahead yet again to the FOMC. Watching and waiting.

There is only one thing you have to monitor re China. It's the outlook for property. And the govt seems intent on tightening. But prices are doing ok even if volume is falling. Commodities selling off bc frankly they had no reason to be up here. mining equites look interesting here. Fmg anyone. Even if xi will tighten in November, I think ppl still believe he can control property market pretty easily by using same playbook of easing restrictions if needed....

ReplyRe johno and em. Forget about em equities as a derivative of etching growth ( though I share the same view) right now all investors care about it technology. What's the best performing sectors in U.S., eu and em. It's tech. Everyone is tech crazy...maybe aapl, googl, Amzn and Fb will all be trillion dollar companies, along with baba, Samsung, tencent etc. but if there is no macro growth it's comes at the expense of someone else. Anyways this is what the market cares about now.

I actually think if Bitcoin starts falling a lot it might send a warning sign across tech land. But otherwise these tech guys are still killing earning so we have to wait for some earnings misses b4 you can step in front.

I dunno abee, it all works until it doesn't. These tech co's are run by folks who are in a bubble. They get a bit ahead of themselves and it all goes to shitter one day. Yes, I share the excitement of new technologies, the solutions for the new age, the innovations for better living. But I start looking around when 200K cyber attack victims are scrambling to repair their "bricks" and I lose the warm feeling. Let's see if it elevates the cyber security companies' stocks while demolishing the ones being attacked. MSFT can't be feeling too comfortable on Monday morning, as folks shoot first and ask questions later.

ReplyCan't imagine the fix being that easy when the web servers go down rather than individual computers. This stuff is just starting and we are so dependent on internet and cloud for just about everything now. Many will make an investment thesis out of this, a la Y2K upgrade cycle. I wouldn't be so quick and remind that once the web is down it doesn't matter what device you are using, it all won't work. The day is coming and is closer than anyone thinks. Sorry for the opposite Debbie Downer view today :)

good point IPA, I was kinda surprised how easily the markets took friday's hack in stride. Also, while GOOGL, AMZN, FB, AAPL all have secular tailwinds, they are essentially consumer driven stories. Advertising and products. While we havent seen one in a while, they too go through cycles.

ReplyI really like tech long term but am very cautious here. I know way too many ppl telling me its just so easy to invest in the stock market, you just buy this or that tech company. They know nothing about valuations or cycles, but have been right so far and these are not ppl punting around small sizes either. But tech is probably gonna be the last to go [down] in this cycle.

The big thing I wonder about with GOOG and FB is what we see everyday with Internet advertising. One person summarized it as "I bought a humidifier after researching it online, and now the Internet thinks I'd like to start a collection of humidifiers."

ReplySo when are advertisers going to start thinking they are spending too much money on delivering impressions to people that are not as "targeted" as the ad rates suggest they are?

I could be badly wrong on this, because this isn't exactly a new phenomenon, and it hasn't seemed to have hurt the businesses yet. But I'm wonderin'

- Whammer

It isn't that long ago you couldn't get away from stories for biopharms et al now it's tech. When the stories get too prevalent smart people start to put something in the bank. This is a very usual behavioural trend and as far as I can see it is never different.

ReplyAnyone picking up the noise on Trump indictment? No major news outlets coverage yet. Buzz is getting around and it looks like the traders are dismissing it (judging by the bid in risk this morning). Crazy to think that they may have something on him, let alone this early.

ReplyIPA, he said something Comey Tapes on Friday

Reply"Former Employees of Donald Trump Say They Saw Him Tape Conversations

Three former employees say they saw Mr. Trump tape phone calls in Trump Tower before he was president"

https://www.wsj.com/articles/former-employees-of-donald-trump-say-they-saw-him-tape-conversations-1494715712

Isn't it interesting that no matter the story in the press, equities continue to grind higher? Amusing to watch people here make up some silly reason to short (because of a tweet they read or some-such in depth analysis) and then be proved wrong for the 6000th time.

ReplyTalking of always being wrong, I wonder how Nico is doing? US equity indexes are back at all time highs... his 300+ct spooz short must be fun. Jesus that guy was stupid as f*ck. LOL !

HH, I know what you are doing, you lonely dog. Hey, nobody's shorting anything. You are delusional. Reduce your position down to sleep-at-night size so you don't have to come here and pump yourself up every 0.01% or worse yet lose your mind on this blog. You have embarrassed yourself enough, no need to continue this game. Zero respect here and nobody to trade against as your only target has now left for good. Nico G is relaxing somewhere on the islands off the pacific coast as you are eating your brain away staring at a screen with one chart. We are a couple of traders bouncing around chatter we heard in the morning. Open up your mind, the world is a different place when you have perspective from various sources. Trading is about collaboration and weighing different thesis and listening to the other side. I am not even seriously trying to talk to you right now, just hoping that other traders read my comment and join the debate. I am NOT short against your position so please do not replace Nico G with me or anyone else here in your nonsensical rants full of expletives, childish bravado and claims of annihilation of all traders who ever walked the face of the earth on the other side of your trade. We are all still here, bro, alive and kicking, trading our non-blown accounts. Stop your stupid offensive remarks toward a person who is no longer here to defend himself, relax, breathe, move on!! If you don't then all you'll hear from us is STFU from here on. So please STFU!

ReplyIPA, no sleeping probs here (our longs locked in healthy profit some time ago) - boredom yes as this market grinds upwards at a snail's pace (hence my coming here from time to time).

ReplyAs for the shorts, there were a few more than Nico (you can check the previous posts) if you're so inclined. But as you say, it matters not, I think most here are paper traders anyway. Nico certainly must be, as he'd be living in a cardboard box by ow, not on a beach with his millions of dollars losses. Hahaha

So, good for you! Now stop this silly exercise of punishing those who are not here for things they really never did, as you said "paper traded", even though I think their accounts are still real, alive and well. But really, we are here to discuss so many other trades, ideas, trends, our very existence as a trading community going forward. We are so over this Nico G bashing!! You will gain something by being here more often but in different capacity, more inviting to conversation rather than us telling you to shut the fuck up. You made some money, be proud, be humble, be human!!! You are the undisputed best trader here! You put Nico G in the cardboard box by the ocean, now please let the man rest and enjoy the waves. And more importantly, please stop interrupting our deep thoughts with your infant scream. I have two kids all grown up, it is time for peace and interaction with adults here, please!

Replywell said IPA. Hope HH will understand and stop his nonsense.

Reply@others' That would be me ,but on the UK not the US so no attention to detail as usual. Up to last week that position made money having been taken back to market neutral once already. Since it's restart last week it is once again marginally on the wrong side. If anyone wishes to tell me they have always been in the money on every position they started by all means do so HH. Then we can all agree that we know what you are. Although I already know if only because every time you open your mouth whether you like it or not you disclose information other than what you intend.

ReplyNow STFU and go back to mastering your rattle and diaper training.

abee, TJX and ROST, the time has finally come, imo. Those who are patient will get rewarded. We have an entry here on breakdown and stops above ATH are paltry vs the juicy targets below. TJX report stinks. ROST reports on Thu. Expect a battle though. Cults die slowly :)

ReplyWhere is your target for ROST? I am short that one too...

ReplyCheers IPA, i had missed TJX. Yeah cults do die quickly, but the 12m momo of TJX has been soft for a while, so I am assuming quant guys/IBD guys (are they the same now?) didnt really get hurt. And that is what I am looking for. When a current cult name gets bashed (ie Bitcoin, NVDA, FB etc) then the party will be over. iPhone 8 flop? though I wouldnt bet on it...

Replyre Checkmate, I hear you that smart ppl start taking money off the table. My only push back is that the tech giants are just vacuuming up revenues/profits and thats what the market cares about. Valuations dont matter to these folk as the fundamentals keep surprising to the upside (look at NVDA or FB earnings projections). I dunno how long it can last but that is what I am tryin to pay attention to. FWIW, its now driving EM too, as opposed to commodity prices.

Mi Pa, I got my ROST exits @ 53, 48, and 43.

Replyabee, while I am a technicals guy I am mostly a fundamentals guy when it comes to retail, owned one for 12 yrs. - cycle's a bitch, especially when it comes to clothing and home goods, and both of them are in it. Plus I got my wife as my best, most reliable channel check.

IPA, ask your wife what she thinks of Aerie and then tell me if you like AEO.

ReplyMan, here's a lesson -- never do a trade all banks start pitching at once. Was short USDTRY variously, but wanted more long lira exposure so got taken in by the TRYZAR pitch at 3.79. Last 3.68. Small position, but a big move! Damn. No matter that Zuma has sacked Gordhan, re-installed a thief to run Eskom, and is going populist to hold power, saying he'll re-do the constitution to appropriate assets without compensation. But hey, it's a bull market in stuff, so just buy that sh1t. Curious whether anyone has views on the coming court decision on a secret ballot no-confidence vote. Which way is it likely to go, and will it matter?

ReplyBeen luckier elsewhere. Actually went very long oil (longest I ever get in a commodity) and then somehow top-ticked it. Fool's luck on the exit. The Saudi/Russia announcement has brought forward OPEC meeting lift I was expecting, which leaves us waiting for visible draws to push oil higher. Analysts I rate say those draws are coming imminently, but we'll see. Might get long again, or maybe just stick with my remaining call spread and KO call positions.

In rates, I'm still short buxl. Exited shorts in US 5Y a few days ago. Especially after this US inflation data (which means we need to see some good data just to get back to where we were), it's hard to expect a hawkish statement accompanying a June hike. Such a statement is probably a couple months out now, in the best case. On the other hand, rates have tended to sell off into hikes, and also into SEP releases, so not appealing to go long rates either. In a nutshell, I don't see the bearish catalysts for rates coming from the data in the near-term, but perhaps from incremental hawkish language around QE in Europe.

In FX, this move in EUR will have people questioning their assumptions. I've got these EURUSD flys (middle strike RKI) that are looking good now. The big news was the Macron-Merkel meeting which feeds hopes that if France can deliver reforms, Merkel will support previously taboo treaty changes. One usually skeptical/astute commentator just wrote this morning that people will be surprised by how much support Macron gets from socialists and many center-rights after the parliamentary elections. Maybe.

abee, lol, wrong age bracket, will have to ask my daughter. I don't like AEO, especially if they acquire ANF. Looks like the stock wants to go to $10.

ReplyJohno, I'm by no means an expert in ZAR trading but I get occasionally involved there. My impression is, ZAR is seen by many as the ultimate EM risk currency, whatever flows happen in EM get expressed via ZAR, of course there are phases when ZAR trades on its own, that's when something idiosyncratic to SA happens, but most of the time it's ignored and the SARB seems completely oblivious to where ZAR trades. Not that I agree with the way ZAR is traded, but the perception is that the rest of liquid EM has lots of BIG political risk involved, has a central bank that can get nasty or is in a uncomfortable time zones. Ultimately ZAR will blow up bigly, but you don't want to short it and see it going down to a 10 handle...

ReplyChina...

ReplySo the expansion in credit in China has been driven into the commercial, corporate, SEO, SME sector. Less so retail, or at least mortgages were already pumped. So, the authorities are tightening the bank lending, but much expansion runs through shadow lending. They can't take deposits but raise funds through retail bonds/investments. Risk here is they borrow short lend long. So the risk is a similar problem to 2009 in the West happening in China which would mean the PBOC would step in and provide liquidity to replace any runs on 'deposits' and resume confidence in the system.

Interestingly, inflation is not high in China, so this credit expansion is not finding its way into the real economy? Suspects are propping up the revenue line in loss making SOEs. Second place is speculation. How about that rapid run up and crash in Chinese shares, commodities and now bitcoin? The credit liquidity is sloshing around chasing the latest asset craze. Also Chinese have sent a lot of money abroad to buy foreign property.

So, eventually the credit growth has to stop. Then 6% growth is off the table for a couple of years while it works through.

Timing? Market thinks not this year with the National Congress on the way

risk off- hit the ZAR button!

ReplyTook off my buxl future short 165.2-ish and some EMFX.

ReplyI'm no great judge of these things, but this doesn't look great for Trump. Have dialed down the risk a bit here. Anyone see especially good analysis? From what I've seen, institutions were expecting tax cut/reform next year, not this year, but if we have impeachment proceedings, then all legislative bets have to be off.

Funny thing is just last week the acting FBI head said "there has been no effort to impede our investigation to date." NYT says that he was referring to Trump campaign/Russia but Flynn/Russia is separate (I find it ridiculous that McCabe would have let the latter go unmentioned when asked the question about the former, but WTF do I know?).

Was the remark to Comey "obstruction of justice?" Maybe. To me, it isn't clear-cut either way. Impeachment is a "quasi-judicial, quasi-political process" as was written in the press somewhere, so a Republican Congress is going to interpret this favorably for Trump, right? That he was speaking "solely out of sympathy or good will for Flynn," to quote someone else. Still, it seems like the wheels are in motion for stuff to come out. And do we see a special prosecutor appointed, and what are the implications of that?

Those who were lucky to get filled at 48.05 that I mentioned on WTI should move the stops up now. Who knows what EIA holds for us. Take some off here too, risk off, ain't it?

ReplyJohno, on Zar, the commentary I read was that the market sees Zuma as a lame duck now, and are just waiting 2 years for him to be gone and someone better .....

ReplyIs this the gap that doesn't get filled (for a few years?). One never knows until after the fact. Likely there will be some dip-buying enthusiasts out there… our guess is that the dip does get bought into Friday's expiration, before a summer swoon resumes.

ReplyNice work on WTI by those who caught the 10%+ move off the bottom. It's probably not a great day to be long though. Crude remains arguably (and perhaps this is correct) in a trading range - but with the possibility of a move into an even lower trading range, which obviously impacts inflation expectations, and therefore both US rates and the USD.

Of course we are one of the resident fixed income specialists here, so you'll be pleased to hear we have remained long through the last few weeks and even added to our longs almost every time the 30y > 3.00%. It would take a big change in sentiment and a substantial panic in equities for us to begin lightening up on bonds. Even the media are now walking back the inevitability of a June rate hike. This could be a very typical US summer fixed income rally, we have seen a few.

WTI is hopping again. I'll sell another 1/3 of my original long @ 50, leave the last 1/3 for 52 target and move the stop up to 47.90

Replyabee, I hope you did not buy AEO, ouch!! Even a 6-yr support @ $10 may not hold with a report like today. $8.50 after that.

Gold is shining. Buy more GC and GDX. The egocentric lunatic did it again! How many lives does this cat have? More importantly, what happens to consumer confidence and pretty much the whole economy when half of the country has no president they voted for?

Leftback, great trade on TLT! Citigroup Economic Surprise Index is driving the 10-yr yield.

http://www.yardeni.com/pub/citigroup.pdf

A good day for LB. Kicking myself for not selling USDJPY, but at least cut lose my buxl short at good levels. Only so much you can expect at two in the morning local time, perhaps.

ReplyI think the Trump news means you put lower odds of stimulus/tax legislation passing, which means the 2019 part of the forward curve (which is most sensitive to some over-heating), in particular, should rally. Roughly that's what we're seeing (actually more centered around 2020). One thing I'd add. I don't have much contact with high-up Washington types, but one I spoke to last month told me the key man to watch is Mitch McConnell. People here might take note of his interview with Bloomberg yesterday, which pushes back hard against Trump's tax plan. Anyway, clearest implications are for rates.

Market likes the EIA #s but I'm not sure these are the #s one should chase.

Notable that we've had some liquidity injections in China, finally, and the coal/iron/steel complex has caught a small bid.

Re the UK, anyone see that Bloomberg article on the candidates May is selecting to run? Seems to counter the narrative that the election allows her to sidestep the hard-Brexiters when negotiating with the EU. Anyone have thoughts on that? Reading the article certainly made me less constructive on GBP.

Johno

ReplyRe the Uk I'd be les interested in the politics and more interested in the property market. It is not an accident that in 2013 and prior people were talking about the Uk as 'the sick man of Europe'. Given it's skew towards finance and property how could it not be. It is not an accident that within 12 months the government had stepped allover the housing market with policy and suddenly Lo people cannot praise the Uk growth enough. Within that context our property oriented boom is over. Transaction volumes are dropping and nothing short of further major policy intervention is going to stop it. Without that engine firing the UK growth rate will be hard to sustain.

Big question is: do you buy EM fixed-income driven currencies here? Equity-driven FX seems ambiguous because you have lower US growth effects cutting against the benign rate effects. But fixed-income driven EM currencies look less imperiled by US rates now. USDMYR which I've mentioned here before historically correlates well with fixed income flows, for example.

ReplyFilling up some more space ...

Reply2s10s has broken below the pre-election level. I'm not a big charts guy, but I think it's significant when you retrace and then break through the level existing before a major catalyst/narrative for a market. You won't catch me owning any US bank stocks, man (though I do own WFC and BAC "L" preferreds).

This Comey thing isn't going to die. We're probably looking at weeks/months of uncertainty. I'd think probability of tax cuts/reform is now materially lower, however, there is a narrative that Congress is going to feel very pressured by the 2018 midterm elections to pass something, maybe more so now. Even if that's true, it probably also means whatever gets passed is going to be a lot more modest than otherwise. Mitch McConnell can and will say "no."

Yesterday's Heard on the Street on China was worthwhile. Agree with the view there, that China cycle has turned, but 1) AAA-versus-AA spreads are not signalling heightened fundamental risk and 2) the PBOC is stepping in now with liquidity, which is what you'd expect if you believe (as I do), that they are not going to risk anything like a hard landing prior to October.

Leftback: Is this the gap that doesn't get filled (for a few years?)

ReplyI tend to agree. There are lots of gaps that the market created on the grind higher. I reckon those will be filled before this gap is filled.

One of my mates at a large fund was talking about how the Russians need capex in oil industry which requires higher oil prices and so they are likely to comply with cuts. I'm skeptical, but just thought I would fyi.

It probably was NOT a good day for the Vol selling Bros down at the Good Ole Boy state pension fund…. who knew being short vol of vol was risky?

ReplySpecial prosecutor -- draws a line under this for now?

Replyholy... what's happening in EM currencies this night?

Replyfwdem, maybe it's that Brazil is going to be a sh1t show tomorrow. O Globo reports that the Carwash probe has turned up a tape implicating Temer. Kiss goodbye to pension reform and all that. Hardly trades but the BRM7 currency futures are down over 5% right now.

Replygrt tks, explains why MXN is the laggard, re BRM7 as there is no spot market in BRL where do they get the price from? Is there somekind of reference (probably onshore?) like spot if for other currencies ? Or is it really people only trading on CME and everything else closed?

Replyok, trading was a bit rich...but there is a price

ReplyIt's the unknown that scares markets the most, no visibility going forward. You hit a wall you never saw and it wakes you up, if doesn't kill you. Today is a wake up call for those who chose to ignore what's been said here so many times: Trump will end the stock market rally. Is impeachment a certainty? Probably as certain as the tax reform, not at all. But it's the perception of one that makes the players exit. Try to make a sense out of one day of trading and you are in peril, but put a week of this together and you have a trend, a place where to park your stops, a high to hide behind, a gauge to measure consistent fear. A herd of raging bulls turned into a flock of fearful calves today, leaving a trace of manure on the way to the exit, the same bullshit they were fed to buy it all up.

ReplyFinancial markets are just like ladies are they not. They have 'that time of the month' ! Some of the outcomes are decidedly similar as well.

ReplyLeads to me to wonder as anyone ever developed a trading system based upon the Menstrual Cycle?

ReplyHere comes the dip buyers. Buy buy buy...

ReplyIs it not the time to go long big on Brazilian equities?

ReplyBRZU tanked 52%, I know it is a suicidal 3x ETF, but if it bounces back, it is serious money.

Full Kevlar body suit and gloves if you are interested in Brazil today but this one looks like a five-alarm fire in a tire factory for the moment. EBR-B probably the best long term bet out there, but we are going to sit and watch this burn into expiration at least. Yesterday's USD bleed has been staunched. Capital flight out of BRL into the usual safe haven for Latin America - USD!!

ReplyOne has to question the timing of the EM v DM call from certain eminent punters recently…. Really ?? From this corner, we might venture to suggest that punters should stick to his/her knitting, and focus on fixed income.

The last two days have been like this:

1) Wake up. Look at rates. [this is every day]. Look at various Falling Knives.

2) Think: "thank Heaven I am not a Long-Only Equity Guy".

3) Think: "shit. I am glad I only have a tiny sliver of that piece of excrement".

4) Think: "this may just be the beginning of more instability".

5) Think: "this will put the Fed on hold"

6) Look at rates.