AUDNZD has been in my interest since its initial bottom in mid-2014. Historically speaking the pair's movement is reflective of the business cycle differences between the two economies. We have bounced off historical lows both in nominal terms and real terms.

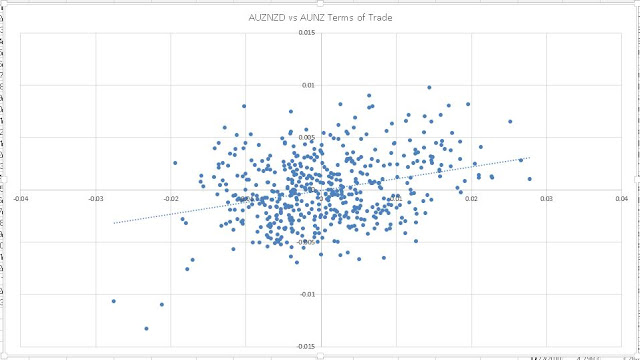

One of the main things I’m looking at here is the divergence in Australia’s and New Zealand’s respective terms of trade. There has been a strong correlation between the two country’s terms of trade and their currency levels. The rising prices for Australia’s commodities have been driving by the huge rebound in metal prices (20% to 25% of Australia’s exports = iron ore, the price of which has risen precipitously).

As you can see this signal isn’t always a focal point in driving returns, but I believe moving forward, it will matter.

However, base metal prices have failed to maintain these current levels, as the Trump/populist trade unwound somewhat in the past few weeks. On the other hand, milk futures prices seem to be establishing a bottom. It’s reasonable to expect an appreciation of AUDNZD to come to a halt as well. But if the fortunes of those two commodities groups reverse.....well I’ll leave that to your imagination.

NZ has experienced growth and inflation after the RBNZ lowered rates after the Christchurch earthquake in 2011. After experiencing growth, they were the only major central bank raising rates back around ~2014. AU has been relatively more stagnant, however, after having relatively lower rates since mid-2014 is starting to pick up.

Looking at relative unemployment rates, we are at a local low of NZ minus AU unemployment (higher unemployment rate in AU than NZ) and have to start to trend the other direction. Ultimately, from a trades perspective, New Zealand is strongly dependent on Australia (~19% of total trade) but the reliance is non-existent the other way around (~3%). One could interpolate from this relationship that New Zealand, with their higher interest policy, will soon start to feel some of the economic pains that Australia has had to deal with in the last couple of years.

I also built a real rate spread using extrapolated CPI and government bond yields (to calculate a real rate). This does show that there continues to be a break between AUDNZD and real rate differentials

So now what?

However, after the explosive move driven by the rise in inflation and yields (derivative effect evinced through rising base metal prices), we could possibly be in a position of over extension of those metal prices. If we pullback in metals/inflation (I think we can pull back), so can AUDNZD.

Unemployment differentials show a clear bottom, but no clear strengthening in Australia vs New Zealand. Risk reward is to be long that chart and thus AUDNZD.

Finally, positions seem a little stretched at this point, but obviously, this doesn't necessarily have to be the utmost driving factor.

Conclusion:

I think it's okay to be a short term dodgers fan and book some profits for now. But as AUDNZD pulls back between 1.05 and 1.06. I would look to rebuild or add to a long position.

Thanks guys, good luck tomorrow with the jobs number. Been really busy of late - will do some work on US equities + Wars - look out for a Syria piece this weekend!

60 comments

Click here for commentsgreat post, thanks

ReplyNice, thanks. I like the trade and your analysis was excellent.

ReplyTo some extent AUDNZD is also a function of bullishness on China and industrial commodities, no? This may also be because AUD is usually traded by a different group of punters, often with a higher degree of leverage than is the NZD. So the short-term movements in this pair may be triggered by Chinese data, I suppose, and therefore perhaps also by the undulations of whatever it is that passes for US foreign and trade policy these days.

A spot of mean reversion in the BLS number today, we have been warning about that since the February number came out many sigmas above expectation and here we are with those sigmas rebounding back at us. Having said that the lack of volatility in the US Treasury market of late is quite a surprise, almost as though traders decided the FOMC is on autopilot on its pre-set course. I wonder if that will prove correct.

Back to FX for a moment, we are seeing more volatility there, and it's going to be all about USDJPY in the end - once that breaks down seriously…. it's over, no matter what Harry H and the other little children have to say.

Left,

ReplyThat 110.20 level on USDJPY is rock solid. I am at a loss to figure out what eventually drives a stake through its heart.

Bring out the garlic, Tim. $/¥ fell to 110.091 in overnight trading, but your point is well taken. Let's call it 110, for now, shall we? Look out below if it breaks down, with only minor support at 107.20 and then major support at 105.20.

ReplyIf MM is correct then we may not have too long to wait, and the recent breakdown of EDZ7/EDZ8 spread below 0.40 will be followed by a major breakdown in US10y and USDJPY.

Just for now, with a boring early week of US data ahead of us, I am tempted to take a bit off in US fixed income here and reload later ahead of next week's inflation data. We are bumping against the upper end of the trading range again, and no I have no idea what will trigger the breakout, especially if the sub-100k NFP number didn't oblige. Perhaps the following trifecta: lower than expected PPI and CPI, and a miss on retail sales?

Leftback, agree, market is ignoring things until it will not. It is myopic but Trump is waving a big candy in front of its nose so why bother with anything else? We just discussed retail at length last week and we got the confirmation today, 65K retail jobs lost in the last two months, 89K since October. One does not need to doubt this will continue and accelerate as 3,500 more stores nationwide will be closed soon. I am pretty sure all these folks are going to have a very big problem finding jobs unless they are willing to shovel dirt at a construction of a beautiful concrete wall.

ReplyBack to fantasy dream where children drive their imaginary company cars while buying their diapers online.

I said this smells bad. Noway Putin lets Syria go for so many reasons. I will buy gold futures tomorrow and GDX Jan'18 24/32 call spreads on Monday.

Replyhttps://www.bloomberg.com/politics/articles/2017-04-07/u-s-launches-missile-strike-on-syria-in-response-to-gas-attack

By far the best piece anyone has put together on what Syria means to Russia. What a mess! I see gold at 1300 by the end of April and at 1500 by the end of the year. I see GDX at or above 32 before the end of the year.

Replyhttps://beta.theglobeandmail.com/news/world/russian-resolve-why-syria-matters-to-putin/article34643406/?ref=http://www.theglobeandmail.com&service=mobile

@IPA It sounds that you're very confident. Why limit yourself to GDX, when there's also GDXJ?

ReplyAlso would like to hear your thoughts on JPY, if we truly get a "risk-off" Syria moment?

Drones in Syria , ships heading to N Korea. I suspect by now questioning minds might be asking what as this got to do with 'putting America first' which most of Trumps voters assumed equated to somehow improving their standard of living and increasing their aspirations for the futures of their families. More cynical minds no doubt just say nothing really changes in politics. Politicians needing popularity simply keep embracing issues they have seen working in the past. Your voters don't like you then find a nice issue that needs a military style response and appear to 'man up'. Always a winner with IQ's of less than 100. Except just perhaps this time it might be out of step with what the public tried to vote for so recently. Afterall didn't they think the problems that needed addressing were a lot closer to home ? I would love to see what surveys made of this latest shift in direction by Trump.

ReplyAs for regime change in Syria that is impossible without outright war with Russia. I doubt Biff is really up to that. Putin actually as balls whereas Biff prefers to see them on a golf cpurse.

@tester, I am going with GDX vs GDXJ for mostly technical reasons. I want to be in large cap best of breed since I am going with long-dated spread. Speaking of which, the call spread I am doing on GDX is giving me a 1:3 risk/reward ratio and I can't find quite the same in GDXJ. Also, GDXJ bid/ask spreads are too wide for me to get a competitive fill quickly on Monday morning and the short options volume would be kind of thin, $14 away from current underlying price in order to capture the same 36% move I am looking for in GDX.

ReplyBTW, GDX has about 4% weighting in GDXJ.

JPY is such a complex animal. Central banks, bond markets, equity market hedgers, money flows, and so many other things affect it, therefore think that I will not get a true flight to safety result on it. I'd rather go with gold which is forgotten, abandoned, under-appreciated, under-owned, and may shine in truly scary geopolitical risk times like I think we are about to have here.

Hussman adds some grist to Leftback's mills...

Reply"Civilian employment now stands at 153.0 million workers. Based on demographic projections by the U.S. Bureau of Labor Statistics, the civilian labor force will reach 163.8 million workers in 2024. Even if we assume that the unemployment rate will remain at 4.5% at that date, the resulting level of civilian employment would be (1-.045)*163.8 = 156.4 million workers. Let that figure sink in. Even assuming a permanently low unemployment rate of 4.5%, cumulative U.S. job creation over the coming 7 years is likely to amount to 3.4 million workers, averaging about 40,000 new jobs per month. That's dramatically fewer than investors seem to be expecting. Worse, if the unemployment rate was to climb to 6.6% by 2024, the number of jobs created over the intervening 7-year period would be zero."

Re geopolitical risks ...

ReplyThe missile strike looks like a one-off to not look weak. I don't expect an escalation. Not even Trump is so dumb as to go to war with Russia over Syria.

Where I positioned for geopolitical risk the other week is in Korea, buying sovereign CDS. Even if we end up living with a North Korea armed with nuclear ICBMs, the path will probably be nail-biting. And the path to North Korea stopping its program would also be nail-biting. Nail-biting because, even supposing North Korea just used conventional ordinance on South Korea, you'll get horrific loss of life and tremendous damage to production/infrastructure. Not saying I'm expected that, but if the market starts pricing that risk, the CDS probably has a long way to go. Happy to hear push-back or better expressions in FX/equity option space.

Turkey is going to be the big macro opportunity, I think. Arguably, a "yes" vote in the referendum secures Erdogan, making him less likely to pursue crazy policies (or so the argument goes).

Johno,

Replybear in mind that sovereign CDS are to some extent also a bet on interpretation of the underlying rules (depending on what your plan is, of course). See for example

http://www.lexology.com/library/detail.aspx?g=e9c8eae6-b2ad-4fe7-9a9f-9f299cd2607f.

"Voluntary" restructuring or effective subordination probably won't constitute events of default.

johno-

ReplyI am also long protection in Korea - i like the idea behind the trade and I happen to think it is indeed the best vehicle to express it.

Associated with the NK issue, China is retaliating trade with SK (e.g. see auto exports and PMI), so a growth slowdown is not likely to be credit-positive.

On why not FX: the fear of being labeled of currency manipulation means, there will be no intervention in fx, hence the huge CA surplus will be a constant force driving KRW stronger, all else equal. So currency probably not the weakest link

On equities -> not my camp, but happy to hear thoughts on it.

The question I have is whether this is a trade to buy protection at 50 and sell at 65, or there will be a bigger rise (as you imply). As we all should know, CDS is almost always a bigger fool game (as Eddie has implied above). So I am not a huge fan of holding this position for a long time.

Good luck, FMD

Sell SOX buy Gold.

ReplyMr Bond is extremely close to breaking free of the shackles of the recent range trade, and if and when that finally happens there will be no shortage of pain for the Curve Steepener, Rising Rate, Reflation Trade crowd.

ReplyJust before the election, TNX was 1.85% and TYX around 2.60%. 10s moved about 40 bps in a matter of 5 days, so quickly that there is essentially no technical support for long end yields, and in a moderate equity panic the entire move could be retraced in a few weeks. You want to know what the Pain Trade is here? You're looking at it… :-)

Maybe, LB. On the other hand, speculative shorts in bonds have been cut way back, looking across a range of data/surveys. And the Bloomberg Barclays global aggregate index duration shown in today's FT looks the highest ever.

ReplyMeantime, the global growth impulse from China still appears positive (I'm giving it another couple months of life) . And it seems to me this Fed really wants to get real rates to zero, so there's a good likelihood a hike is coming in June. It may be too soon to price, but you also have the Fed wanting to start shrinking its balance sheet later this year, issuer constraints possibly forcing a tapering by the ECB next year, and what some called a change in tone by Kuroda on the balance sheet just today.

Thanks for the feedback on Korea CDS Eddie and fmd.

Sell copper (target 2.50) and AUD (target 0.73).

ReplyAndrew Thrasher, CMT

ReplyIndependent

Date Written: April 10, 2017

Forecasting a Volatility Tsunami

Abstract

The empirical aim of this paper is motivated by the anecdotal belief among the professional and non-professional investment community, that a “low” reading in the CBOE Volatility Index (VIX) or large decline alone are ample reasons to believe that volatility will spike in the near future. While the Volatility Index can be a useful tool for investors and traders, it is often misinterpreted and poorly used. This paper will demonstrate that the dispersion of the Volatility Index acts as a better predictor of its future VIX spikes.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2949847

Nice post detroit red...im a big yzerman fan.

ReplyLike the sox gold trade ipa. Already innit.

Wow yen is really hitting the risk off. Damn i was totally wrong on it...but does anyone really think BoJ is gonna move on rates anytime soon ? I guess it doesnt matter. Would love to hear the bullish case for yen aside from risk off ...global growth hogher --> higher ca balance (even with oil ?)

I'd love to hear the bear case on USDJPY too (is it just geopolitics-driven repatriation optionality?). Looks rich versus rate differentials. I actually took off my USD put JPY call spread yesterday with spot around here.

ReplyI've actually shorted gold and the US 5Y here. I figure I'll know if I'm wrong at levels not far from here. I don't mind being wrong at a small cost.

johno, I hope you have a hard stop in on gold. Crazy animal will jump $20 once it breaks above $1280. We'll see $1300 in one shot.

ReplyWhile children are on spring break, is it time to short FANG yet? I think it is. Back to school may start with a lesson on how to keep the profits.

abee, Yzerman, those were the days!

Last chance saloon for the bond bears, we are once again sitting on the last strong support here at 10y 2.30% and 30y 2.93%.

ReplyJohno is betting that the range trade holds yet again. It's a perfectly reasonable idea but we recommend a tight stop there too. Yields could dump 25bps in a hurry in 5s and 7s, and 40-50bps at the long end if the support finally breaks down.

To be quite honest, with the French election still out there, a bit of concern about US data and a lot of doubt about Washington DC all of a sudden, we like all the haven trades a lot here. Bonds, yen and gold.

Nothing positive for the yen - other than when the herd of elephants has to unwind leveraged USDJPY and other carry trades. Elephants make a mess....

Well, that was quick! Got out even before stops hit when the WSJ headlines came out. Ridiculous, but such is the world ...

ReplyDrove the stake through JPY at 110.20 good and hard!

ReplyI'm finally stirring from my lair.

ReplyIf there is one thing I have learnt through all the crises is that most people don't care about what is about to hit them until it hits them. the basic economy will not discount something it could see may happen, contrary to what pure economics teaches. It follows its peer group instead. SO you end up with phase change instead of gentle curves. Phase change is a typical behavioural occurrence but is Something else economists are rubbish at working with.

So .. I ma now of the thought that we are all happy to play long risk as everyone is long risk and it's just fine even though out of the train window we can see a load of trouble ahead. I am not talking economic data blah blah backward looking trouble I m talking hit a wall ahead you didn't see because you were so busy looking back at charts of history.

I m wth LB. Haven trade time and even this goldbug mocker is buying gold

more here .. https://polemics-pains.blogspot.co.uk/2017/04/orpington-markets.html

Don't like how AUD gained 100 and 200 dma on this report. Still think it runs into resistance @ 7590-7600 and reverses back below both of those moving averages and heads for 7300. But I gotta trade what I see. That was a good jobs report. Stopped myself out. Will revisit on a reversal, if one comes.

ReplyVery happy with copper. Out half, stop to b/e.

not to suggest the Aussie jobs number was bogus but the 95% confidence interval on that survey ranges + 2 to + 119 k . Given all that, I would suggest this involves a better entry point for those looking to dell $a

ReplyTim,

ReplyDon't tell you know who !

@Polemic said: "If there is one thing I have learnt through all the crises is that most people don't care about what is about to hit them until it hits them."

ReplyThe housing bubble that precipitated the GFC was exactly like that. Most people had no idea what MBS and CDOs were, and "it was contained", so they had a plan to deal with any problems. Then as Tyson said "everyone has a plan; until they get hit in the face". What's more, once something does hit them in the face they don't care what it is, they just want to get their face out of the way, along with a huge herd of other very scared people.

The herd of Treasury shorts is now obviously spooked, and the smarter ones amongst them are just beginning to turn around and run in the opposite direction. Once the panic begins in earnest it will become self-perpetuating and we will probably see another emotional undershoot in yields. As always on such occasions, he/she who panics first, panics best.

Supports are cracking in yields, and the reflationists keep making up new support levels that are not going to hold.

Polemic made a comeback. Leftback has made a call. And I'm left wondering have I top tick it in reverse fashion. Well, the S&P500 traders have driven me to dwell on a song I grew up on. The best song ever written.

Replyhttps://www.youtube.com/watch?v=gAirINwjaxE

We look to have all the ingredients for an equity correction. But will it ever happen? I am guessing now is the best time before LePen loses and EU takes off..

ReplyUS cyclicals breaking down, commodity prices lower, Small caps on edge, HY toppy, and interest rates giving the message that global growth isnt so strong (US 10 year has been better correlated with global growth, according to some views). but then we have earnings comming out soon and if the US tech titans kill it again, who knows. Maybe they surprise and miss, but I wouldnt make that a big bet of mine.

I watched a program on the French elections. I was surprised to say the least. I've generally thought Nico had it wrong that France might follow the UK politically. After that program I am not so sure at all. The questions and more importantly the responses could have been the very same we heard in the UK prior to the referendum. The sentiments were uniformally the same; lack of hope/aspiration ; disillusionment that the establishment were interested , and of course many of the same misinformed ideas about who was responsible and how it might be rectified. The parallels to what was heard here in the UK were eerily similar regardless of differences in accents.

ReplyMy disquiet after that was not helped when it was surveyed that in a second round Macron is thought to outgun Le Pen by around 60/40. This appears to assume that in the second round Macron picks up 2 extra votes to Le Pens 1 vote. Looking at the stance of the 4 primary candidates and what they appear to stand for that simply looks absurd to me. I would think if anything most will simply not vote at all leaving those most motivated to go the polling station. I don't understand why those will favour Macron rather than Le Pen ,because in this strange case the more committed lefties actually have more policy matches with Le Pen than Macron.

Once again I have this thought that this is going to be much much closer than the surveys would have us believe and I have no way of guessing which way it is going to tilt. On that basis get your protection why you still can at any reasonable price.

Leaving aside the French election and geopolitical issues, let us remember that 70% of US GDP is domestic consumer spending and consider the hard data that just appeared this week.

ReplyNow we have just seen a weakening JOLTS survey, a soft PPI, a negative retail sales number and perhaps most shocking because of its importance to FOMC, the CPI turned negative, INCLUDING core CPI. Reflate that lot...

Cold Steel time for the bond shorts. It's going to be ugly for a lot of people on Monday. :-)

We'll be back next week, with a short piece on Bond's latest escape. For now here is a brief summary of our trade:

https://www.youtube.com/watch?v=OhUlXS09lM0

That miss in US CPI speaks by itself, and Atlanta GDPNow decreased (again) its estimate for Q1 GDP to 0.5%...

ReplyI am liking SEK at the moment, holding near 4 months lows against the dollar, and could start beating the drums as the Riksbank meeting approaches..

Any thoughts?

Best,

M

LB,

ReplyRe your comment from the earlier post:

4. QE off (balance sheet reduction, rate hikes etc...) = sell risky assets, buy bonds.

Sell risky assets to clueless retail punters and buy bonds.

Whats the reason to buy bonds? Is it because of risk off, flight to safety due to effects of tightening?

Agree with Leftback, consumer is not as healthy as the soft data portrays. Time for retail sales to show the broad market the way. I mean, folks, last month crapped for a four-tick downward revision. Take the three months of significant contraction in auto sales and extrapolate that into the whole picture. Never mind Trump's 4% target in our lifetime, it's time to worry about 2017 growth possibly not hitting Fed's 2% target. Sell XRT, target 35.

ReplyFurthermore, if you read the UoM comments of respondents, they said they'll buy less homes and more cars. Well, they ain't buying more cars and retail sales less autos are unch for two months. Building materials sales down 1.5% in March, ouch! Sell XHB, target 28.

Most new incumbents are gifted a honeymoon period unless your name is Trump in which case you get to pass GO straight to the popularity nightmare phase. In the face of batting zero on domestic policy wishlists Trump becomes the latest in a long line of Presidents who realise the easier route to popularity is to switch over to foreign policy. In that phase you roll out the usual suspect list of world political clowns who first and foremost offer an easy target. Step up the usual Middle Eastern medieval jokers not forgetting the ultimate clown prince of them all N Korea.

ReplyCall me cynical if you will ,but Middle Eastern countries have been doing the nasty to each other for my entire life time so right now nothing much as changed. Ditto N K as been rattling sabres for decades mainly because it's the only way the family keeps control of it's peasants. However, the family have never to date been stupid enough to assume that talking about war and starting a war they cannot win are the same thing in terms of keeping hold of their political goals. So once again as anything at all really changed here. I would say no. What as changed recently is we have yet another lame duck President who feels the need to restore is reputational losses with the voters.

Get f##ked wall street. Get f##ked fashion. And get f##ked new york. Not coming. Leave a poor mug alone.

ReplyYou New York investors and what not can keep going. Yeah, I'll get there. And I'll piss all your money down the subway drain. It's time to leave a poor mug alone.

ReplyHey, Macro Man. I've seen some things in the betting ring in my days. But, boy, if you link me up with a HF on wall street the only guarantee you'll get is that I'll stand everything that you've ever heard of on its head in week! Just for shit giggles!

ReplyIs that it for the bond rally? Massive miss on CPI, disappointing retail sales, Empire, and NAHB and the 5-year bond is down on Thursday's close. This whole narrative that there are crowded shorts in bonds is bogus.

ReplyDisappointing move in Turkish markets today. Cons: Erdogan keeps talking about death penalty, the State of Emergency has been extended, some question over ballots counted. Pros: no election until 2019, Erdogan needs the economy to grow more than short-term political wins if he's going to win in 2019, IMO. Anyone with a strong view one way or other?

Erdogan has been made a sultan. With his ego viagraed you could argue indeed that he will now focus on the economy and give some back to the people, rather than waste energy trying to act tough abroad. Could be a nice run for TRY and Turkish equities.

ReplyIt is hard to read into a psychopath's mind though. I naively expected Trump would execute according to his very own beliefs, rather than flipping on every possible issue within 100 days because her daughter got kinda upset. Yellen in particular must be scratching her head.

The immediate objective now is France, and keeping Macron out of job. Still expect a le Pen win which will give a nice liquidation buy à la Brexit/Trump election. This time it will be the lack of majority (June elections, even more important) that will prevent le Pen from executing her electoral promises and whatever does not kill Europe makes it stronger.

Yesterdays US post holiday session looks to have been lost in translation as we continue with more of the same risk weakness. Call it political risk, profit taking, imminent war. Does not really matter. We see this seasonality in most recent years and there's always some sort of convenient explanation for it. Frankly, who cares ,the only issue should be is your P&L going up or down.

ReplyFactory orders down, @Johno. Perhaps even more importantly, there are more signs that crude oil is topping out here and that the supply issues will soon drive down not only energy prices but also inflation expectations. We don't think that North Korea has much to do with it, although uncertainty in French elections undoubtedly does, for the time being.

ReplyThat was clearly NOT it for the bond rally… US 10y and 30y now at new lows for the year, and although short positions have been reduced at the long end of the curve, speculators are still net short. In addition there are massive short positions at the front end, even as the odds of a June rate hike by the Fed seem to be receding. Short Eurodollar positions still at extremely high levels. We should also add that sentiment hasn't changed a great deal with regard to bonds and most punters still believe "rates are going higher". If and when sentiment swings (even for a couple of quarters) then there will be a much stronger bond rally until even the dumb money decides to get on board. We suspect that this move has a long way to run.

@Checkmate is suggesting that the narrative is unimportant and that "Sell in May" has arrived early this year, and that may well turn out to be true. We are reminded of the optimistic climate that prevailed in April 2010, and how quickly that faded.

LB,

ReplyActually I wasn't saying 'sell in May'. When their have been major gains in equity as early as this year I have no problem banking profits and building short positions long before May ever arrives. My initial position was posted back in Mid Feb and aggregate entry since. I have no problem being in drawdown on positions like that because you can be sure the portfolio is doing well elsewhere until the position comes right. I'm always going to be out of step with people who try to time markets with a lot more precision than me. Not bothered at all as my job is to manage the equity curve and make sure it is as smooth as I expect it to be.

Positioning update for children to track. We trade and you suck on a pacifier.

ReplyOut 1/3 KOL short, stop to b/e. They stopped me out at b/e on my remaining copper half of short and reversed like crazy on this iron ore dump. Same for Aussie, reversed on minutes and iron ore. Coal, iron ore, copper, AUD - just beginning of something larger to come in commodities? Still think crude oil is in a trading range: 45(7) - 52(3).

FANG is getting closer on my radar for a sell, imo. NFLX Q1 revs and subs missed.

Your turn, kids...

LB, agree that shorts are still stretched in eurodollars; I just don't see it in bonds. Your observation that punters are still biased to "rates are going higher" is likely correct and it would make sense for bonds to reverse once that bias has reversed (usually the way it works). Certainly not there yet. And today's trading makes yesterday's look like an aberration of light attendance. We'll see. I'm generally bad at trading bonds, so sidelined.

ReplyGreat discussion chaps, and apologies for my absence. You know, holiday money to spend and all ;). Anyway LB has been right, yet again, on the long bond and my PnL is taking note. So ...

Reply"We suspect that this move has a long way to run"

I agree ..dare I say a 1.5 handle before this is done. I think it's doable guys, very doable. The reflation trade is losing its gusto and positioning hasn't really taken not yet. I am not Stephen Major bullish or anything, but don't fade it.

Great discussion.

ReplyMay wants a snap election, which introduces great uncertainty into GBP. The rally in GBP is quite eye-opening especially when you look at those crosses. I would like to think that this June election changes the fundamental of GBP at certain extent just like the surprising Brexit vote.

Consider, there is almost no chance for someone further down the anti-EU side of May to win the election and there is plenty of odds that someone from the more pro-EU side to win the election. Anything could happen I guess and pro-EU voters will be more motivated to vote this time. So GBP might still have a lot of room to run on the upside in the next month IMO.

And US equity really looks like to be near a large correction. The market is not panic yet, and it needs to get panic. Is it too late to enter short position now? I just have a tiny short position on NFLX, which had a really bad quarter and a not-so good future IMO.

Unknown

Replyit was easier to short euphoria if you short now you need to be able to stomach a failed retest of the highs. Risk Reward ratio is 1:2 your obvious target is MA200

I see a lot of you guys are on your A-game. No doubt inspired by the quality analysis given by Detroit Red.

ReplyHere you go guys... https://youtu.be/FPQlXNH36mI

People voting for Fillon at this point are effectively voting for Melenchon. How f-ed up is that? If Fillon voters are at all logical, we should see Fillon do worse than polls and Macron better.

ReplyPerhaps a bit early for a victory lap on fixed income, but…. there is no doubt that most of the supports we had flagged as critical for US 10y and 30y yields have now gone for a Burton. All that remains now is for Dame Janet to coo and take the June hike off the table, so that the front end can collapse, crushing the Eurodollar shorts. The belly of the curve seems to be anticipating this already.

ReplyLB will be back this week with some more technical analysis on the fixed income markets and the reversal of the Reflation Trade, arguably the most important of 2017 market trends.

As a teaser for the morning, the latest run-up in oil prices (a 9% run-up, mainly a short squeeze blamed on Saudi rumors) is probably over and tomorrow's data should give WTI and RBOB the cement shoes treatment, with predictable follow through for the 5y5y break-evens and US rates.

Have a great night, Mr (fixed income) Shorty...

Banks are throwing in the towel today. For example, GS closes its 10Y break-even trade and JPM its steepener and 5Y outright short (latter at a loss of 21 bps in just over a week!). At the same time, option market (put/call ratios, CS's OSI) suggesting bonds are over-sold (could always get more so). You've had rates break through the key levels and French and Korean risks had to be feeling more visceral to anyone with size shorts -- all to say, if you had a size short and you're still holding it now, you have some constitution! But I think the bond longs may have to show some mettle soon. The next big event on the calendar is the French first-round election and the modal outcome, IMO, is a sigh of relief. Suppose Le Pen does as she's been polling and Macron does in-line or better than he's polled (due to Fillon supporters deciding not to throw away their votes on a lost cause and instead ensure Hugo Chavez doesn't win). With the boost in confidence in the polls, Frexit risk might get all priced out Monday. How are those US bond shorts going to do when the bund gaps up 20bps? Maybe it'll be the bond longs who will be exiting positions from now until Friday's close anticipating this? At the very least, taking some profit. I've been buying topside risk in EURUSD, but tempted to short rates (which I historically suck at trading) directly.

ReplyThanks for sharing this wonderful article

ReplyPackers and Movers bommanahalli

Packers and Movers in yeshwanthpur

Packers and Movers in jayanagar

Packers and Movers indiranagar

Packers and Movers in yelahanka

Packers and Movers in alwal"

ReplyNice blog post for reading and Thanks for sharing the wonderful article

No1 Packers and Movers Bangalore

Top Packers and Movers in Banashankari

Affordable Packers and Movers in Bommanahalli

Best Packers and Movers Domlur

Nice blog post for reading and Thanks for sharing the wonderful article

ReplyNo1 Packers and Movers Koramangala

Top Packers and Movers in madiwala

Affordable Packers and Movers in Marathahalli

Best Packers and Movers shivajinagar

ReplyI loved this publish and your located up so fantastic and really informative , thanks for sharing this positioned up and gain some knowledge on sales techniques.