Macro Man's already come to grips with his basketball defeat and rationalized it away. A little bit of measuring last night revealed that the Macro Boy, while still an inch and a half (3.5 cm) shorter than his old man, already has a longer wingspan. No wonder Macro Man had so much trouble rebounding! In any event, he can still whip the kid where it matters, i.e. on a bicycle.

He still has a few tricks up his sleeve when it comes to Mr. Market, as well. Sure, the quants can data mine a model to their hearts' content, and it will work great, too....until it doesn't. One of the benefits of a bit of age and experience is knowing where to look to see if the wheels are going to fall off.

Take an old standby from recent years: Spooz and Blues. This strategy, coined by David Zervos at Jefferies, simply involves buying a given amount of Spooz and an equivalent risk-weighted amount of blue (i.e., 4th year) eurodollar futures. Macro Man actually ran a bit of this strategy at his old fund, and no doubt the quant legends and risk parity heroes are doing something similar, if a little more sophisticated. It's not hard to see why; even given the ruptures of August and September, the returns of the strategy have remained strong; much stronger, it must be said, than the pre-fee return profile of most macro funds out there.

Of course, the model doesn't necessarily have the same path dependency that most macro punters operate under; if it has a bad day or week, there's no threat of a tap on the shoulder and a cut in the risk allocation. Like the honey badger (also popular at the time of the Spooz and Blues heydey), it just doesn't care.

The six years comprising this return history would seem like a pretty decent sample period, justifying a good amount of faith in the strategy. In reality, the entirety of the period doesn't even resemble a sniff of a full market cycle; indeed, the sample covered in the chart above has been dominated by a policy regime more or less explicitly geared to make Spooz and Blues work (i.e., by pushing down yields and interest rate expectations to benefit risky assets.)

If we look at a longer sample of the strategy covering actual market cycles, we find a return profile that is somewhat less impressive. Macro Man ran the performance of Spooz and Blues since 1992, and while the performance is still positive the information ratio goes from 1.16 to 0.61.

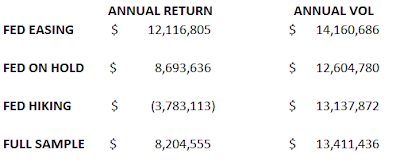

Now, it seems pretty obvious that different policy regimes are going to deliver different type of results for this strategy...and guess what? It's true! Macro Man ran a simple filter of model performance based on Fed policy regimes, and whaddya know: Spooz and Blues does best when the Fed is easing and worst when it is tightening!

Now, Macro Man doesn't expect anyone to be particularly blown away by this insight, because frankly it's not that insightful. Heck, even some of the clever models might pre-emptively filter for this sort of thing and reduce risk....then again, given the propensity to focus on ex post rather than ex ante returns these days, perhaps not.

The point is, however, that having a certain degree of experience to understand the existence of different regimes and to forecast their arrival can be incredibly useful in dodging the odd bullet. This is clearly a simple example; not only did Macro Man know where to look immediately, but he suspects that most model designers would, too. However, in more complex systems and models, it's not always so easy or obvious to know where to look...or when to turn the machines off.

It's hard to believe that the great "Quantmageddon" of 2007 was more than eight years ago, and clearly a new breed has sprung up in place of those that have faded away. One of the benefits of youth is having a short memory, and not being scarred by the traumatic experiences of earlier years. Then again, one of the dangers of youth is not being scarred by the traumatic experiences of earlier years and possessing a false sense of infallibility.

It's a fine line between wearing blinders on the one hand and seeing monsters behind every door on the other. Quants and kids can mine data...but give me a macro guy any day to understand the data....preferably one with gray hair! Readers are invited to judge for themselves whether the investment regime of the last six years is going to continue, a world of JBTFD and Spooz and Blues and Unicorns. History suggests that it won't, and while history doesn't repeat, it usually rhymes....

He still has a few tricks up his sleeve when it comes to Mr. Market, as well. Sure, the quants can data mine a model to their hearts' content, and it will work great, too....until it doesn't. One of the benefits of a bit of age and experience is knowing where to look to see if the wheels are going to fall off.

Take an old standby from recent years: Spooz and Blues. This strategy, coined by David Zervos at Jefferies, simply involves buying a given amount of Spooz and an equivalent risk-weighted amount of blue (i.e., 4th year) eurodollar futures. Macro Man actually ran a bit of this strategy at his old fund, and no doubt the quant legends and risk parity heroes are doing something similar, if a little more sophisticated. It's not hard to see why; even given the ruptures of August and September, the returns of the strategy have remained strong; much stronger, it must be said, than the pre-fee return profile of most macro funds out there.

Of course, the model doesn't necessarily have the same path dependency that most macro punters operate under; if it has a bad day or week, there's no threat of a tap on the shoulder and a cut in the risk allocation. Like the honey badger (also popular at the time of the Spooz and Blues heydey), it just doesn't care.

The six years comprising this return history would seem like a pretty decent sample period, justifying a good amount of faith in the strategy. In reality, the entirety of the period doesn't even resemble a sniff of a full market cycle; indeed, the sample covered in the chart above has been dominated by a policy regime more or less explicitly geared to make Spooz and Blues work (i.e., by pushing down yields and interest rate expectations to benefit risky assets.)

If we look at a longer sample of the strategy covering actual market cycles, we find a return profile that is somewhat less impressive. Macro Man ran the performance of Spooz and Blues since 1992, and while the performance is still positive the information ratio goes from 1.16 to 0.61.

Now, it seems pretty obvious that different policy regimes are going to deliver different type of results for this strategy...and guess what? It's true! Macro Man ran a simple filter of model performance based on Fed policy regimes, and whaddya know: Spooz and Blues does best when the Fed is easing and worst when it is tightening!

Now, Macro Man doesn't expect anyone to be particularly blown away by this insight, because frankly it's not that insightful. Heck, even some of the clever models might pre-emptively filter for this sort of thing and reduce risk....then again, given the propensity to focus on ex post rather than ex ante returns these days, perhaps not.

The point is, however, that having a certain degree of experience to understand the existence of different regimes and to forecast their arrival can be incredibly useful in dodging the odd bullet. This is clearly a simple example; not only did Macro Man know where to look immediately, but he suspects that most model designers would, too. However, in more complex systems and models, it's not always so easy or obvious to know where to look...or when to turn the machines off.

It's hard to believe that the great "Quantmageddon" of 2007 was more than eight years ago, and clearly a new breed has sprung up in place of those that have faded away. One of the benefits of youth is having a short memory, and not being scarred by the traumatic experiences of earlier years. Then again, one of the dangers of youth is not being scarred by the traumatic experiences of earlier years and possessing a false sense of infallibility.

It's a fine line between wearing blinders on the one hand and seeing monsters behind every door on the other. Quants and kids can mine data...but give me a macro guy any day to understand the data....preferably one with gray hair! Readers are invited to judge for themselves whether the investment regime of the last six years is going to continue, a world of JBTFD and Spooz and Blues and Unicorns. History suggests that it won't, and while history doesn't repeat, it usually rhymes....

25 comments

Click here for commentsapparently Turkey just shot a Russian warplane

ReplyGood To see it Thanks for sharing with us .

ReplyStock Trading Tips

Putin tested in Crimea and Syria while visiting Iran.

ReplyNico - this jet downing is only your Wall of Worry as I was told here months ago. Since then, Russian passenger jet exploded mid-air, ISIS came to town (every town) and a Russia fighter jet has been shot down.

Yes, my Wall of Worry.

am with you i've warned for years that the shia/sunni Syrian play was a proxy for WWIII

ReplyToday's sell-off in equities is purely big money running stops into thanksgiving ready for the santa rally. No-one gives a sh*t about geopolitical events - here's why:

Replya) if everything is good, the ECB and BOJ will print pushing up equities

b) if everything is bad (war in ME etc), ALL CB's will print, pushing up equities

My bet is that equities pull-back a few days and then go up.

Equities might rally. Sure. But Europeans don't really high five at all time highs. They get apprehensive. You're mistaking the effects of US QE for European. Did you not see the unwind earlier inthe year? Global growth is slowing down, there are geopolitical and terrorist risks. European politicians flip flop. Id the next round of ECB QE proves lacklustre, it will unwind rapidly. If Merkel goes, forget about it. Asset price inflation does not go in a straight line forever.

ReplyThe question is how macho Putin reacts. I dont think he will just look away. After downing of passenger jet, power blackout in Crimea, he needs to look tough.

ReplyI've had this argument for years and then some more years. Do you want to play a system that is in effect a 'Blackbox'. All you know about it is the numbers it appears to generate ,or do you want to play a system where the player knows why it works and hence has a good idea when it's likely to stop working so well ? Answers on a postcard to Quants Inc.

ReplyBelektron:

ReplyOne can hope they will act the same way as when the Syrians shot down a Turkish F-4 reconnaissance jet for violating Syrian air space. But nuclear war has suddenly become a real possibility again. Should the rest of NATO stand by Turkey... that's the question.

I am wondering whether a TWINE trade in EZ bonds is the way to go here. Probably need to get past Mr. Draghi's dovish broad-side next week, but then ... oh boy!

ReplyNice post MM. The Spooz and Blues trade certainly was amazing, though the same cant be said for the Stoxx and Euribor just yet.

ReplyAdding to what you had said of quants vs macro, I think it was Soros who said he makes the most money when the rules of the game have changed [regime shift] yet players are still using the old rules.

The problem today is that the feedback loops from within the markets are so huge that you have to be really careful data mining. Nothing is really independent anymore

The other problem is seeing regime change where none exists....there is a strong tendency to predict what you want to happen, rather than what you think will happen.

ReplyI am going to make two comments bout 'spooz and blues', in (I think) increasing order of usefulness:

Reply1) A winning strategy that is lauded in the blogosphere its usually peaking, and

2) The alpha in the strategy ultimately comes from eurodollar futures holding their own when equities rally, therefore, its been helped by CB buying, the bond bull market, and disinflation for the last 3 decades - this board is smart enough to know none of those are laws of physics, exactly.

Equities already shaking off the Russian "bad news". JBTFD.

Reply@ washed, S & B probably peaked two and a half years ago, and yet it has still worked. That's a prime example of why people want quants these days.

ReplyWell put MM, there is a big trade off between riding a trend and looking for a regime shift. if you can do both well, you are an amazing investor. If you can do one well you can still be very profitable. They are the crux of macro investing

ReplyBack to the markets, leveraged loans, like the CCC bucket of HY are kicking lower. Banks unloading before YE? No one wants its on their books for stress tests?

Anon 2:57 here. Dow up over +100 points since I last posted 2hrs ago. It's not difficult is it?

Replyanon 4;48 yes btfd is working but i remain skeptical given move in credit ( only energy i hear) and just general backdrop with usd strength valuations etc etc

Replybook is long some puts out to march......spoos unch on the day here looks as good a slot as any........

i think a visit to 17 handle on spoos is on the way.....

expecting a regime change with general vol expansion made worse by the HUGE easy money crowd which has got lulled into selling every vix pop

Very true MM - of course one reason why 'spoos and blues' gets attention in portfolio construction is because of the catchy title - what portfolios could we be having similar debates on say a decade from now? Here are some suggestions:

Reply1. Buns and Guns (grains and defense)

2. Hold and Gold (cash and gold)

3. Shiny and Tiny (silver/gold and small caps)

4. Banks and Pranks (financials/cyber security)

5. Junk and Trunk (credit/autos)

6. Stocks and Rocks (equities/mining)

No love for the classics: Now a second post concerning the Son defeating the Father in 1-on-1 b-ball, and nobody (even MM, a man of deep and evident learning) references "The Great Santini."

ReplySad days, sports fans.

@ Rosabarba, you have to ask why I wouldn't raise an analogy in which I am Bull Meecham, a deeply unpleasant individual? Really? (In any case, Lords of Discipline was always my favourite Conroy novel. I went to high school with guys who went to the Citadel.)

Reply2016: inflation surge, rise in rates, crash in equities and bonds, unsustainable debt ratios - read it all here:

Replyhttp://www.telegraph.co.uk/finance/economics/12014821/Elite-funds-prepare-for-reflation-and-a-bloodbath-for-bonds.html

oh nice - the clowns who've been underperforming 2 yr treasuries for 7 years in a row are back, and more convicted than ever that bonds and equities are about to crash - this kind of stuff just might turn me bullish.

Reply'Elite' indeed.

Newsnight bbc saying Russian jet was in Turkish airspace for 17seconds. Shot as it was leaving. One has to assume the ten warnings over 5 minutes was prior to this.

ReplyWhat is the purpose of this? It's hardly a significant incursion. But, it is a significant response. Putin's language suggests the bear has been poked too hard.

What is likely response? Further incursion in Ukraine? Help the Kurds? Fly 6 jets through Turkish airspace tomorrow?

If it was an American jet downed, and footage of their pilots was out there. What would be the response?

Putin is going to get nasty.

http://www.vox.com/2015/6/29/8845913/russia-war

ReplyHow World War III Became Possible: a nuclear conflict with Russia is likelier than you think

by Max Fisher

and

https://www.washingtonpost.com/posteverything/wp/2015/11/24/will-this-russia-turkey-business-get-out-of-control/

Will this Russia-Turkey business get out of control?