In light of today's surprise EIA print. I decided to revisit the oil market to try and get a feel for sentiment and overall market fundamentals.

First comes sentiment. Seems like most places I look, people are generally bullish on oil. Not a huge surprise. Usually, sentiment follows the prevailing price trend. And for oil, we've had a meaningful rebound from the lows. The oil glut crisis seems like a lifetime ago.

Additionally, CFTC positioning is obviously pretty long. I encourage those with BBG terminals handy to go ahead and adjust it for Open Interest for a more accurate picture - although, I don't think it would change much.

But as traders, we profit from questioning the consensus. So let's dig into some fundamentals.

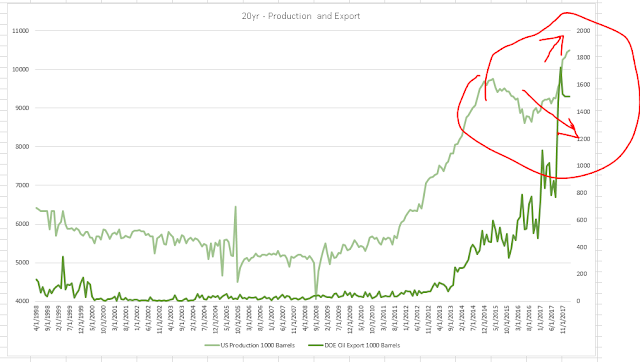

One of the drivers of the oil glut was the increase of US production and subsquently US oil exports. Reviewing the chart shows something peculiar. Around the end of last year, we've had a divergence between US oil production and US oil exports.

We are still pumping out that stuff but are not selling as much of it? Could it be that we are simply consuming more?

Well, it turns out that's not the case either.

At the beginning of this year, we actually saw a trough in US inventory. Since then, that bottom has been clearly made and inventory has continued to build.

Digging into the minutiae of the production numbers. We see that major players in the creation of the oil glut (Russia, OPEC nations) have steadily maintained their production. Now, I'm not saying the possibility of a production decline is non-existent, I'm just saying there's no sign of it right now via the official numbers.

OPEC market share was crucial in the oil decline of 2015 as the OPEC nations could not step in to stem falling prices with production cuts.

Today, it seems that the OPEC nations are back in a precarious position where they probably would not be able to continue supporting falling prices much longer.

Moving on to the Baker Huges Rig count. This has had a meaningful recovery back to early 2015 levels.

Finally, from a more peripheral perspective, we have had a bursting of the sub-prime car bubble in the United States.

Subprime auto loans are trending towards 08 levels (probably a result of monetary tightening) and even prime auto loan losses have ticked up. Which probably ties into this next chart.

In my opinion, each puzzle piece snaps into place this way:

First comes sentiment. Seems like most places I look, people are generally bullish on oil. Not a huge surprise. Usually, sentiment follows the prevailing price trend. And for oil, we've had a meaningful rebound from the lows. The oil glut crisis seems like a lifetime ago.

Additionally, CFTC positioning is obviously pretty long. I encourage those with BBG terminals handy to go ahead and adjust it for Open Interest for a more accurate picture - although, I don't think it would change much.

But as traders, we profit from questioning the consensus. So let's dig into some fundamentals.

One of the drivers of the oil glut was the increase of US production and subsquently US oil exports. Reviewing the chart shows something peculiar. Around the end of last year, we've had a divergence between US oil production and US oil exports.

We are still pumping out that stuff but are not selling as much of it? Could it be that we are simply consuming more?

Well, it turns out that's not the case either.

At the beginning of this year, we actually saw a trough in US inventory. Since then, that bottom has been clearly made and inventory has continued to build.

OPEC market share was crucial in the oil decline of 2015 as the OPEC nations could not step in to stem falling prices with production cuts.

Today, it seems that the OPEC nations are back in a precarious position where they probably would not be able to continue supporting falling prices much longer.

Moving on to the Baker Huges Rig count. This has had a meaningful recovery back to early 2015 levels.

Finally, from a more peripheral perspective, we have had a bursting of the sub-prime car bubble in the United States.

Subprime auto loans are trending towards 08 levels (probably a result of monetary tightening) and even prime auto loan losses have ticked up. Which probably ties into this next chart.

Overal vehicle sales have stopped increasing and could be forming a top. As the glut of car buyers dry up, we can finally piece all of the pieces of the puzzle together.

- The production that caused the oil glut never really stopped. In fact, non-OPEC production has only increased.

- The OPEC countries took a pause when they could to help propel prices higher. However, the sustainability of that strategy is questionable in the face of low market share as evinced numerous times in history, as recently as 2015.

- Auto sales have benefited notably from the emergence of subprime auto loans. As monetary in the US tightened, those subprime buyers are leaving the market. (The increase in LIBOR also doesn't help as it means tightening for everybody).

- As that source of demand dries up, sales are teetering on what looks like a top and could possibly be the shrinking demand explanation for the divergence of US production and export. A lazy way to measure this shrinking demand is looking at inventories.

- The world still mostly thinks oil is a long, but with the aforementioned points above, it's probably to jettison that position.

Well, there you have it. Good luck out there.

88 comments

Click here for commentsYour assertion that crude inventories have bottomed is plainly false, as you fail to account for the fact that recent increases reflect the usual seasonal pattern. In fact, crude inventories have been building much more slowly in 2018 than one would expect for this time of year, and are more than 20% lower than the same week last year.

ReplyYour production story also does not account for the rapid rise in US exports, which are mostly condensates and very light crudes that US refineries can no longer take. These are finding a market abroad, mostly to offset lower light production in Africa and elsewhere. Also your story does not take account of flat to declining OPEC production, and in particular the collapse of Venezuelan output.

The US production centric view of crude- that is, that US output will crash the market again- seems to be the consensus view of the market in my opinion. That view is bearish, and consistently wrong since the mid-2017. Oil is trading with enormous relative strength and acting like it- especially Brent and other heavier grades- is going to go a lot higher. I'm not sure what the COT data means, but whatever it does is not representative of the overall market. Bears are putting a lot of faith (misplaced in my opinion) that the exchanges can really tell the difference between a hedger and a speculator.

@Cheesehedge

ReplyFirst of all thanks for the input. So I went back and made seasonality adjustment to the inventory data and you're definitely right. The buildup in inventory is much smaller as a result.

Chart here for others to see.

https://imgur.com/mrOZvat

But the trend of this matters more than the absolute level - yes the inventory level is much lower than this time last year, but so are crude prices - I would think much of that is discounted by the market. I would argue the jury is still out whether this is a temporary blip or something that would led to a more meaningful build up in inventory on a seasonality adjusted basis. With that said, I will be keeping the seasonality adjustment as part of my sheet going forward.

Now regarding your other points. My production story does take into account of US exports - according to my data (from BBG) it has been trending down since October-ish of last year. If you have contrary data, please share for our benefit.

Regarding Venezuela, my friend brought up the exact same argument while reading this piece. The production in Venezuela dove. But I would argue that's priced in as it has been well telegraphed over the course of this year thus far. In addition, let's assume Venezuela production goes to 0. That's another 1.4 million barrels-ish off the market. Total global production globally was 90.5mm barrels as of 3/31 and 89.9mm as of 2/28 - a decline of 1.4mm applied to the last production number would mean 89.5mm barrels if everything stays put. That magnitude would be meaningful but with the rest of the factors I have outlined, I do not think it will be flashy headline and not a game changer.

As far as sentiment goes, it is rather subjective but I will agree to disagree. Any additional input is always appreciated.

A view from Australia:

Replyhttps://www.businessinsider.com.au/crude-oil-brent-forecast-opec-shale-2018-3

[The article's lead photo is quite something too ...]

Agree with Cheesehedge on seasonality. We are definitely undersupplied overall by some margin and at current pace should be at average inventories towards the end of the year. As to what happens when and if OPEC end the freeze, it is by no means clear. The better argument is probably that we remain undersupplied.

ReplyIf shale cannot maintain the current pace of expansion we are definitely undersupplied in a big way. If it can maintain current growth, then it will depend on demand and OPEC growth. Probably, demand is stronger but not certain...

@cheesehedge

ReplyAlso fwiw, I would like to add that the DOE inventory data is lagging, not leading vs returns. By the time a bottom is clear and the trend of inventory is higher, the market usually will have already meaningfully turned and your risk-reward will have meaningfully deteriorated.

Guys, have you considered a scenario where crude could be range bound for quite a while? Zoom out on the chart and see how it was doing just that for over a year in '16-'17. I think it may be doing just that here with a double top in place. $58-$66 +/- a few bucks. Speaking of bucks, I think one needs to take into account possible dollar stability/strength and what it may do to commodity prices in a short term (sorry for bringing up the short term ;)

ReplyNot to be off subject, but I can't ignore the fact of today's violent equity breakouts above the downtrend going back all the way to Jan highs. Once again, trying to be careful here, wear a macro hat and not talk about some single stocks that absolutely ran over shorts today, like TSLA (pun intended), but I would just point out some select spiders like XRT and XHB which put in a gigantic daily engulfing pretty much wiping out 8-12 trading sessions at once. Take a note of this development. Is this NFP positioning? That's consumer related stuff I was worried about before, roaring back with a vengeance.

@ IPA

ReplyIt hasn't broken out entirely yet. See my link below for a technical snapshot (of QQQ, although SPX is similar).

https://imgur.com/a/N27aZ

It broke out from one downtrend channel top, but I don't think that was the "true" channel really. I still think there is a good chance for a breakout, but not sure if that'll be a false break only to head lower after a gap up or not. Either way, tomorrow will be very interesting from a directional perspective.

Getting back to Macro discussion, one thing that was causing issue with my more bearish view was the strength in semiconductors, which typically lead markets until the very end of a bull. Semis however are now showing a bit of weakness, and actually have some fundamental weakening signs behind them. A lot of them are individualistic, but it's still relevant.

- Nvidia is now facing headwinds from the self-driving car sector, the crypto-mining sector, and possibly other sectors as overall tech sees a bit of a slowdown.

- Intel took a big hit when Apple announced they'll be switching over to building their own processors eventually.

- Micron gets half their sales from China, which is starting to see a slowdown.

- "trade war" issues may hurt semiconductors overall.

On the whole, the sector is suddenly looking not nearly as rosy at it was now that people have come back down to earth regarding things like AI, Big Data, and Cryptocurrency, which were carrying the markets to a degree over the past 1-2 years. IF we get any bit of an economic slowdown, thing swill get more interesting then.

Good stuff here, both the post and comments. I don’t have a dog in this fight, but 1) the EIA has some great seasonality charts/data, and 2) this guy at oilprice.com has some pretty good points about demand. Basically in line w what cheesehedge said above.

Replyhttps://oilprice.com/Energy/Energy-General/Are-We-Sleepwalking-Into-The-Next-Oil-Crisis.html

On the other side I believe Barclays was out with some saguine comments on demand earlier this week.

As for Oil, I think a big question that hasn't been addressed is that of falling demand. All of the oil trade has been propped up on presumptions of high demand. Personally, I feel a lot of that is narrative driven given the fact that we are "late cycle" in the economy, and therefore Oil is supposed to do well. Also, the "goldilocks" economy that clearly was never much of a reality is still driving a lot of the narrative behind the presumed energy demands.

ReplyGiven, I'm not anything of an expert on Oil, but every time I see people project high oil prices, it always seems to be associated with assumptions of a roaring economy, which I'm not seeing.

A lot of the price crash in 2013-2015 was due to oversupply, but is also was largely due to a drop in demand from China and Europe as well. Now... looking at economic data, it doesn't seem to me that Europe and China are "roaring" right now by any means, so I wouldn't be surprised if the demand side of the equation were to drop somewhat.

Another thing worth talking about regarding Oil is that it seems a lot of people are projecting oil based on past market cycles. IE, the oil was high during 2007-2008 as it often does well late-cycle as commodities and inflation boom. My thinking here is that this already has happened in our economy, but we've had blinders pulled over our eyes because Shale has killed off a major part of that equation. If you were to take shale out of the picture, our economy would look very similar to 2007-2008 in my opinion. The fallacy now is thinking that we need to get back to the same price point we did in 2007-2008 to hit "peak" inflation. That ignores the fact that we have far more supply than we did in past economy cycles, so the pricing won't reflect that demand for the commodity.

@Cbus20122

ReplyAgree that the "other general" NVDA is starting to show weakness. While some analysts estimate that crypto-mining only represents 5% of revenue, I think it's likely much higher, not to mention the fact that tighter supply/demand dynamics driven by crypto have given them more pricing power. Given what's happening now, it's likely that demand for incremental crypto-mining GPU units will evaporate, and used units will enter the market. In addition Bitmain announced today an ASIC-based unit that offers a 2x power:price ratio.

The data center business has been a major driver due to hyperscale cloud providers buying NVDA GPUs to provide GPUaaS and supercomputer applications, I think the former is vulnerable to the hyperscale providers building their own solutions, the latter seems to be fairly solid for now.

Given the cost structure of the business, the incremental GP from crypto basically flowed down to OP. GAAP OP margins have doubled over the past 2 years from around 15% to 30%. Incremental margins cut both ways.

Don't feel as convicted as I do in my FB short, but have a small position on here.

Also, I think all of us would appreciate stronger measures taken to prevent trolling on these forums. I have followed the discourse here for a long time, there are some high quality posters whose perspectives I have learned a lot from, and it's a shame that things are being muddied by one bad apple.

ReplyThe steps displayed below are much stronger (IP identification and ban) than what is available in Blogger natively.

http://blogging.nitecruzr.net/2009/10/identifying-and-blocking-malicious.html

@Cbus, I hear you on QQQ. Was looking at select sectors and wanted to shout about consumer, since I've been worried about him. He went out and bought autos in size across the board in March, which bodes a bit of a head scratcher to the peak auto scenario, albeit one month does not a trend make, I should add. Dunno if this is tax refunds, or incentives, or what the heck else is going on with heavy discounting by mfg's and dealers to push the inventory out before the bottom drops out. @Detroit Red has excellent points above on lending slowing down. BTW, on lending...mortgage data on Wed was horrendous. Again, confusion galore considering builders absolutely crushing the sales estimates - LEN.

ReplyOn SOX, it is way above the Feb low and did not come close to testing it. Gonna need to see significantly more pain there to believe the sector growth is done. I hear your and @D's concerns and agree on importance of NVDA. If Trump calms down on his China rhetoric we may see some spectacular rally in chips.

IPA,

ReplyOn builders , again :)

Given the lending data do we have access to any kind of breakdown on the role of cash buyers?

I'm intrigued as to what might explain the apparent divergence in data. Mortgage lending as been dropping also in the UK ,but as it stands there is little sign of it within the volume of transactions data which had me wondering about the role of cash buyers over here.

IPA it's not enough to just "hear my concerns" - people like yourself also need to stop feeding the troll. While you do, you're equally guilty of causing problems on this forum.

ReplyPerhaps a permanent ban of the troll and temporary ban of those involved in juvenile arguments with him is the way forward?

Thank you Detroit, I've had skin in the oil trade for years now and really appreciate you covering it. Thank you.

ReplyOne observation I'll make about oil discussions, though, is how US-centric they always become and I am concerned that drilling into the minutiae of US car sales maybe insignificant to global demand.

We still have vast swathes of the planet emerging from relative poverty and you only need a small increase in consumption from each person in the huge rising base of the global pyramid of wealth to swamp the finicky appetites of Americans.

INteresting to see 80bil oil reserve find in Bahrain. No lack of actual oil to pump and if we carry on at this rate the balance of concern over burning fossil fuels may switch from a Peak Oil argument to a Peak Oxygen one! Are we long of the wrong component in the combustion equation!

As for sentiment, I felt oil went off the radar once it first peaked above 70 in brent and though core positions for pros are of course there, as a spec game in retail it dropped out of sight (certainly less froth) and for that reason I wouldn't be surprised to see it put in a more meaningful headline-grabbing rally if brent gets above 70 again. Of course this is measuring oil in USD which has seen its own falls which is rarely adjusted for.

Something has to break in Saudi Arabia real soon. They need to sell more oil. Shaking down the billionaires has run it's course.

Replyhttps://www.trendsmap.com/twitter/tweet/980558070416859137

FWIW March US auto sales included Easter weekend through April 2, so gives a distorted picture of what's going on.

ReplyRegarding the price of oil going forward, this is pretty interesting ("amazing"):

https://www.mcoscillator.com/learning_center/weekly_chart/crude_oil_swooping_up_on_schedule/

@IPA and D, I agree and I'm not sure I would say that I would be fully negative on Semi's right now. But I finally see a break in the enormous momentum story. Semi's were one of the few pockets of the market over the past few months have have lived up to the growth story as well as the valuation story. But as we all know, that's entirely contingent on revenue staying where it's at. I just think that may be starting to shift somewhat.

ReplyAs for builders / autos, I tend to believe a lot of the spike was tax related. The rest of the data doesn't support long term support in these sectors. Subprime auto looks really bad right now (I've had some puts bought against $SC).

Final note... The dollar is looking like it wants to trade higher right now. Not rallying hard yet, but at least from a technical perspective, it is looking more like a "bottoming" than anything else right now. The dollar in my opinion is the most critical piece in the markets right now. IF the dollar rallies, all the super-crowded trades will get unwound. A dollar rally unwinds the short bond trade, the long oil trade, the long emerging market trade, which then hurts the junk bond trade, etc etc. We will see. I was listening to a macrovoices podcast the other day and I tend to agree that the long-term dollar is in trouble, but shorter term may see a squeeze.

https://twitter.com/zerohedge/status/981913026738745344

ReplyRead this & weep bitches ;)

Thanks for the thoughtful post on WTI. Have been long-term bearish for a while now, but have stayed away In view of sound short-term analysis from many here. Keeping an eye open for a blow-off top at some point this year, an echo of the 2008 spike? If and when it happens, the nascent USD rally will rapidly curtail it and the outlook for oil will become extremely bearish.

ReplyTA can be very tedious, and almost worthless, when volatility is low. In markets with normal or elevated volatility, technicals become more important as the population and character of active traders changes - the vol sellers are gone for the time being.

TA watchers may therefore be interested to know that IWM popped up to its 50 DMA (153.58) and stopped before retreating. The small caps have tended to lead the other indices of late, on the way down as well as on the bounce. Small caps are also rate-sensitive. A strong number tomorrow morning might give us an echo of the early February "Risk Parity" sell-offs, in which case bonds and equities will both decline and small caps will fare worse. FYI the 50DMA for SPX is at 271 (SPY 271).

Wotcha LB

ReplyI'd propose that the ratio of Technical Analysis espoused is always inversely proportional to the amount of knowledge.

Ie when everyone is clueless as to the why's and wherefore's all they are left with is TA

I mean just look at crypto chatter .. all TA as there is F-All else to it but historic price.

LB, Polemic - I agree. johno & IPA for example are big TA enthusiasts, which proves the point (let's face it, they're not too bright ;)

Reply@checkmate, the divergence in data could be the result of reporting frequency: mtg data comes out weekly and home sales come out monthly. Also, new home sales are not broken down in financed vs cash (at least not that I know of). So cash purchases are only reported on existing home sales. NAR had a detailed breakdown on declining cash sales.

Replyhttp://economistsoutlook.blogs.realtor.org/2018/02/05/fewer-cash-sales-investor-buyers-and-distressed-sales-in-2017/

This is my last post. I really appreciate the work MM, TMM, and TMM2 have done and look forward to reading more of it. However, I will not be posting in the comments nor reading any of them from now on. It seems my "BS -- blah, blah, blah" really set off Buy Stocks, who posted under multiple identities, including my own. It's creepy and besides, it's just not worth my time to be checking here to see whether someone is posting under my name.

ReplyAnyway, you get as many final words as you like, BS. I won't be reading any of them. Any posts under my name on this blog after this one are fake.

I wish you all well (even Buy Stocks). Toodle pip.

with Trump's announcement of $100bn in new tariffs and the subsequent hairball coughed up by S&P futures, can we all stop with the day trading victory laps? If you made a smart call, show a little humility, recognize this was at best one of the 57% of the times you'll be right-- and wait for someone else to complement you on it.

ReplyThis isn't Harlem playground basketball for Pete's sake.

Shawn: I don't understand why you just don't block the offending commenters? Am I missing something?

Replyhttp://www.globaltimes.cn/content/1096648.shtml

ReplyFrom the Chinese Global Times:

"If the trade war happens, China will show that it has just as many reserve plans as the US, if not more. Chinese experts suggest that China could even take actions to weaken the strength of its currency. Since China is the world's largest trading economy and the largest buyer of commodities like oil products, China could use its influence to push its own currency, RMB, in global markets to reduce the dominance of the US dollar. That would be a heavy blow to Washington."

What could possibly go wrong?

Lol. USA is not exactly in the best position, but China's debt makes it really hard for them to have much leverage here.

ReplyI'm starting to think that Trump knows this and is pressuring them because of this. Not a fan of Trump, but this does seem to be the case.

Ultimately, we all trade our books for profit.

ReplyGlorifying yourself, taking victory laps, and making fun of others will never be additive to your bottom line. Sometimes we all need a reminder of why we got involved in trading in the first place.

@johno, hope to see you here soon. Always enjoyed your comments.

ReplyIn my experience people have tantrum and exit blogs when they're losing... enough said.

ReplyMeanwhile in the markets, I'm enjoying watching most of social media become a global political/trade war "expert". Especially when the subsequent market action proves them wrong every day.

Also wondering why no one has considered that any serious trade war will bankrupt a heavily indebted China. Not to mention that pressure from currency & increased cost of food imports will likely cause a revolution there - resulting in the downfall of the communist regime. Quite simply, Trump will win this battle.

China is only indebted to itself.

ReplyThe debt-asset distribution is only effectively an internal book-keeping structure between state, quasi-state and state regulated private, all within the confines of an overall command economy.

They are fine.

https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp180406.en.html

ReplyThe consequences of protectionism. If anyone is interested.

@Polemic

ReplyFinancial repression is not without pain in the final analysis.

Michael Pettis https://www.financialsense.com/contributors/michael-pettis/what-is-financial-reform-in-china

"Under these circumstances it would take uncommonly heroic levels of restraint and understanding for investors not to engage in value destroying activity. This is why countries following the investment-driven growth model – like Germany in the 1930s, the USSR in the 1950s and 1960s, Brazil in the 1960s and 1970s, Japan in the 1980s, and many other smaller countries – have always overinvested for many years leading, in every case, either to a debt crisis or a “lost decade” of surging debt and low growth"

Also a prescient article on looming US isolationism from 2014 based on the numbers, the burden of the current set up:

http://carnegieendowment.org/chinafinancialmarkets/56822

Thanks AI .. I have taken a quick squint at that and have huge admiration for Pettis, but I don't think he isn't necessarily right on many of his comparisons.

ReplyMAssive infrastructure spend may look cooky as far as pay offs go when considering present relatively low wages, but this is eminently sensible to use current low wages to pay for infrastructure that will be benefiting them when wages rise. Cheaper to do it now.

"restraint and understanding of the investors"? That is ultimately the state and they have all the time in the world.

I also wonder how many of the debt crises above occurred because of foreign debt funding rather than internal. In the case of China the effective funding is coming from the trade surplus rather than FDI. The point Pettis makes is that when private lenders get fed up with low rates of return they normally protest via political outlets. In China they can't. Xi is strapping everything down.

If the USA is trying to cut off China funding via trade then that is like squeezing a balloon between your fingers. It will pop out elsewhere. China has enormous influence over the rest of the world and there is no way the US can now control it.

If you have a population who is prepared to go through greater hardships than your competition you are ultimately going to provide better value, and short of revolution in China, the population will always bow to the will of the state no matter how much it hurts.

So .. as we can see by Pettis's paper being already 5 years old and China still doing fine thanks, even despite the odd 2015 style panic which it also weathered handsomely, I think China will be fine.

If I didn't I'd also be short of everything California on the basis that ONE DAY the San Andreas fault is DEFINITELY going to cause a massive shake up. But no one ever trades that one though the odds are even more certain.

@Polemic

ReplyI agree about trading. I think Keynes reached the same conclusion.

I think the point is that when you over invest via financial repression and lower wages, you are asking someone external to pick up the slack in demand. Over investment never ends well because that someone else eventually decides to look after their own interests...they have to. In fact many argue that it is via over investment that companies lose pricing power triggering a 'depression'. In the case of 1929, the restoration of pricing power didn't really take place until a world war destroyed much of the productive capacity of the world.

Trump's actions aren't just 'Trump again' but a depressingly inevitable consequence of global imbalances and in the wake of weak wage growth and 'cuts' since the financial crisis leaving people feeling bad. This hastens what China then needs to do re its over investment and the need for rebalancing what it does internally....with bad consequences for the near term potentially. If China tries to foist its current account surplus by dumping elsewhere, expect to see escalaton globally.

That'll be my last word on the matter Pol because it is somewhat off topic I've realised.

Thanks AI

ReplyYes, too huge a subject to start here. Dinner/Pubs etc better and appreciate you trying to steer me politely in the right direction!

Maybe one of the authors will indeed suddenly make it on topic, but until then.

Have a good weekend.

Regarding the new tariffs, Trump said the stock market might take a bit of a hit in the short term but he insisted the country will be stronger in the long run.

Reply"I'm not saying there won't be a little pain but the market's gone up 40 percent, 42 percent -— so we might lose a little bit of it —- but we're going to have a much stronger country when we're finished", Trump said.

Never mind our friend BS, this entire market is BS! I am not making a grandstanding call here, but this choppy trade isn't going to go on indefinitely, and it isn't going to resolve upwards in a quiet shallow way on an ocean of vol selling. That's over.

ReplyPeople (even Buy Stocks) are going to get tired of entering on the long side, only to have Trump wake up in the middle of the night and poke the Chinese in the eye with a stick so that we wake up to a sea of red ink. At some point a lot of responsible adults are going to say, to hell with US equities, and withdraw their liquidity. If that emotion begins to engulf global institutional investors (even the SNB) and Real Money, then this market is in big trouble. This is why relentless volatility leads to crashes - large punters from the long side become exhausted and simply start to set exit levels. Even if you ignore Trump/China, the Fed is reducing their balance sheet. Even large punters know the deck is stacked again - but this time on the short side.

Not to be all technical, but April 5 is a beautiful Abandoned Baby candle (bearish doji star). Gap up, doji, gap down. This is not a bullish omen. LB loves a squeeze as much as anyone but is more than ever firmly convinced that this is a Sell the Rips market. The reason? Every time there is a market rally the news flow flips back to negative, before volatility can truly subside. VIX will not go below 18. Sell vol at your peril here... If and when the Big One begins, algos will just amplify this by selling at a variety of stops presumably now set somewhere below the 200DMA.

Fans of the 1962 and 1987 analogies will point out that we are due for a substantial dump. Although not a fan of historical market analogies, there are dynamics that develop within markets that can certainly repeat. SPX has a nice short-term double top in place at 2670. There is a distinct possibility that we will not see that level again for a long time. Tax week is here bulls, why not cash out while you can still afford to pay?

In Africa last month i met two Chinese engineers at a restaurant. Super nice guys who worked for Huawei in Ethiopia they were drinking their duty-free Jaegermeister bottle and invited to share it.

ReplyThey work from 8am to 8pm 6 days a week. They take 10 days of holidays per year. Those two facts alone show why China will be world's top economy sooner than we think. As a European and a French at that, realising how cosy we got with our 35 hour week and truckloads of benefits, there is just no way, and no will to compete.

The Houellebecq prophecy of a 2050 France with a sole industry of tourism for Chinese families - provided that China stole and replicated every other industry we have - is quite haunting.

China's development has been impressive, but they're almost a carbon copy of Japan in the 80's, and I expect this to play out in a similar fashion.

ReplyTheir debt is not remotely sustainable. The only way it can be sustained is by continued easing, which by itself is not sustainable, and will only lead to a bigger crash when the inevitable happens. And anybody who thinks they'll be able to de-leverage quietly has no appreciation for history.

To me, China is a binary situation. Either they continue to deleverage, causing their economy and banking system to crumble, or they start easing once again only to kick the can down the road another year or two before repeating the same issues.

If you look at political posturing, it looks to me like Xi's intent is to deleverage for now before things get completely out of hand. Trump I believe realizes this and is putting his foot on the gas pedal. Now, a conspiracy theorist may believe this is agreed upon by both Xi and Trump since this allows Xi to blame the west for their "crash", thus preserving his political power, and it allows Trump to claim "victory" over Chinese trade.

Red Detroit, I get nervous when the comment section here goes quite all of a sudden. The fact that-let's say a generous 33% of the comments(All of su Oil doesn't matter? LOL) only managed to stay on topic speaks volumes.

ReplyGreat Post.

Trade war with China sounds more scary than real war with NK. Both are not going to happen, imho. I think Xi extends his arm this coming week and two men start talking behind the scenes. Trump wants a deal and Xi wants stability. If I was a shorty of US equities (especially chips and transports), or any risk for that matter, I would be covering on Monday. Earnings, possible NAFTA deal, and possible talks with China = back to the top of the trading range on SPX. Would not want to be short into a possible 300-point rally. Just like @LB, I am not making a grandstanding call, simply bringing a scenario from the opposite side. Forget the face, that kind of rally will rip your heart out.

ReplyShort term, I have to agree with Leftback: I do get the the sense markets are at risk here. I thought a few days of stability would bring out buyers, but in retropsect I'm not sure the price "stability" is justified by the news flow. Note to Trump: "Trust me" aint gonna cut it. Mess with the hidden base that elected you at your peril.

ReplyLiquidity is really tough to measure in the era of algos, and I wish I had a better handle on it. However, I have to think that there's a much more nonlinear relationship between vol and liquidity than we may appreciate both micro (marketmaking) and macro (portfolio flows). If volume drops here, then (at least my regression on SPY would suggest) fwd rtns could get ugly.

Markets trying to rally again. We'll see how high this goes. Russia in the meantime dropped over 7% in a day. To me, that seems like a negative for long term oil prices.

ReplyRegardless, I can't help but notice that there are a lot of short term "headline" economic stories popping up that are missing the basic fact that there is a much broader global slowdown starting to occur. RE markets around the world are starting to feel a lot of pressure. NY, Vancouver/Toronto, Hong Kong, Australian Cities, all seeing falls in RE prices and purchasing activity.

Feels like we chilling a bit risk wise after recent drama which should be driver for some weakness in bunds/eur rates. Been a bit of a one way train recently, given bigger picture of end of asset purchases in Sep/tightening cycle something to fade at these levels I think

ReplyReally low volume rally today. I sold off short term positions not too long ago. Might bounce some tomorrow, but I get the impression most are awaiting data and feedback from events later this week.

ReplyIn Xi we trust :)

ReplyBTW, SPX now has a perfect inverted head and shoulders in place with a target of 2793.

ReplySince I can't post links apparently, I'll just mention this.

ReplyI think the Deep-throat-ipo blog may have just broke the biggest financial news story ever. I know that's dramatic, but his very in depth research is true, then it would absolutely be. And from my limited knowledge, the math and everything else checks out like a glass slipper. I strongly recommend viewing the blog and reading the most recent post.

Cbus - Thx for the ipo blog link, makes for v interesting reading.

ReplyI kid you not. I know this may be in bad taste. But if you were a bookie in NY , you'd be undecided if you'd want trumpy on the team.

ReplyThe plague is well truly alive in NY.....and ((spreading))

And then you have the daily morning correlated like no other to the spoos morning tweet blitzkrieg!

I hope someone close to him is getting on!

Trumpy vs S&P500 reminds me of the character in the movie the "Chinese Bookie"....the Chinese bookie sitting in the oval office.

ReplyIs this another opp to buy the dollar before the takeoff? I don't see Draghi going full throttle in this environment. I can't quite see today's CPI as a big reason for weakness ahead, as the dollar was already down and is essentially unch from the report. Japan is in status quo, so the yen strength is all geopolitical. I say when the missiles start flying so will the buck. DXY needs to hold the 89.25 - 89.50 area. Staying long.

ReplyThis could be interesting for equity and FI people:

Replyhttp://epsilontheory.com/the-narrative-giveth-and-the-narrative-taketh-away/

'To steal a line from Game of Thrones (see, told you I couldn’t help myself), we’re now at the point where the catch phrase is about to shift from “Inflation is Coming” to “Inflation is Here.” And if that’s married with disappointing growth from say, oh, I dunno … a TRADE WAR WITH CHINA … well, that’s not just inflation, that’s stagflation. And that’s the market equivalent of the Night King and the White Walkers running rampant over all of Westeros. Is that the most likely scenario? No. Is it a scenario that we need to take seriously? Absolutely.'

its over for the dollar. We are in a multi year USD bear market driven by sell the fact on rate hikes/tax changes and corresponding flows out of USD by big global players. Wake me up when USD is objectively cheap and we can discuss catalysts for the end of the USD bear market, but I imagine that's a matter of years not months.

ReplyThe USD bear market also corresponds with the end of the USD asset boom. The value of USD stock market in foreign currency terms will continue to follow a very negative trajectory for the foreseeable future. Again, wake me up when its objectively cheap.

Much longer term, dollar imperialism has compromised its status as a reserve currency. Expect to see continued efforts by much of the world to establish a post dollar era, catalysed by recent use of dollar sanctions that incentivise non-dollar countries to consider alternatives to avoid the risk they fall under the gaze.

@Unknown, this is exactly why I come here, want to hear the other side. I am adding to my long USD position today. I have been short DXY from 95, covered, and reversed. All the arguments you have provided could be true, but USD has been pronounced dead many times before only to come back and do serious damage to shorts. I feel that it is oversold and a tradable bounce of respectable magnitude is in order, especially vs the Yen. I don't want to hear bunch of "yes" people around me when I take the trade. I was criticized here on my DXY short when I took it. Again, thank you for your input!

ReplyThe dollar trade is tough. I see both sides of the argument. While common intuition would say that only one can be correct, I think it's a matter of timing here. As a result, both can be right, just on different time scales. I would personally think that a dollar bounce will happen, but longer term, the dollar weakens significantly. This isn't all too different from what happened in 2008 to be honest as the dollar rally was more of a spike than a long term rally.

ReplyOn another topic, I'm becoming more and more convinced that the yield curve may not actually invert this time around before a recession hits. It's been a great indicator in the past, but the elements that made it a great indicator in the past are inherently different this time.

- First off, the yield is far lower this time around, leading to lower incentive to get into long dated bonds as many investors will see a lower risk to reward profile anticipating that yields won't go negative (or at least won't go too far into negative territory).

- Second off, inflation concerns are different this time around with the US gov stimulating and threatening protectionism at a very late point in the cycle. These two things are inherently inflationary, and would incentivize investors to stay out of fixed income more than normal.

- Third, worldwide yield distortions through easing are completely distorting things, likely in ways that many people aren't all that aware of. The politics of things (think asian countries buying t-bonds) can have a major effect here on prices that have little to do with belief in future economics of the markets. I don't know if this would cause the curve to flatten quicker or do the opposite, but I believe heavily that it has created a lot of distortions that we haven't seen in eras past.

I believe there are many other factors that would screw things up here as well. The main point is that I wouldn't necessarily trust the yield curve inversion as a binary "risk off" signal as we could have in years past. I think the yield curves still tell a lot of very valuable information, but I'm not sure everyone will be reading them in the right manner.

ReplyJual obat aborsi semarang

Jual obat aborsi malang

Jual obat aborsi pekanbaru

Jual obat aborsi batam

Jual obat aborsi makassar

Jual obat aborsi denpasar bali

Jual obat aborsi palembang

Jual obat aborsi surabaya

Jual obat aborsi jakarta

Untuk layanan pemesanan langsung resep aborsi anda bisa menghubungi line kontak berikut ini : Jual obat aborsi

HP : 0819-1160-4593 - BBM : DE00B34A - Whatsapp : 0819-1160-4593

Hard to get excited about any FX trade at the moment. Very low vol.

ReplyIf I had to choose, I would still be long DX rather than short here, just based on the chart. Agree with cbus, at some point, when commodities and EMFX finally fold, another 2008-like spike (but not so severe) in DX will happen. Then we will see a much weaker DX afterwards.

We may have seen spoos trade close to the top of the range again today. If I had a position, which I don't here, it would be on the short side for now. SPY hit a 38.2% retracement at 265.64 and stopped almost on the button. Another mildly bearish omen was the 20 day crossing below the 100 day.

With earnings and missiles on tap, who would want any overnight position?

Not to get overly technical, but SPX is looking like a bear flag right now. I think the key will be if it can definitively break past 2670 or not. Breaking past that means breaking past resistance and possible neckline of inverse head and shoulders. Failing there would imply failing at the top of a bear flag.

ReplyTo me, fundamentals are more bearish right now, so I'm not confident it'll break through here. But if it does, I'll definitely be on the lookout for some short term trades.

Yes - I also have the 2670 area flagged as an important resistance.

ReplyLB ... let's call that resistance area 2666. That would nicely match with the 666 of 2009 fame.

ReplyAre you guys betting on the level to hold? Let's have a little perspective. Third time up here, so she is gonna pop to scoop the stops, just to screw with you.

ReplyYou say a bear flag, your time frame? Zoom out, it's a bull flag on weekly/monthly (macro blog here, eh? ;)

Look at DJI, trying to break out above two trendlines: one from Jan high and one from 11/4/16 & 9/8/17 connected lows (above both lines as I type).

Look at NDX, already broke out above the downward channel (third session today) and above 3/29 and 4/5 horizontal resistance.

So after a deeper look - 2670 area is going to be broken, imho.

@IPA, I'm not really betting what will or won't happen. Just evaluating what specifically it is that I'll be reacting to. If I had a guess, I think we will see a rise into earnings, but I can see it dropping down a bit again before the corporate bid comes back. But that's pure conjecture, and given the geopolitical volatility, it's pretty impossible to make any real predictions nowadays.

ReplyAll I know is that there is an ascending wedge in both SPX and NDX right now and it has traded pretty well within that range. I'm fairly agnostic about what actually happens, just waiting for the confirmation before making any decisions. I'm still on a short term horizon with any bullishness since I don't see any fundamental reasons to buy into a longer term bullish scenario. I think we're at the point where people are just trying to squeeze the very last drops of juice from this bull. We may get another top, but it'll take a lot of squeezing for that to occur in my opinion.

I have a feeling earnings aren't going to be the blowout they were last quarter, but will still be positive. My main worry going forward will be guidance steering much more negative as pricing pressures and higher rates cause issues. I know for example that the company I work for is doing well this quarter, but the issue is that people are going to start to catch on to what is coming around the corner here. So while we may see some upward swings based on momentum of the 10 yr bull market, I just do not believe we'll get any actual real sustained growth from an economic perspective that hasn't already been priced in. As a result, I'm left with shorter term trading as I balance holding longer dated puts on select companies / etfs.

Gus has a remarkable memory. :-)

ReplyTwo large dumps of SPY today- at 12.38 and 1.08 and a smaller one there at 1.14. Someone else punting with size who thinks maybe that resistance area will hold...

Two similar dumps in IWM at 1.08 and 1.14. Just sayin'.... and another one at 1.22.

Not doing anything on a weekly/monthly basis at the moment, IPA. Drank one of your namesake products last night, btw. All in the name of liquidity....

FOREX INTERVENTION SIGNALS THE PATH FOR HIGHER RATES IN HONG KONG NATIXIS

ReplyHKMA WARNS LIQUIDITY MAY SUFFER AS RATES INCREASE

97% OF HK RESIDENTIAL MORTGAGES ARE FLOATING RATE

AT 19.5X AVERAGE EARNINGS HONG KONG IS THE LEAST AFFORDABLE PROPERTY MARKET IN THE WORLD

One of the best articles that I have benefited so much I wish you more

ReplyI am happy to visit my site

https://ahbabelmadina.com/%D8%B4%D8%B1%D9%83%D8%A9-%D8%AA%D9%86%D8%B3%D9%8A%D9%82-%D8%AD%D8%AF%D8%A7%D8%A6%D9%82-%D8%A8%D8%A7%D9%84%D9%85%D8%AF%D9%8A%D9%86%D8%A9-%D8%A7%D9%84%D9%85%D9%86%D9%88%D8%B1%D8%A9-0557763091/

jual obat aborsi pills cytotec asli manjur untuk menggugurkan kandungan usia 1 - 6 bulan gugur tuntas.CYTOTEC OBAT ASLI sangat efektif mengatasi TELAT DATANG BULANdan menjadikan anda gagal hamil , CYTOTEC adalah OBAT ABORSI 3 JAM BERHASIL GUGUR TUNTAS dengan kwalitas terbaik produk asli pfizer nomor 1 di dunia medis

ReplyJUAL OBAT PENGGUGUR KANDUNGAN DI JAKARTA

JUAL OBAT ABORSI DI TIGARAKSA

JUAL OBAT ABORSI DI BATAM

JUAL OBAT ABORSI DI TAIWAN

JUAL OBAT ABORSI DI HONGKONG

JUAL OBAT ABORSI DI PALEMBANG

jual obat aborsi

jual obat aborsi pills cytotec asli manjur untuk menggugurkan kandungan usia 1 - 6 bulan gugur tuntas.CYTOTEC OBAT ASLI sangat efektif mengatasi TELAT DATANG BULANdan menjadikan anda gagal hamil , CYTOTEC adalah OBAT ABORSI 3 JAM BERHASIL GUGUR TUNTAS dengan kwalitas terbaik produk asli pfizer nomor 1 di dunia medis

ReplyJUAL OBAT PENGGUGUR KANDUNGAN DI JAKARTA

JUAL OBAT ABORSI DI TIGARAKSA

JUAL OBAT ABORSI DI BATAM

JUAL OBAT ABORSI DI TAIWAN

JUAL OBAT ABORSI DI HONGKONG

JUAL OBAT ABORSI DI PALEMBANG

jual obat aborsi

Nice post Thank you for your post เซียนคาสิโน | UFABET ลืมรหัส

ReplyA new type of investment That is ready to make money continuously With the best casino services.

Replyบาคาร่าออนไลน์ เครดิตฟรี

ไฮโลออนไลน์ มือถือ

ป๊อกเด้งออนไลน์ ได้เงินจริง

I think these must be useful to you.

Replyวิธีเล่นไพ่ป๊อกเด้ง ให้ได้เงิน

CHIN SHI HUANG รีวิวเกมสล็อตออนไลน์

OCTAGON GEM 2 รีวิวเกมสล็อตออนไลน์

สูตรน้ำแตงโมปั่น

สูตรน้ำพันซ์แอปเปิลพาย

Thank you for your interest.

Thank you for sharing good information.

Replyดูหนังออนไลน์ฟรี

ดูซีรี่ย์ Netflix

The best top 1 casino website

Replyเว็บคาสิโน ไม่ผ่านเอเยนต์

Thank for this post. we want more!

Reply야한동영상

대딸방

타이마사지

안마

바카라사이트

What an interesting piece of information you have provided so appreciated. I would like to know more information about this. Thank you so much.

Reply룰렛사이트탑

I’m still learning from you, as I’m trying to achieve my goals. I definitely love reading everything that is written on your site.Keep the aarticles coming.온라인바둑이

ReplyA very awesome blog post. We are really grateful for your blog post. You will find a lot of approaches after visiting your post.เกมสล็อต

ReplyThanks for posting this, it was unbelievably informative and helped me a lot.

Reply토토사이트

사설토토

"I think youve created some actually interesting points.

Reply토토

먹튀검증

Simply desire to say your article is as amazing.

Reply카지노사이트존

카지노사이트

Thank you for addressing this important issue. Your post not only shed light on the challenges we face but also provided practical solutions. Your writing style is engaging and inspiring. Looking forward to more insightful articles from you!Distrito Nueva Jersey Reglas Locales Protección Orden

ReplyI'm grateful for your fantastic blog.Abogado de DUI Condado de Prince William

ReplyI cannot thank you enough for the blog post.Really looking forward to read more. Awesome.

ReplyI value the blog article. Thanks Again. Really Great.

Reply