Hi ho silver! Well, not really; after a nice break higher in the US morning, price action was actually pretty flaccid. So despite silver finally breaking its record losing streak, it felt notable that commodities seemed to lag the dollar weakness that materialized in FX markets. Even there, the strength of the euro has actually been quite modest; however, given the increase in positioning and the lack of evident catalyst, the correction somehow felt a bit bigger than it actually was.

Given that increasing focus is being paid to positioning risks on the dollar trade, particularly versus the euro, Macro Man thought it was worth re-visiting the trade through the prism of a number of fundamental factors that typically drive exchange rates. None of these will provide much real-time comfort if and as a positioning squeeze materializes, but recalling where we are in the bigger picture can provide an intellectual anchor to knowing how to trade the noise.

Let's look at 5 factors that impact the supply and demand for currency over time:

* Short rates

* Long rates

* Other monetary policy considerations

* Valuation

* External balances

Obviously there are other factors that come into play, such as central bank diversification flow and international equity investment; at the moment, however, the former is reacting to developments in the first 3 factors while the latter is generally not large enough to make a substantial impact.

Short rates

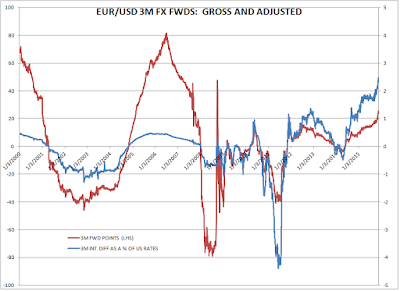

Developments here are pretty unambiguously negative for EUR/USD; since the "policy divergence" theme came to the fore a few weeks ago, EUR/USD has followed the evolution of the 3 month forward points more or less to a T.

Putting the FX forwards into historical context, we can arrive at a couple of different signals. The current level of the 3m forwards (in red in the chart below), while the highest since the crisis, are nevertheless pretty paltry in the grand historical context. This would argue for a relatively meager bear signal for EUR/USD that one could argue is more than in the price. However, the level of the implied interest rate differential (0.90% in the 3 month tenor) is massive considering the low (or in the case of Europe, negative) level of interest rates. Indeed, if we express that implied rate differential as a percentage of the US interest rate, we find that this is the largest difference in the history of the euro! This would certainly argue in favor of further weakness in EUR/USD if that implied differential remains steady or widens further.

Long rates

The Treasury/Bund spread is widening back out towards the multi-decade highs of the spring. One could argue that until it gets there, the justification for further euro weakness may be weak. Moreover, the historical link between this spread and the exchange rate is poor on a contemporaneous basis. On the other hand, these are the sort of market developments that impact central bank asset allocation decisions (as well as spreads at the short end of the curve.) Indeed, there has been plenty of anecdotal evidence of reserve managers shifting out of European government securities because of the low yield on offer. For your guide, they're not sticking that money on deposit to earn zero; they're getting the hell out of dodge.

In reality, it may be unrealistic to expect to much more of a widening from here, given how stretched we are from an historical perspective; barring an abrupt narrowing, however, the yield advantage of Treasuries across the curve should keep attracting central bank flows.

Other monetary policy considerations.

In other words, QE. The ECB is expanding its balance sheet and looks set to accelerate and/or extend that trend in a few weeks' time. The Fed, meanwhile, has been there and done that; while they haven't got the cojones to shrink the balance sheet just yet, even through ending the portfolio reinvestment policy, the tide of relative balance sheet expansion has tilted unquestionably against the euro. This factor has borne a solid resemblance to the trend in the EUR/USD exchange rate after the crisis, and looks set to point towards more euro weakness.

Valuation

Macro Man is old school (quite literally); he uses a PPP model that he first developed a dozen years ago to generate his estimate for EUR/USD fair value. This is not a dynamic model, and there is little expectation that deviations can or should be corrected quickly. His current PPP estimate is 1.17, with European deflation pushing it higher since its 1.08 valuation before the crisis.

It's interesting to note that the model shows the euro to be undervalued for the first time in a dozen years; coincidentally (or not), that was the last time that FX reserve managers didn't feature heavily as regular buyers of the single currency. The current misalignment is exceptionally modest by historical standards; it's worth observing that most cycles have taken the euro to be misvalued by at least 20%. As such, valuation is not much of a concern...yet. Below parity, on the other hand, and the magnitude of undervaluation will be sufficiently large as to prompt greater inquiry as to how and when the rubber band might snap back.

External balances

Here's the thing about current account balances: they don't matter until they matter. In the ordinary course of business of open financial systems, capital account flows tend to dominate supply and demand demand for currencies. Ordinarily, countries running C/A deficits compensate investors for financing the deficit; investors generally like to be compensated, and so the C/A gets financed. Obviously, you occasionally find situations like Brazil over the last couple of years, where the compensation is deemed inadequate for the financial/political/economic risks, and then current accounts matter very much indeed.

As such, they are worth observing, not as a signal for what will happen today, tomorrow, or this time next year, but rather as a signal for what will happen if everything resets to zero. In the case of EUR/USD, you will probably not be surprised to see that the current account factor is not at all supportive of the dollar; indeed, over the last year the relative current account and the EUR/US exchange rate have moved in opposite directions.

Now, given everything written above, it would be absurd to buy euros based on this current account dynamic. There is almost always a narrative that accompanies periods where current accounts are useful as factor of exchange rate determination; you know, G7/G20 statements, that sort of thing. We're clearly pretty far away from that at the moment. Nevertheless, it is worth noting that if the compensation offered by the US to fund its C/A were deemed insufficient (such as negative interest rates, god forbid), then external balances would likely matter again, and the US would look very ropy indeed.

How are we left? The short term fundamental drivers of the EUR/USD exchange rate continue to point towards further weakness. Longer term risk factors both argue that the EUR should be stronger; frankly, over a full market cycle (if such a thing even exists any more), it almost certainly will be. Macro Man is left much wear he started; thinking that we'll dip below parity, and that the ex ante returns from the trade won't look so good once we do. In the meantime, any slings and arrows thrown his way from positioning unwinds are best viewed as an opportunity rather than a threat.

Given that increasing focus is being paid to positioning risks on the dollar trade, particularly versus the euro, Macro Man thought it was worth re-visiting the trade through the prism of a number of fundamental factors that typically drive exchange rates. None of these will provide much real-time comfort if and as a positioning squeeze materializes, but recalling where we are in the bigger picture can provide an intellectual anchor to knowing how to trade the noise.

Let's look at 5 factors that impact the supply and demand for currency over time:

* Short rates

* Long rates

* Other monetary policy considerations

* Valuation

* External balances

Obviously there are other factors that come into play, such as central bank diversification flow and international equity investment; at the moment, however, the former is reacting to developments in the first 3 factors while the latter is generally not large enough to make a substantial impact.

Short rates

Developments here are pretty unambiguously negative for EUR/USD; since the "policy divergence" theme came to the fore a few weeks ago, EUR/USD has followed the evolution of the 3 month forward points more or less to a T.

Putting the FX forwards into historical context, we can arrive at a couple of different signals. The current level of the 3m forwards (in red in the chart below), while the highest since the crisis, are nevertheless pretty paltry in the grand historical context. This would argue for a relatively meager bear signal for EUR/USD that one could argue is more than in the price. However, the level of the implied interest rate differential (0.90% in the 3 month tenor) is massive considering the low (or in the case of Europe, negative) level of interest rates. Indeed, if we express that implied rate differential as a percentage of the US interest rate, we find that this is the largest difference in the history of the euro! This would certainly argue in favor of further weakness in EUR/USD if that implied differential remains steady or widens further.

Long rates

The Treasury/Bund spread is widening back out towards the multi-decade highs of the spring. One could argue that until it gets there, the justification for further euro weakness may be weak. Moreover, the historical link between this spread and the exchange rate is poor on a contemporaneous basis. On the other hand, these are the sort of market developments that impact central bank asset allocation decisions (as well as spreads at the short end of the curve.) Indeed, there has been plenty of anecdotal evidence of reserve managers shifting out of European government securities because of the low yield on offer. For your guide, they're not sticking that money on deposit to earn zero; they're getting the hell out of dodge.

In reality, it may be unrealistic to expect to much more of a widening from here, given how stretched we are from an historical perspective; barring an abrupt narrowing, however, the yield advantage of Treasuries across the curve should keep attracting central bank flows.

Other monetary policy considerations.

In other words, QE. The ECB is expanding its balance sheet and looks set to accelerate and/or extend that trend in a few weeks' time. The Fed, meanwhile, has been there and done that; while they haven't got the cojones to shrink the balance sheet just yet, even through ending the portfolio reinvestment policy, the tide of relative balance sheet expansion has tilted unquestionably against the euro. This factor has borne a solid resemblance to the trend in the EUR/USD exchange rate after the crisis, and looks set to point towards more euro weakness.

Valuation

Macro Man is old school (quite literally); he uses a PPP model that he first developed a dozen years ago to generate his estimate for EUR/USD fair value. This is not a dynamic model, and there is little expectation that deviations can or should be corrected quickly. His current PPP estimate is 1.17, with European deflation pushing it higher since its 1.08 valuation before the crisis.

It's interesting to note that the model shows the euro to be undervalued for the first time in a dozen years; coincidentally (or not), that was the last time that FX reserve managers didn't feature heavily as regular buyers of the single currency. The current misalignment is exceptionally modest by historical standards; it's worth observing that most cycles have taken the euro to be misvalued by at least 20%. As such, valuation is not much of a concern...yet. Below parity, on the other hand, and the magnitude of undervaluation will be sufficiently large as to prompt greater inquiry as to how and when the rubber band might snap back.

External balances

Here's the thing about current account balances: they don't matter until they matter. In the ordinary course of business of open financial systems, capital account flows tend to dominate supply and demand demand for currencies. Ordinarily, countries running C/A deficits compensate investors for financing the deficit; investors generally like to be compensated, and so the C/A gets financed. Obviously, you occasionally find situations like Brazil over the last couple of years, where the compensation is deemed inadequate for the financial/political/economic risks, and then current accounts matter very much indeed.

As such, they are worth observing, not as a signal for what will happen today, tomorrow, or this time next year, but rather as a signal for what will happen if everything resets to zero. In the case of EUR/USD, you will probably not be surprised to see that the current account factor is not at all supportive of the dollar; indeed, over the last year the relative current account and the EUR/US exchange rate have moved in opposite directions.

Now, given everything written above, it would be absurd to buy euros based on this current account dynamic. There is almost always a narrative that accompanies periods where current accounts are useful as factor of exchange rate determination; you know, G7/G20 statements, that sort of thing. We're clearly pretty far away from that at the moment. Nevertheless, it is worth noting that if the compensation offered by the US to fund its C/A were deemed insufficient (such as negative interest rates, god forbid), then external balances would likely matter again, and the US would look very ropy indeed.

How are we left? The short term fundamental drivers of the EUR/USD exchange rate continue to point towards further weakness. Longer term risk factors both argue that the EUR should be stronger; frankly, over a full market cycle (if such a thing even exists any more), it almost certainly will be. Macro Man is left much wear he started; thinking that we'll dip below parity, and that the ex ante returns from the trade won't look so good once we do. In the meantime, any slings and arrows thrown his way from positioning unwinds are best viewed as an opportunity rather than a threat.

20 comments

Click here for commentsThanks for the post, very very enjoyable. If anyone has any recommended reading on PPP models would love to hear suggestions.... I'm an FX light weight and have always wondered on how to construct a "fair value" on FX levels.

ReplyWithout trying to be a bore, is the sustainability factor for the fx one that should go in the analysis for the medium term eg Greece will be back with the will they won't they go drama inside the next 2years given their programme which is set up to fail (sell assets equivalent to 25% of GDP, yeah right). Appreciate that is far less a tangebile topic vs infaltion/C/A surpluses, interest rate differentials etc etc etc, nonetheless would/will have fundamental impact on the single currency.

Good post. To add to the above, I read some insightful comments on ZeroHedge on the subject of ECB monetary policy and FX valuations, basically it goes as follows:

Reply"Draghi will print MOAR !!!"

Hope that helps clarify the matter somewhat ;-)

MM, great article. Another thing I would add into the consideration is the outstanding short interest and inverse correlation to the DAX/eurostox. At around 1.05, with high levels of short interest due to large hedging positions on eurostox, it is more prone to sharp short covering rallies.

ReplyOil looks weak, as does the whole commodity complex in spite of the dollar correction over the last 2 days. Which indicates it has a good chance of resuming the descent to new lows when the dollar rallies. Significant divergence between commodities and com-bloc currencies is emerging and I see relative value in short aud.usd, nzd.usd and aud.cad from current levels. usd.cnh has been gradually edging higher despite the dollar correction of the last 2 days.

For my part, I think the easy money in the eur.usd short since Draghi's speech may well be over. There may be follow through on his announcement or not depending on whether he over-delivers. I am looking at com-bloc and EM weakness. Com-bloc look like a better level to initiate short positions from here. They should benefit from further dollar strength, commodity weakness or euro weakness, if any of these eventuate in the next month.

Adding to Boogers point on Commodities, high yield commodity bonds are selling off in style. No bids for US Steel even though they have enough cash for the next few years. Yes they face a really bad situation and I dont want to own it longer term but every bond has a price. For the past month, no one wants to buy anything with hair on it.

ReplyAnd its not just in some of the bad commodity names, check out retail, or communications

http://www.bloomberg.com/news/articles/2015-11-20/junk-bond-traders-in-retail-raise-white-flag-before-black-friday

not a good sign but Nasdaq doesnt care, nor should it really. But this rally should be seen as what it is, a momo chasing one and not a broad based one until this turns.

ReplyNo positions yet but the NA-focused steel supply chain looks better to me than the seaborne focused big guys. BHP/VALE/RIO etc, its just a bet on China. CLF/X/ATI/STLD/NUE - a risky bet that quality beats quantity, that very cheap energy overcomes cheaper inputs, and a tail risk bet on a general reduction in seaborne trade. The whole bulk shipping industry does not appear financially viable at these prices. I don't think the X bonds would be trading at 20%+ yields if the regulators had not neutered bond market liquidity via banks.

Great overview.

ReplyI wonder how much jawboning has already been priced in the pair. The magic seems to be to repeat the same things over and over again while making it unnoticeable to the listeners, and stretch the effect to a time span as long as possible. Another thing of course might be that France now rightly gained a casus belli against austerity, and that should mean that others are following not too far away. So by the time we get to the December meeting the trades based on that stuff might've already been mostly exhausted. Of course nothing fundamental here, just short term narratives. And besides it might be that pure monetary policy is loosing more of its wow effect every time it's used, anyway.

We might even be staging up to get the annual Greek festival next spring which never seems to let one down. With the Project getting flak from all directions it will be amusing to see the tables turned in terms of who is exerting leverage this time around. I've long had the opinion (which is only strengthening during recent events) that these so called "dramas" have never been the life endangering threats to the EU as they often have been pretended to be. Kind of like what doesn't kill makes stronger, until it doesn't.

There is half-a-trillion dollars worth of oil & gas debt that will likely go to sh*t in 2016, and no one is really talking about it. Watch those banks with this trash on their books... things are gonna get interesting.

Replyu know what that means - banks are about to own oil and gas production on top of everything else, baby!

Replybuy buy buy.

Advanced Notice of a Meeting under Expedited Procedures

ReplyIt is anticipated that the closed meeting of the Board of Governors of the Federal Reserve System at 11:30 AM on Monday, November 23, 2015, will be held under expedited procedures, as set forth in section 26lb.7 of the Board's Rules Regarding Public Observation of Meetings, at the Board's offices at 20th Street and C Streets, N.W., Washington, D.C. The following items of official Board business are tentatively scheduled to be considered at that meeting.

1. Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.

hipper: Draghi over-delivered last time so the market will be expecting him to overdeliver. I would look to be longing eur.usd for a brief bounce after the announcement and some short covering. The bounce would probably not have legs unless the fed defers hike in December.

ReplyI didn't have a chance to respond to your and Washedup's illuminating exchange on IOER yesterday. I think Washed is right, the Fed wants to hike in a way that does not tighten conditions. Charles Hugh Smith had an interesting article recently where he postulated that by increasing interest rates via IOER, "as it has essentially promised to do, it (The Fed) will do so to pursue multiple objectives:

1.It's attempting to preserve its credibility, which is threatened by a zero-interest-rate forever policy.

2.It's attempting to maintain its political capital, which is eroding as even the mainstream media has accepted the reality that Fed policy has enriched the already-wealthy at the expense of everyone else.

3.It's attempting to "normalize" interest rates without killing its favorite child, the stock market.

4.It's attempting to raise rates without upsetting the fragile global currency/debt cart."

Draining a proportion of excess reserves would be the right thing to do IF they thought the economy could take it and IF they could risk a correction in equities. Increasing IOER allows them to preserve credibility and say, hey we did one rate hike and the world did not collapse, so it is all good. But it is not really a rate hike, but hopefully the equity market will not notice much and everyone can do high fives and victory laps.

On 2, they may get away with it as everyone's attention is distracted by the victory laps. But there is a bill currently doing rounds of the house about the Fed act and there may well be political backlash. IOER was introduced during a time of crisis. Now that rates have been reduced 20 times 25bps, it does seem a bit much to be saying to raise once x 25bps, we need to provide further banking sector transfers. But maybe no one will notice!

How does that saying go about the road to hell being paved with good intentions and little steps ? On a moral/intellectual level, they should not be interfering in the market as it creates winners and losers, so supporting the equity child and paying banks causes losers elsewhere and who gave them the power to do that? But that started when they started providing a put and crash protection services with Greenspan and now are openly pro-asset appreciation. Central banks now buy bonds, index ETF's and whatever else and we barely batter an eyelid, so maybe they will get away with IOER.

One thing they must be still wondering is whether a rate hike will put too much pressure on EM/China with copper, oil in the dogbox still.

hyg spy big divergence last couple of days-....have given some spoos into close here( bought some calls to cover)....weeklies premium is silly low ( yes thanksgiving and all that...)

ReplyWhile I expected an opex rally this week, I thought it would be tempered by the events in Europe. The scale of the rally has baffled me. Medium term, it looks like there's an all nout attack on the French when you factor in events in Mali and earlier in the year. The EU is all bit defunct. When Merkel goes, put yoir trades on quick. It will unravel fast. FED are showing themselves for what they really are. Economists!

ReplySounds like German authorities had their hands full.

Replyhttp://m.independent.ie/world-news/europe/fivebomb-plot-to-hit-soccer-game-in-germany-34221691.html

Belgium on lockdown. QE isn't going to make a difference this time.

From Reuters: Venezuelan oil minister Eulogio del Pino said on Sunday that OPEC cannot allow an oil price war and must take action to stabilize the crude market soon. When asked how low oil prices could go in 2016 if OPEC doesn't change its policy, he said: "Mid-20s."

ReplyBucky remains rampant. DX may kiss 100 overnight tonight. Prepare for several sessions of silly season Tool Time™ trading. Things will start to get interesting after the last of the turkey sandwiches have been eaten. We will be watching US fixed income and looking out for signs of another squeeze in EURUSD some time within the next few weeks.

ReplyNot wanting to be overly pedantic but where you get the -90bps from?

ReplyEURI3M is -60bps.

Really decent post tho, thanks.

Fwiw I struggle with even a dip below <1, so many houses been calling it badly for so long.

Had a great headfk from an ECB guy the other day who was saying how much they welcome the developments in the fx mkt (ie cheap EUR), all while continuing to reiterate that it is absolutely not an intended consequence, nor a tool, of their mon pol., but noting that it is practically the only successful transmission channel. Bank lending wahwahwah.... -ve rates are deflationary mate...

Rant over, thanks :)

JL

EURI3M is -60 bps, which is the implied euro rate based on FX forwards. $ Libor is 30 something bps.... 30 - (-60) = 90!

Replyhmm not sure that makes sense to me, the fx implied rate requires a USD rate (3m$L - which is now 41!) & the fx points, taking it back out to give a "single" ccy rate seems spurious imho.

ReplyAlso instructive to add EUBSC curncy, &/or the 3m libor break/diffs, especially post ecb & into yr end!

Thanks for answering MM.

JL

The basis swap represents the difference between the rate differential implied by the forward points and those implied by the depo rates. 3mL ~ 40, 3m Euribor ~ -10, and FX Fwds imply ~100 difference. Lo and behold the basis swap is -50! ;)

Reply