Clubber Lang: My prediction?

Interviewer: Yes, your prediction.

Clubber Lang (swivels to glower into the camera): Pain.

-Rocky III

With markets looking more than a little punch-drunk, Macro Man cannot help but think in pugilistic terms this morning. When he saw the SPX tape yesterday evening and the underlying cause of the weakness, he couldn't help but think of one of his favourite film quotes of all time, repeated above. While Rocky ultimately triumphed over Clubber towards the end of the film, it wasn't before he endured a helluva beating (and a subsequent training regime to improve his fundamental fitness) first.

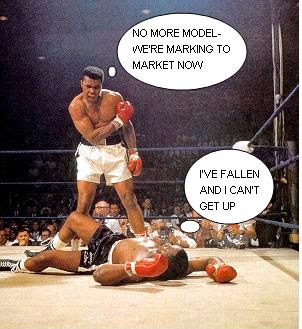

The list of recipients of Clubber Lang-style beatings seems to grow by the day. Indeed, recent news is reminiscent of an actual, historical boxing match- the second bout between Muhammad

Ali and Sonny Liston. As all afficionados of the sweet science know, Ali felled Liston with a single, quick punch in the first round.

Ali and Sonny Liston. As all afficionados of the sweet science know, Ali felled Liston with a single, quick punch in the first round. Some commentators suggested malfeasance- that Liston was in hock to the mafia and threw the fight to finance his debts. Stop-action replay suggests that the so-called 'phantom punch' did land, though of course there is no way of knowing whether it was of sufficient force to truly dispatch Liston so quickly.

Regardless, the speed of the knockout reminds Macro Man of American Home Mortgage. Consider the swiftness of its demise:

* On June 28, it issued a profit warning

* On July 19, the company refused to comment on unusual market activity in its common stock

* On July 27, it announced that its dividend, scheduled for payment yesterday, had been suspended.

* And yesterday, July 31, the company announced that it had run out of both cash and borrowing facilities. The result, predictably, was a Sonny-Liston style crash to the canvas and the immediate filing of a class-action lawsuit.

Of course, AHM is not the only institution to be battered by that heavyweight knockout artist known as 'Subprime.' In the last few days, we've also seen/heard from:

Of course, AHM is not the only institution to be battered by that heavyweight knockout artist known as 'Subprime.' In the last few days, we've also seen/heard from: The only question in his mind is whether to position for the bounce or to sit tight through Wave B and be ready to rock and roll through Wave C. At the moment, he is leaning towards taking some short risk off the table into any weakness today, paricularly as there is plenty of macro data released this week that could prompt a swift corrective rally.

The only question in his mind is whether to position for the bounce or to sit tight through Wave B and be ready to rock and roll through Wave C. At the moment, he is leaning towards taking some short risk off the table into any weakness today, paricularly as there is plenty of macro data released this week that could prompt a swift corrective rally.

10 comments

Click here for commentsMM,

ReplyIf you recall, the speed with which A-B-C transpired in March, as compared with the previous May, rendered the plan less than practicable - despite its fundamental adequacy. Thinking along similar lines and for the sake of argument, let's place B at about 10 AM eastern yesterday and C, at whatever SPX level comes out of the mix when individual stocks become appealling on their own merits (this without even considering 'extraneous' macro stuff).

It's true that March didn't work exactly as planned, though I believe that the methodology was sound. These sorts of analyses are, after all, mere exercises in statistics, and a perfect hit ratio on timing and levels is not to be expected.

ReplyI think that a 12 hour Wave B is a little too short to be a Wave B, which is why I suspect that there is a nasty squeeze in the offing today or tomorrow. Today's price action in the yen crosses, all of which made substantial new lows this morning before recovering all of the lost ground at lunchtime, is particularly instuctive.

On a single security level I think there is already some value emerging, though I am admittdly not a stock-picker. Certainly credit is offering pockets of substantial value, but I for one am not brave enough to dip my toe; those who did yesterday have found piranhas swimming in the water.

March's call was perfect - if you lived at your office.

ReplyThanks to the 'miracle' of Bloomberg at home, I basically do. The problem with March was that Wave C was shorter than expected in both time and magnitude.

ReplyWill the same happen again this time? I suspect not but could be wrong, so will probably look to buy somethign earlier than I did last time.

Not being a bond guy...

ReplyIt seems like anyone long bonds with leverage got killed last month - does this sound right? If so, isn't this a good percentage of the hedge funds out there? Sowood, Macquarie, Bear, etc...?

Au contraire, long bonds were a tremendously profitable trade last month.

ReplyThe primary sources of distress (other than long credit, which I don't think (m)any macro guys had) would have been long equities and, on the margin, long FX carry- the latter as a 'diversifier' and the former as part of a long equity/short credit RV trade. When I get a chance I'll post the graph of the HFR macro HF return index, which is basically the same chart as the S&P 500 (less 2 and 20, naturally).

well, i get the waves. but is there a bonafide macro reason behind all this? does it really have to do with subprime anymore? i mean, one lost fact in the macquarie story is that it was not subprime -- it was just credit. hence the mark to market pain that's been inevitable. anyway, when does this become macro? or just another bout of market vol that subsides when people realize the macro story hasn't really changed? or has the credit story become so dot-com it can unravel the fundamentals? i still doubt so, if only because companies themselves are not the leveraged ones, but PE and the like...

ReplyI think there are two aspects to this, macro wise. The first is if any equity selloff is deep and durable enough that stock gain no longer compensate for housing declines and household wealth falls. Then you probably finally see the consumer start to rebuild savings, which would probably be recessionary.

ReplyThe second is that the fallout from all of this will undoubtedly be tighter lending standards moving forwards, which will make it less renumerative to lever up one's balance sheet (be it household or corporate). That, I should think, would mean economic and earnin gs growth will remain relatively subpar for a while.

What will be intresting to see is how corporate profits are ultimately revised. The recent downward revision to historical US GDP growth would suggest to me that downward revisions to NIPA profit estimates will probably follow. The same thing happened in the late 90's, and we know how that ended...

tmcgee...

ReplyNever forget that US PCE is dependant upon credit to a degree well into mid-to-high 12-digits. IF it becomes difficult say for well-presented PE boys to get credit secured against prime assets for which there is a readily available benchmark valuation , imagine what will happen when and if this filters through to the massive credit extended throughout the US to folks livin paycheck-to-paycheck, with no collateral, and little in the way of measure future stability of income streams.

As this worsens, the percentile living on the edge and beyond their means rises since their savings were "home equity" which in due time, with due destruction will have evaporated.

Yes maybe 30%apr covers most eventualities. But then again. Maybe it won't....

But you should listen to Annaly's earnings call yesterday (avail on BBG AV).

Yes he's a well known bear on credit, but he is not Marc Faber and he is also sitting on $35bn spread portfolio 12x leveraged upon his veneer of capital.

Muhammad Ali is one of the best fighters in boxing of all time. He was able to dominate a monster like Liston and other formidable opponents.

Reply